April 2023

This quarterly blog from the KPMG ECB Office and KPMG Global Portfolio Solution Group EMA provides our overview of the main developments in the European NPL market, the regulatory changes impacting the industry, and the expected trends in deals’ volume.

Non-performing loans (NPLs): March 2023

The potential threat to banks’ capital strength posed by the impact of higher interest rates on bond portfolios has been dominating headlines in recent weeks. While the European authorities are confident that the risks of contagion from events in the United States and Switzerland are small, there is no question that investors’ confidence in the banking sector has been shaken. There are also now growing concerns that the recent stresses in the banking sector may further accentuate the tightening of credit standards in the euro area, putting additional pressure on borrowers and the EU economies.

So far, asset quality remains resilient and NPL levels in the sector continued to decline during 2022. Nonetheless, a lot of uncertainty still remains. The recent shocks have only accentuated the ECB’s conviction that the careful oversight of credit risks and adequate management of non-performing loans (NPLs) are vital to the long-term stability of the EU banking sector. As a result, the ECB continues to focus on prudence (see recent blog on credit risks).

The current situation of high inflation and rising interest rates is already putting pressure on certain borrower segments. Signs of latent risk can be observed across asset classes (e.g., consumer finance, residential real estate), particularly in the level of stage 2 loans and with a slight increase in default rates towards the end of last year. A potential gradual deterioration in asset quality – and thus a rise in NPLs – is still a very realistic scenario for 2023, although this will of course greatly depend on macroeconomic (and geopolitical) developments over the coming months. Further instabilities in the financial markets would also only intensify the risks ahead.

A broad range of deficiencies in banks’ management of NPEs still remain

The topic of NPLs remains under close scrutiny from the ECB. The regulator expects banks to be well prepared for any potential asset quality deterioration. This starts with having robust risk management and sound provisioning practices.

It is interesting to look back at the supervisory activities of last year as an indication of how prominent the issue of NPLs remains. The ECB 2022 supervisory review and evaluation process (SREP) uncovered a broad range of gaps to be addressed by banks with regards to NPLs. These include issues with strategic and operational elements of NPL management, coverage expectations, related reporting, forbearance and NPL classifications. The supervisor expects these deficiencies to be remediated rapidly.

One important gap identified last year was provisioning. The ECB uncovered multiple instances of inadequate coverage for non-performing exposures (NPEs), which led it to impose a dedicated NPE add-on in the P2R decisions of 24 banks it supervises. An interesting point is that banks can ask for their P2R add-ons linked to NPE coverage shortfalls to be updated at three quarterly points during the year, provided that relevant actions are being taken to reduce coverage shortfalls – such as NPE disposals, increases in provisions, or voluntary deductions from CET1 capital. This therefore continues to be a driver for NPL deleveraging activities by banks.

NPL European Market Outlook

Despite current uncertainties, NPLs ratios have continued to decrease or stabilise in most EU jurisdictions – mainly as the result of NPL disposals and write-offs.

The recent projections from the European Commission and the IMF (see IMF World Economic Outlook update) now anticipate there will not be a recession in the EU or in the euro area in 2023 (see ECB). But a lot of doubt remains, and subdued growth expectations persist. At the European level, a reduction in GDP growth of 0.7 percentage points is still expected during 2023 compared to 2022.

Several factors resulting from the volatile macroeconomic and geopolitical outlook already began to affect banks' asset quality last year. The effects of the war in Ukraine, the energy crisis, high inflation, and restrictive monetary policies (including the rise in interest rates) all continue to contribute to the prevailing uncertainty, to affect market confidence, and to put pressure on borrowers.

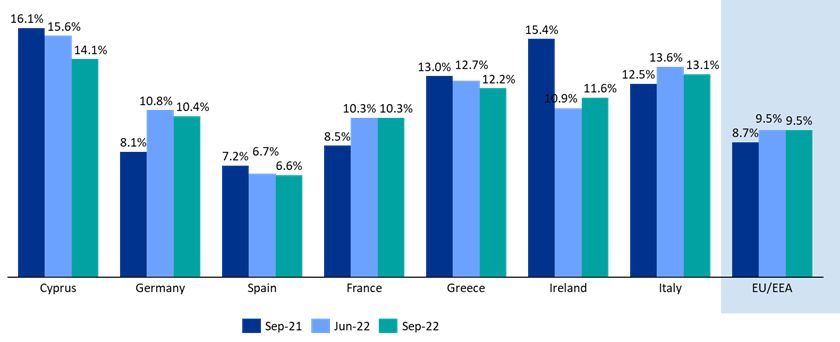

Some signs of stress on borrowers can be observed via the persistent elevated share of loans classified at stage 2 under IFRS 9, which remained above pre-pandemic levels at 9.5 percent as of Q3 2022 (EBA Risk Dashboard). The situation is more pronounced in some countries with historically higher levels of NPLs (as shown in the Chart 1 below).

Further deterioration in macroeconomic fundamentals could put additional strain on borrowers and lead to an increase in defaults and NPLs later in the year, especially for certain exposures in the energy-intensive corporate sectors, residential and commercial real estate, consumer finance and leveraged finance. The fact that the actual impacts on different asset classes are very difficult to predict is prompting regulators to maintain the utmost prudence.

For example, residential real estate (RRE) represents a significant portion of European banks’ lending books. Concerns over households’ debt servicing capacity, and the risks of a price correction in housing held as collateral, are raising the alarm for regulators. The ECB is already performing a targeted review of banks across Europe this year, to assess the resilience of their RRE portfolios in the current macroeconomic environment. We discuss the topic of real estate lending risks and supervisory focus further in our previous article.

Chart 1: EU Countries share of loans classified in Stage 2

(Source: EBA Risk Dashboard)

Update on the EBA’s NPLs transaction data templates

An important topic which remains on top of the regulators’ agenda is NPL data. Following last year’s public consultation (see our previous article), in December 2022 the EBA published its final draft Implementing Technical Standards (ITS) on its non-performing loans (NPLs) transaction data templates (EBA/CP/2022/05), which are expected to be adopted in the coming months.

This has raised a lot of questions and concerns from the industry. One of the main issues is the fact that no specific enforceability or reporting requirements are defined in the ITS. It therefore remains to be seen how supervisors (both the ECB and National Competent Authorities) will use the templates. This lack of clarity around implementation concerns banks. Moreover, as these will become new minimum NPL data standards, there is also the likelihood that the supervisors will expect banks to maintain the relevant data points in their systems throughout the lending lifecycle (not only at the moment of selling), in line with the requirements in other EBA Guidelines (i.e. EBA/GL/2020/06 and EBA/GL/2018/06). This could have implications for banks’ data management and systems.

To assess how banks perceive this challenge, KPMG recently conducted a short survey with a sample of significant institutions from 10 European jurisdictions, asking for their perspective on the activities required to implement the final ITS Draft. The results revealed different approaches. Over half of the banks believe that the ITS will be challenging to implement, with a majority of them already planning (or having started) a gap analysis or an internal alignment program. In contrast, a significant number of the banks are opting for a wait-and-see approach, and will only act once the supervisors’ expectations are communicated.

Going forward – forecast for 2023

This year the ECB will continue to monitor banks very closely to ensure their timely remediation of any remaining gaps in their NPL management and provisioning practices. It will also continue to require banks to have credible and forward looking NPL strategies and plans. With the supervisory pressure remaining high, we expect NPL deleveraging activities to continue over the coming years.

At the moment however there are limited new portfolios being offered for sale, due to levels of legacy NPLs having fallen significantly in most jurisdictions. The anticipated gradual deterioration in asset quality and the likely rise in default rates in 2023 may bring a new wave of portfolios to the market, although the magnitude and timing remains very difficult to predict.

The anticipated (but uncertain) renewal of government guaranteed NPL securitisation schemes in Italy and Greece (i.e., GACS and HAPS) would contribute to maintaining the transaction pipeline in the EU this year. Moreover, the development of a secondary NPL market is also expected, following the securitisations carried out in recent years with reperforming portfolios. This could drive further market activity alongside the securitisation of smaller NPL portfolios.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today