November 2022

Non-performing loans: Early signs points towards an increase next year

While banks’ asset quality remained relatively resilient to the COVID-19 pandemic, there is growing concern that pressure is now mounting and pointing towards an imminent increase in non-performing loans (NPLs). Early signs of asset quality deterioration were already seen in Q2 2022, and the increasing likelihood of a recession is expected to only magnify those risks.

The ECB has reiterated the need for vigilance and prudence, and this caution is likely to shape supervision in 20231. We expect EU regulators to continue pressuring banks to identify signs of borrower stress or distress early, to act on them swiftly, and to keep NPL ratios under control.

This article discusses the pressure points that may lead to a rise in NPLs in the coming months. Our accompanying article on credit risk focuses on mounting supervisory concerns over real estate.

Most banks are well prepared to face the current crisis

Fortunately, the efforts of recent years to reduce EU banks’ NPL levels have been largely successful. Banks therefore enter this crisis in a relatively robust position.

According to the latest EBA Risk Dashboard, NPLs in the EU/EEA dropped to 1.8% in Q2 2022, the lowest level since the global financial crisis (GFC). The downward trend of NPL ratios reflects both a lower numerator (due to continuous NPL deleveraging) and a higher denominator (owing to growth in the total amount of loans).

Significant institutions have also built strong capital positions and liquidity buffers, and expect the positive effects of rising interest rates to offset some of the impacts of weaker asset quality and higher funding costs.

However, the ECB is calling for prudence

The ECB has recently reiterated that banks should take a prudent approach to the highly uncertain geopolitical and macroeconomic environment2. It is impossible to know exactly how the current volatility may affect defaults and NPLs, but pressure on individual and business borrowers is expected to intensify. Banks are advised not to be overly optimistic and keep monitoring the downside risks ahead, which include ensuring that their models have adequate adaptability and predictive capacity.

The ECB has already indicated it will raise interest rates again in the coming months. Moreover, we do not expect borrowers to receive as much state support as during the pandemic. Both the ECB and the IMF have called on fiscal authorities to restrain from introducing large, untargeted support schemes that could limit the inflation-taming effects of monetary tightening. Assuming the current trajectory continues, NPLs therefore seem more likely to materialise than during the pandemic.

First warning signs of a deterioration in asset quality

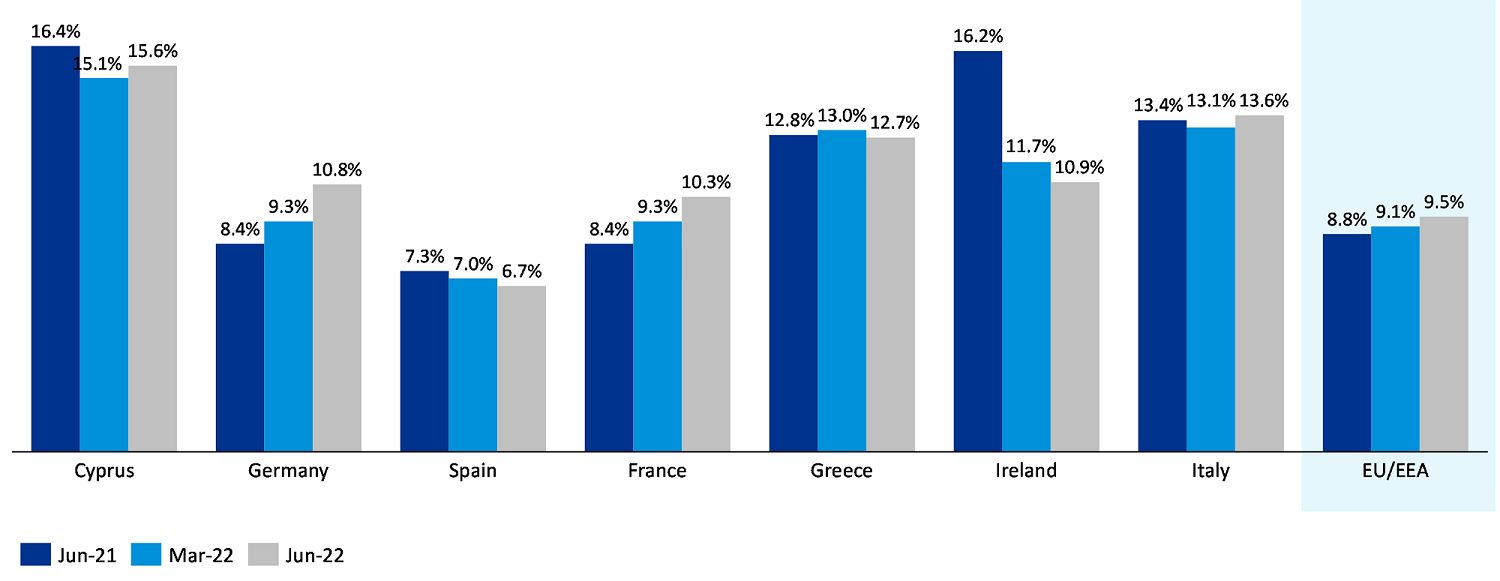

According to the EBA3, stage 2 loans increased to almost 9.5% in Q2 2022. That is higher than the previous peak in Q4 2020 and could represent the first warning sign of a deterioration in asset quality. Regulators are particularly concerned about the impact of high inflation on vulnerable firms and households. A potential correction of residential real estate prices in some jurisdictions, caused by rising interest rates, would amplify challenges for the retail sector.

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Chart 1: EU countries’ share of loans classified in stage 2

Source: EBA Risk Dashboard, 2022

In addition, growing credit spreads between markets will inevitably magnify the pressure on stressed debtors in countries with higher borrowing costs, particularly for companies competing at EU level.

The current crisis is expected to be different from the GFC, and banks are advised to closely monitor under-performing sectors and unlikely to pay (UTP) exposures. There is a renewed regulatory focus on banks’ preventive measures, such as adequate early warning indicators and systems.

The EBA is focused on emerging risks for high energy sectors, given surging prices. Gas rationing could also impact production in many sectors, amplifying supply-chain bottlenecks and probably leading to defaults. According to AnaCredit4, exposures to vulnerable sectors represent approximately 18% of non-financial portfolios, concentrated mainly on energy suppliers and construction of buildings.

Chart 2: EU bank exposures to vulnerable sectors and evolution of % stage 2

Source: ECB Banking Supervision, 2022

Supervisors expect forward looking NPL strategies – favouring NPL transactions

Banks today should be much better placed to manage NPLs than after the GFC, owing to the EBA Guidelines on non-performing and forborne exposures5 and higher supervisory standards. However, falling NPLs in recent years have led many banks to reallocate resources away from work-out units. Regulators are likely to expect banks to be operationally prepared to keep their NPL ratios manageable despite a potential rise in distressed exposures.

This is likely to accelerate banks’ deleveraging activities from 2023 onwards. Levels of NPL transactions were buoyant in 2022, with some jurisdictions achieving record deal volumes. High levels of dry powder6 are expected to drive NPL transactions and securitisations higher in 2023. We expect banks to use active deleveraging strategies, tackling distressed exposures quickly. This is likely to lead to more UTP exposures also being sold. As pressure mounts on the real estate market, we also anticipate a dynamic level of transactions for this segment, both for NPLs and foreclosed assets.

EU regulators are also encouraging more active secondary markets via a range of initiatives resulting from the European Commission Advisory Panel. These include the Directive on credit servicers and purchasers (Directive (EU) 2021/2167) and, more recently, the EBA public Consultation Paper7 on NPL transaction templates discussed in our previous article. The European Commission also recently published its Guidelines on a best-execution process for sales of NPLs on secondary markets, providing best practices to less experienced sellers of NPLs. In the coming months, further guidance is expected from the European Commission on topics such as NPL securitisation and EU NPL market specificities.

Related content

1Source: ECB Banking Supervision, 2022: Better safe than sorry: banking supervision in the wake of exogenous shocks (europa.eu)

2Source: ECB Banking Supervision, 2022: Better safe than sorry: banking supervision in the wake of exogenous shocks (europa.eu)

3Source: EBA Risk Dashboard, 2022: EBA Dashboard - Q2 2022.pdf (europa.eu)

4Source: ECB Banking Supervision, 2022: Better safe than sorry: banking supervision in the wake of exogenous shocks (europa.eu)

5Source: EBA, 2018: Final Guidelines on management of non-performing and forborne exposures.pdf (europa.eu)

6Source: Prequin, 2021: Distressed Debt Dry Powder Jumps as Mega Funds Close (preqin.com)

7Source: EBA, 2022: Consultation paper on draft ITS on NPL transaction data templates.pdf (europa.eu)