While the supervisory review and evaluation process (SREP) of 2018 saw P2R and P2G remain largely stable, total capital needs and MDA triggers have risen. Understanding supervisory thinking is the best way for banks to reduce MDA triggers, anticipate future changes and optimise their capital management and external communications.

This is not the first time that we have noted the ECB's changing approach to regulatory capital. We've seen Pillar 2 calculations grow more transparent and risk sensitive and, more recently, looked at the proposed changes to the stacking order of regulatory capital.

So how are things evolving now? As we end the first quarter of 2019, and with SSM banks having received the outcomes of last year's SREP, we are starting to see greater clarity over the outcomes of the SREP 2018 process.

Focusing first on the quantitative outcomes of the SREP 2018, we have observed that average levels of Pillar 2 Requirement (P2R) and Pillar 2 Guidance (P2G) have remained broadly similar to those set by SREP 2017. Within that average however, it's interesting to note that the sensitivity of P2R to banks' overall SREP scores seems to have further decreased. Even though this is a minor factor relative to the increasing supervisory attention associated with weaker scores this means that banks with relatively weak scores may see a comparative reduction in P2Rs.

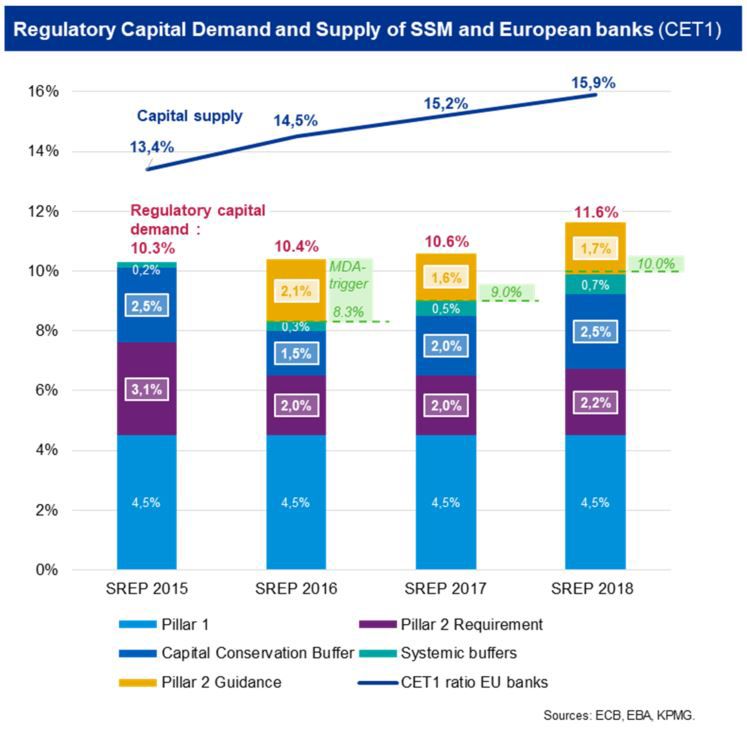

Given the stability of P2R and the fact that the ECB does not seem to have offset the impact of the phase-in of the Capital Conservation Buffer (CCB), or of the growing Systemic Risk Buffers (SRB) Systemic Risk Buffers are comprised of: (i) the Countercyclical Buffer and (ii) firm-specific buffers, usually G-SII or O-SII buffers., average requirements for total regulatory capital have therefore increased year-on-year. This is mirrored by the observed growth in European banks' actual average levels of Common Equity Tier 1 (CET1) ratios.

These factors also generate the second major finding of the SREP 2018: that the average level of the Maximum Distributable Amount (MDA) trigger has increased from 9% to close to 10% year-on-year. Given that around 3.2% of total regulatory capital is now driven by the `insensitive' CCB and SRB, with Pillar 1 accounting for a further 4.5% of CET1 capital requirements, it seems that:

- 10% looks likely to represent the `new normal' level for average MDA triggers; and

- The ECB has limited future scope to flex P2R without pushing individual MDA triggers even higher.

Going forward, we therefore expect P2R levels to remain relatively stable. That's made even more probable by two coming changes. The first is the likelihood that Basel IV, implemented in the EU via CRR 2 and a future CRR 3, will push up banks' Pillar 1 capital demand. The second change is the ECB's plan to prevent banks from using P2G funds to make up any shortfall in Additional Tier 1 (AT1) or Tier 2 (T2) capital in line with the EBA's SREP guidelines (EBA/GL(2018/03).

What about the qualitative results of SREP 2018? Overall, our observations point to increasing harmonisation between the supervisory standards of the EBA and ECB in a number of governance-related areas. The ECB's growing focus on the Internal Governance & Risk Management (IGRM) element of SREP is apparent from the sheer number of weaknesses and remediation actions identified in this area. On the upside, we also see the ECB making an effort to boost the transparency of its communications with banks compared with previous SREP cycles, including more granular feedback and closer monitoring of remediation.

The overall effect of the focus on IGRM is to make the determination of Pillar 2 more `qualitative' than in prior years. The fact that the ECB appears to be placing more weight on IGRM findings and less on other elements such as Risks to Capital should probably come as no surprise, given the continuing rise in European banks' average levels of CET1 supply.

If we consider the quantitative and qualitative outcomes of SREP 2018 together, we believe there is a common theme - almost a message from the ECB - that banks should take notice of: addressing the SREP's qualitative findings as comprehensively as possible is the best way to reduce the level of the MDA trigger.

With this in mind, we believe that banks hoping to optimise their capital efficiency should take three key sets of actions, as follows:

- Analyse: Compare the level of MDA trigger to that of peers; consider which SREP findings have had the greatest effect on P2R; and assess how best to respond to the ECB's findings.

- Anticipate: Consider what impact future changes to Pillars 1 and 2 could have on the capital intensity of different activities. In particular, investigate the potential impact of Basel IV/CRR 2, as well as other changes to supervisory standards in areas such as ICLAAP, NPLs and Definition of Default. Consider also how the ECB might change its “risk appetite” for the bank given observed sensitivities to macroeconomic risk factors.

- Prepare: Work to optimise capital planning and stakeholder communication in the light of:

- Further evolution in the SREP - both from a top-down and a bottom-up perspective;

- Future changes under Basel IV/CRR 2; and

- The ECB's proposed new stacking order for regulatory capital.

It's not enough for banks to know that average levels of total regulatory capital and MDA triggers are rising. With the right understanding, they can understand the thinking behind these trends, optimise their responses and minimise the effect on their businesses.

Footnote

1Systemic Risk Buffers are comprised of: (i) the Countercyclical Buffer and (ii) firm-specific buffers, usually G-SII or O-SII buffers.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia