July 2022

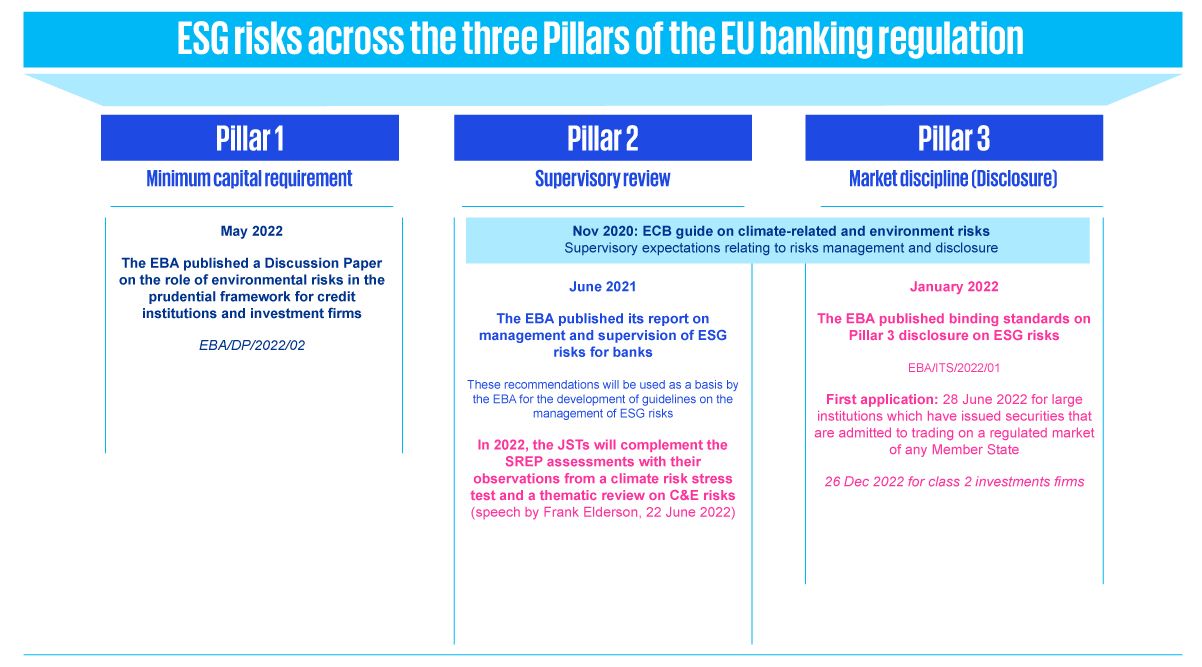

As highlighted in our previous publications, environmental and other ESG risks have become increasingly integrated into European banking supervision since 2021. Until recently, the ECB and EBA have concentrated mainly on enhancing ESG requirements in Pillar 2 (supervisory review) and Pillar 3 (disclosure). Now, the EBA is extending its analyses on environmental risks to Pillar 1 – which defines minimum capital requirements (see Figure 1).

In 2021 the Capital Requirements Regulation (CRR) mandated the EBA to “assess whether a dedicated prudential treatment of exposures related to assets, including securitisations, or activities associated substantially with environmental and/or social objectives would be justified” . In response, May 2022 saw the EBA publish a discussion paper (DP) on the integration of environmental risks into Pillar 1 minimum capital requirements. Consultation on the DP – which does not address social factors – is now open.

Figure 1: Main ESG publications from the ECB and EBA across the three pillars of EU Banking regulation

Source: KPMG International, 2022

The analysis takes a strictly risk-based approach to ensure that prudential requirements reflect underlying risks

The DP is predicated on an expectation that environmental risks and their associated losses will increase in future. It therefore aims to explore whether the EU’s current prudential framework captures these risks appropriately; and, if not, whether capital requirements might be understated.

The DP takes a risk-based approach, with a particular focus on credit risk. The EBA report considers the prudential framework in a holistic manner, suggesting also targeted amendments on market risk, operational risk, concentration risk for banks and on the prudential framework applicable to investment firms. The EBA stresses that the goal of regulation is to ensure that prudential requirements reflect underlying risk exposures – not to pursue other policy objectives, such as accelerating the transition to a more sustainable economy.

The DP also emphasises the importance of avoiding any double counting of risk. Any adjustment to the Pillar 1 requirements should be designed in a way that avoids covering any environmental risks already captured by the existing prudential framework.

EBA puts up for discussion the use of forward-looking methodologies

Even though the paper is exploratory and draws no final conclusions, it offers a valuable first insight into the EBA´s views on future regulatory capital requirements for assets and activities exposed to potential environmental risks.

The DP makes it clear that the EBA favours addressing environmental risks through existing prudential frameworks. Analysis by the EBA suggests that current Pillar 1 mechanisms allow for the inclusion of new risk types, including environmental risks. The evaluation includes among others the use of internal models, external credit ratings and valuations of collateral and financial instruments.

With that in mind, the EBA shows a preference for targeted enhancements or clarifications within the existing prudential framework to explicitly address environmental risks.

In contrast, the DP takes a cautious stance towards the introduction of specific risk-weighted adjustment factors which, according to the EBA’s initial analysis, pose significant design and implementation challenges.

The DP also puts a particular focus on the use of forward-looking methodologies, given that the long-term and non-linear nature of many environmental risks makes it hard to model their impact on asset quality via observable metrics. The EBA discusses some potential solutions, such as introducing expert-based judgements into credit risk differentiation or using specific margins of conservatism when quantifying credit risk.

Key challenges for banks, and how to prepare

The preliminary conclusions shared by the EBA mean that we can already identify several challenges that banks could face in future when integrating environmental risks into their Pillar I capital requirements.

- The first will be to enhance data collection, in order to improve risk management and better quantify potential losses. The regulator emphasises the importance for banks of collecting relevant and reliable information on environmental risks and their impact on financial losses. However, data collection is made more complex by data gaps and the lack of common reporting standards.

- Another challenge will be to develop analytical tools for quantifying the impact of environmental risks, such as sensitivity and scenario analysis. This requires taking the forward-looking nature of environmental risks into account, and making assumptions about transition pathways and bottom-up scenarios across a range of risk drivers.

- Banks also need to look past Pillar I and monitor the evolving impact of climate-related and environmental risks on institution-specific Pillar 2 regulation, on Pillar 3 disclosure, on macroprudential capital buffers, and on accounting provisioning requirements.

Finally, the DP leaves open the fundamental question of whether environmental factors will increase risk levels across the whole economic system – pushing up sector-wide capital requirements – or whether they will lead to a reassessment of risk profiles of individual firms and sectors while having a neutral overall impact.

Any empirical evidence that banks can provide, especially regarding the risk differentials, will contribute to the evolving discussion. Banks and investment firms are encouraged to answer the 35 questions in the DP, or to share their feedback via banking associations. The consultation period closes on 2 August 2022.

Related content

Contact us

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia