Venture Pulse – Q1’17 Global analysis of venture funding

Venture Pulse–Q1’17 Global analysis of venture funding

Quarterly global report on VC trends published by KPMG Private Enterprise.

KPMG Private Enterprise’s Global Network for Innovative Startups has launched has the Q1’17 edition of the Venture Pulse Report. The report analyses the latest global trends in venture capital investment data and provides insights from both a global and regional perspective. KPMG Private Enterprise has expanded the scope of our Venture Pulse report, this edition of the quarterly series provides in-depth analysis on the lifecycle of venture capital investments across the Americas, EMA and ASPAC, including a look at investment activity such as valuations, financing, deal sizes, mergers & acquisitions, exits, corporate investment and industry highlights.

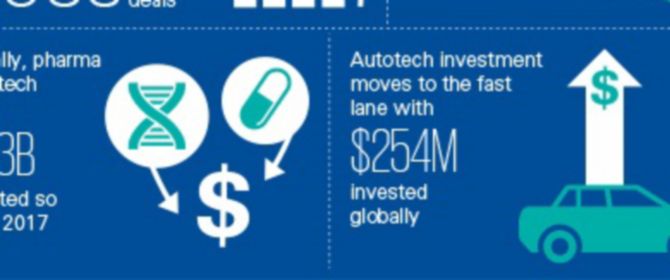

Globally, venture capital activity slid for the fourth consecutive quarter from 3,201 completed financings in the final quarter of 2016 to 2,716 in Q1'17, representing a decrease of 15.2%. Across the same timeframe, however, total capital invested resurged, as $23.8 billion was invested in Q4 2016 and close to $27 billion in the first quarter of 2017. Despite continued lows, there are positive signs for a turnaround in coming quarters. A significant buildup of dry powder in Asia and the US, coupled with signs that the US IPO market may be opening, bode well for activity during the rest of the year.

This edition of the report seeks to answer a number of key questions, including:

- Hot sectors, including deep tech, fintech, and Internet of Things

- US investors’ impact in Latin America

- The effects of the Chinese government’s shifting priorities

- The opportunities of the growing medtech subsector, especially in the US and Europe

See full report for details.