The new EU directive on credit servicers and purchasers (the Directive on NPLs) officially entered into force on 28 December 2021. In addition to setting out authorisation and supervision requirements for credit servicers, it calls for further standardisation in the data requirements for sales of non-performing credit agreements.

The Directive on NPLs is a key element of the European Commission’s action plan on NPLs published in December 2020. The Directive aims to further develop and harmonise Europe’s secondary market for distressed credit while protecting borrowers’ rights. Member states are expected to implement the Directive by 29 December 2023, and to apply the relevant measures from the following day.

So, what changes does the Directive introduce, and what are their implications for the sellers, servicers, and purchasers of NPLs?

Implications for sellers: New data requirements for NPL sales

As discussed in our previous article, the Directive on NPLs calls for the European Banking Authority (EBA) to review its NPL data templates. The goal is to provide a standardised data format for sales of non-performing credit agreements to third-party investors and other credit institutions. These new data sets will be required for all NPL transactions related to credits issued on or after 1 July 2018 that become non-performing after 28 December 2021.

The EBA is currently drafting the implementing technical standards (ITS) that will set out which data fields are to become mandatory, and what the data treatment for confidential information will be. Once implemented, the ITS will require sellers to provide purchasers with detailed information on their credit portfolios — enabling analysis, financial due diligence, and valuation. The timing of this disclosure is not yet defined, but it is expected to be early in the transaction process.

Implications for servicers: Authorisation applications and a range of new requirements

Credit servicers are expected to feel the greatest impact from the Directive, as they will need to be authorised in a home member state before commencing activities in that territory. Entities already carrying out credit servicing on 30 December 2023 will be allowed to continue those activities until 29 June 2024 or the date when they obtain authorisation, whichever is the earlier.

The Directive introduces several other new requirements that will likely impact credit servicers. Among others, these include:

- Demonstrating robust governance arrangements and adequate internal control mechanisms.

- Applying policies that ensure compliance with rules for the protection, and the fair and diligent treatment, of borrowers.

- Having management with sufficient knowledge and experience to conduct business competently and responsibly.

- Setting up adequate anti-money laundering and counter terrorist financing procedures.

Implications for purchasers: Authorisation needed if the purchaser services the loans itself

Credit purchasers will not need to be authorised unless they intend to perform credit servicing operations themselves. Where the borrower is a natural person or a micro, small or medium-sized entity, third-country credit purchasers must appoint both an EU-domiciled representative and an authorised credit servicer.

The Directive also prescribes minimum requirements for credit servicing agreements. These include detailed descriptions of credit servicing activities, the level of remuneration or how it is calculated, the extent of representation for the borrower, and a clause requiring the fair and diligent treatment of borrowers.

EU NPL market update

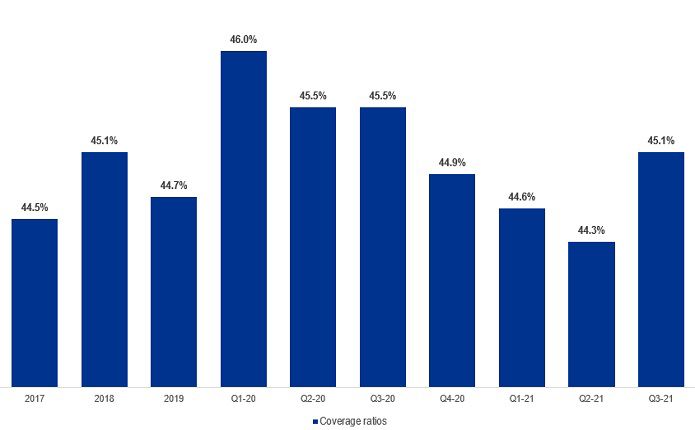

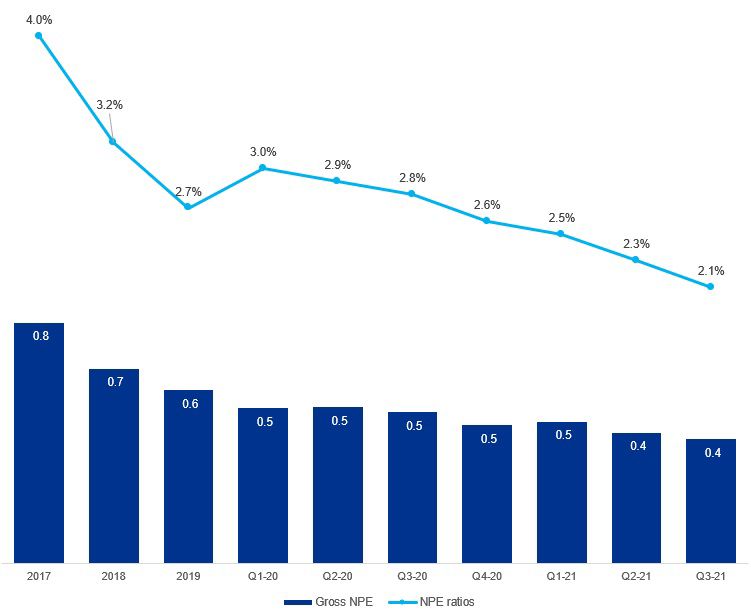

The new Directive arrives at a time when European banks’ asset quality appears to be remaining relatively resilient to the pandemic, with NPL ratios continuing their downward trend — albeit more slowly. Banks’ coverage ratios have also picked up, reinforced by supervisory expectations for NPL provisioning. Despite this positive outlook, the ECB believes it is still too early to dismiss the possibility of material asset quality deterioration in the aftermath of the COVID-19 pandemic. In addition, the ongoing Ukrainian crisis is also foreseen to have both direct and indirect impacts on economies and banks’ asset quality across Europe, although too early to current assess.

Figure 1: Gross NPE volumes in the European Area (€/Bn), NPE ratio (%) and coverage ratio (%)

Source: EBA Risk Dashboard, 2021

Figure 2: Gross NPE volumes in the European Area (€/Bn), NPE ratio (%) and coverage ratio (%)

Source: EBA Risk Dashboard, 2021

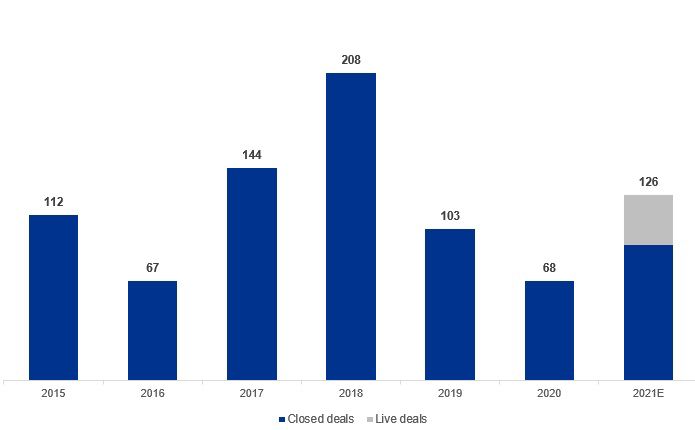

NPL deal volumes declined significantly in 2020 on the back of subdued new NPL flows, but signs of recovery were seen in 2021, driven in large part by securitisation transactions in Italy and Greece under the GACS and Hercules schemes. While the focus has been mainly on deleveraging older stock of NPLs, we also note growing interest in sub-performing portfolios - including unlikely-to-pay loans - and anticipate more activity in this area soon. We expect transaction levels this year to at least match those of 2021, with any rise in NPLs likely to put additional pressure on banks to sell.

Figure 3: EU NPL and non-core loan deals by Year

Source: Debtwire NPL database, 2021

KPMG’s gap analysis tool for the EBA NPL Templates

The Directive on NPLs introduces a broad range of changes. Credit servicers will feel the most significant effects, but the buyers and sellers of NPLs would also do well to familiarise themselves with the new requirements.

For sellers such as banks, the information requirements of the ITS are likely to significantly affect data preparation for NPL transactions. Sellers are advised to begin evaluating any potential gaps now, to anticipate any problems and ensure they are prepared for future transactions.

For more information, or to better understand what these upcoming changes mean for banks, investors or NPL servicers, please reach out to us. For more information about Europe’s NPL transaction market, read our KPMG European Debt Sales report.

Related content

Contact us

Francesco Mazzurco

Associate

KPMG in Italy