Three institutions, three working programs for 2017

Three institutions, three working programs for 2017

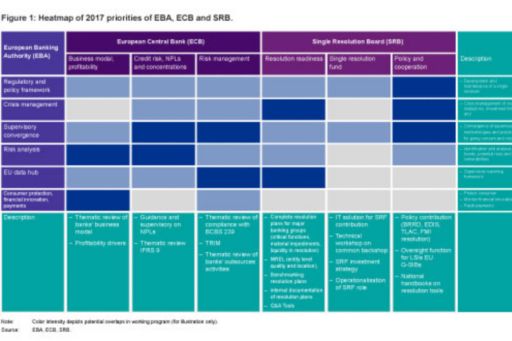

A high-level analysis of the 2017 work programs of the ECB, the SRB and the EBA.

During each month of Q4 2016, a new work program was published: first the EBA published its work program in October, followed by the SRB at the end of November and finally the ECB published its key priorities in mid-December. Since the EBA, ECB and SRB work programs for 2017 also determine the daily agenda of banks, it is worth having a closer look, not only on each of the programs in isolation, but also to identify the current ‘hot topics’ of the European banking sector by looking at how they overlap.

The European Banking Authority’s (EBA) general mission within the banking union is to build a single regulatory and supervisory framework for the entire banking sector. As a de facto ‘standard setter’ for CRR and CRD, the EBA fulfils cross-institutional functions in the European banking regulation framework. For the years 2017 – 2020, the EBA has identified six strategic supervisory areas:

- Regulatory and policy framework (Single Rulebook)

- Crisis management

- Supervisory convergence

- Risk analysis

- EU data hub

- Consumer protection, financial innovation, payments

The EBA work program details the identified actions, the expected results, the main outputs and whether these have been delayed from 2016. In total, 38 activities are specified for seven strategic areas. The EBA have estimated total cost for the fulfillment of the identified actions to be EUR 48 million.

The first pillar of the banking union, the Single Supervisory Mechanism (SSM), which has been placed under the auspices of the European Central Bank (ECB) in Frankfurt, focuses on the daily supervision of significant institutions and has been operational since November 2014. Compared to 2016, the supervisory priorities for 2017 (PDF 27.4 KB) remain broadly unchanged (see our previous article). In 2017 the ECB banking supervision will focus on:

- Business models including profitability drivers;

- Credit risk with focus on NPLs and concentrations; and

- Risk management (BCBS 239 compliance, TRIM and Outsourcing).

According to the ECB, these build on an assessment of the key risks faced by supervised banks, taking into account the latest developments in the economic, regulatory and supervisory environment.

The Single Resolution Mechanism (SRM) forms the second pillar of the banking union; and the mandate of the Single Resolution Board (SRB) is to prepare resolution plans, carry out the resolution scheme and is in charge of the Single Resolution Fund (SRF). The SRB has been fully operational since January 2016. For the 2017 work program (PDF 962 KB), three main operational areas have been identified:

- Resolution Readiness

- Single Resolution Fund

- Policy and Cooperation

The program estimates EUR 38 million total financial resources are needed for actions. As part of its 2017 annual work program, the SRB will also explicitly provide input in the European Deposit Insurance Scheme (EDIS) discussion, the third pillar of the banking union.

Banks should have regulators’ agenda on their agenda.

By comparing the three work programs (see Figure 1), the current ‘hot topics’ of the banking union become visible and we can also see how closely aligned they are with each other. It also becomes evident that some of the EBA’s strategic areas are focused on the daily supervision of banks conducted by the ECB (e.g. IFRS 9, profitability, business model challenges) while others focus on supporting the SRB’s mandate in crisis management (e.g. MREL, convergence of supervisory and resolution practices).

Clearly, banks should take the work programs and priorities into account as these in practice affect also their regulatory agenda and project planning activities respectively. Furthermore, analyzing the work programs in more depth also helps in preparing the dialogue with Joint Supervisory Teams (JSTs) and Internal Resolution Teams (IRTs).