Switzerland - Taxation of cross-border mergers and acquisitions

Taxation of cross-border mergers and acquisitions for Switzerland.

Taxation of cross-border mergers and acquisitions for Switzerland.

Introduction

As part of ongoing globalization, Swiss enterprises are expanding significantly into foreign markets by setting up foreign entities or by merger and acquisition (M&A) transactions. At the same time, foreign strategic and financial investors are increasing their M&A activities in Switzerland, focusing particularly on smaller quoted entities and larger non-quoted entities.

The Swiss tax system and Switzerland’s extensive network of tax treaties offer attractive opportunities for M&A activities. This report addresses the Swiss tax aspects of typical deal structures in Switzerland, the choice of acquisition vehicle and tax-efficient financing arrangements.

Recent developments

As of 1 January 2020, the Swiss tax reform has come into effect. The following aspects of the tax reform may affect M&A activities:

- elimination of privileged Swiss tax regimes, including the holding company, mixed company, principal company and finance branch regimes

- introduction of step-up mechanisms for corporate tax purposes connected to the elimination of privileged tax regimes and the tax-neutral step-up and later amortization of hidden reserves on immigration into Switzerland

- introduction of new incentive rules for research and development activities

- introduction of other tax incentives, including a general reduction of corporate income tax rates at the cantonal/ communal level, reduction of capital tax basis for certain assets (i.e. participations, intangible property) and introduction of a tax credit scheme for permanent establishments (PE) in Switzerland.

In addition, the tax reform resulted in a reduction of ordinary income tax rates at cantonal/communal level.

Asset purchase or share purchase

Whether an acquisition takes place in the form of an asset or a share deal has different tax implications for both the seller and the buyer. Buyers usually prefer asset deals to limit their risks from the acquired business and achieve a step-up in book value. Sellers often prefer share deals, which usually generate capital gains subject to privileged taxation.

Purchase of assets

Purchase price

The purchase price for the acquired business must be allocated to the net assets. Based on accounting regulations, the acquired net assets are reported at their fair market value (FMV) and an excess amount is booked as goodwill.

If the acquired business includes participations, the allocation of the purchase price to participations and other assets has important tax implications for the seller and buyer, as outlined below. Thus, the allocation should be carefully analyzed and agreed on in the purchase agreement.

Goodwill

In the case of the purchase price exceeding the FMV of the net assets of the business acquired, the exceeding amount of the purchase price would be allocated to goodwill. In accordance with Swiss accounting rules, goodwill is depreciated at the level of the buyer. The depreciation allowed for tax purposes is usually either 40 percent per year for 5 years on a declining-balance basis (the remaining balance being considered in the last year) or 20 percent per year on a straight-line basis. This corresponds with the general accounting treatment of intangible property. Therefore, there is no disadvantage in allocating a part of the purchase price to goodwill. Given the high rate of depreciation, it may even be advantageous. If economically justified, it may be possible to accelerate the rate of depreciation.

Depreciation

Safe-haven depreciation rates published by the Swiss tax authorities generally follow Swiss accounting rules.

Tangible assets can be depreciated either on a straight-line or declining-balance basis. Once a depreciation method has been chosen, that method must be applied consistently, unless an amendment is economically justified. It is possible to use different methods for different assets and to apply extraordinary depreciations in certain situations (e.g. for participations).

The write-off of participations is generally tax-deductible, but the shareholder is required to revalue the tax book value of qualifying participations (shareholding with a share quote of at least 10 percent) up to the initial book value if the FMV is going to increase.

Tax attributes

In the case of an asset deal, the buyer cannot use the tax loss carried forward of the acquired business (except for reorganizations under the Merger Act, such as spin-offs and transfers of shares). At the level of the buyer, depreciation of the purchased assets reduces the income tax basis. Special cantonal/communal rules may apply on transfers of real estate (i.e. real estate gains tax).

Value-added tax (VAT)

Where assets are transferred, items that are within the scope of VAT are subject to VAT at the standard rate of 7.7 percent or reduced rate of 2.5 percent. A notification procedure must be applied where assets are transferred between two parties that are registered for Swiss VAT purposes and the following conditions are met.

- The VAT liability would exceed 10,000 Swiss francs (CHF).

- The assets are transferred as part of an intercompany asset transfer.

- The assets are transferred in a reorganization under the Merger Act or a tax-neutral reorganization.

In this case, no VAT needs to be paid, only declared, and the buyer assumes the VAT position of the seller. Where assets are transferred abroad, the applicable VAT rate is 0 percent.

Subject to the tax authorities’ approval, the notification procedure may also be applied voluntarily, particularly where real estate is transferred or well-founded interest can be proven.

Transfer taxes

Securities transfer tax is payable on the transfer of any taxable securities (e.g. bonds, shares) where a registered securities dealer acts on its own account or as an intermediary in the transaction. According to Swiss stamp duty legislation, Swiss securities dealers also include companies not performing a banking-type function (i.e. Swiss companies whose assets include taxable securities with a book value higher than CHF10 million).

The rate of securities transfer tax is 0.15 percent on Swiss securities and 0.30 percent on non-Swiss securities.

Real estate transfer tax and notary fees may apply on the transfer of Swiss-located real estate or shares in Swiss real estate companies and may differ among the 26 cantons.

Purchase of shares

The purchase price is fully attributed to the participations acquired. The book value of participations cannot be written off at the level of a Swiss acquisition company, unless the investment’s FMV decreases. A reduction in value is tax-deductible at the level of the Swiss buyer, whereas a subsequent increase in the FMV triggers a taxable revaluation (clawback). Goodwill cannot be separately reported, neither in the balance sheet nor for tax purposes.

Sellers generally prefer a share deal because a Swiss corporate seller can usually benefit from a tax-exempt capital gain (provided that a share quota of at least 10 percent, which has been held for at least 1 year, is sold). Swiss individuals selling shares as private assets usually achieve a tax-exempt capital gain, subject to compliance with restrictions under the indirect partial liquidation rules (see next section). Individuals selling shares as business assets and selling qualifying shareholdings (share quota of at least 10 percent) may benefit from a privileged taxation.

Indirect partial liquidation

Individuals selling their shares as private assets generally benefit from fully tax-exempt capital gain, whereas dividend income is subject to income tax. In order to avoid abusive transaction schemes, the practice of the so-called ‘indirect partial liquidation’ is assumed if the following conditions are met.

- A Swiss-resident individual sells privately held shares to a company or an individual who is going to hold the acquired shares as business assets.

- At least 20 percent of the share capital (single shareholder or collectively) is transferred.

- Non-business-related assets are available in the target (consolidated approach).

- Distributable reserves are available in the target (from a commercial law point of view).

- Dividends are distributed within a 5-year period after signing.

- There is a certain cooperation between the seller and the buyer.

If these conditions are met, the tax-exempt capital gain of the seller is reclassified into a taxable dividend in the amount of the lower of the capital gain or distributed reserves linked to non-business-related assets. Therefore, sellers usually request the insertion of an appropriate indemnity clause in the share-purchase agreement to restrict the buyer from distributions that might trigger such a reclassification.

Post-acquisition reorganizations, such as a merger between the target company and acquisition vehicle, generally qualify as direct or indirect distributions and trigger an indirect partial liquidation. The distribution of future profits does not qualify as an indirect partial liquidation.

Tax indemnities and warranties

In the case of a share deal, tax liabilities and tax risks remain with the Swiss target company. Thus, a tax due diligence is highly recommended to assess potential exposures. The buyer usually claims contractual tax indemnities and warranties from the seller to shift the target company’s tax exposures of pre-closing periods to the seller. Such indemnities are essential for non-quantifiable tax risks arising in case of tax audits.

Tax losses

Tax losses can be carried forward for a period of 7 years but are usually not approved by the tax authorities until the date of use. With the exception of special cases, such as the transfer of shares in an inactive company, Swiss law does not restrict the use of tax loss carried forward in a target company after a change of ownership.

Crystallization of tax charges

As stated earlier, tax liabilities and tax risks remain with the Swiss target company and crystallize at this company’s level.

For the withholding tax (WHT) on dividends, the buyer needs to consider the so-called ‘old reserves’ theory of the Swiss tax authorities. This practice applies to distributable reserves subject to a non-refundable WHT on dividends. If, due to a change in ownership, the non-refundable WHT is reduced to a more beneficial rate than before the transaction, the Swiss tax authorities may argue that distributable reserves remain subject to the higher non-refundable WHT rate, irrespective of the future shareholder or tax treaty applicable. Distributable reserves qualify as ‘old reserve’ to the extent that non- business relevant assets are available at the time of the change in ownership.

There is also a risk that the Swiss tax authorities may argue that the old reserves rule also applies to the deemed liquidation proceeds on a formal liquidation, ‘partial liquidation’ or post-acquisition merger (so-called ‘liquidation by proxy’ rule). In this case, the Swiss tax authorities may argue that the buyer did not intend to buy and keep the target but to liquidate it on the sellers’ behalf to avoid the WHT on liquidation for these shareholders. As a common example, the liquidation by proxy rule would apply to an acquisition of a real estate company followed by a post-acquisition merger.

Pre-sale dividend

A Swiss seller usually does not wish to pay out pre-sale dividends. However, a buyer can request such dividends to mitigate its WHT exposure under the old reserves theory or if the seller imposes post-closing restrictions under the indirect partial liquidation rules on the buyer (see ‘Indirect partial liquidation’).

A dividend can only be distributed on the basis of (audited) annual accounts not more than 6 months old. Thus, a later dividend distribution of retained earnings may require an (audited) interim balance sheet. Interim dividends (i.e. dividends from current-year earnings) cannot be paid out under Swiss corporate law.

VAT

The sale of shares is generally not subject to Swiss VAT. However, it should be possible to recover input taxes on the acquisition costs, because such costs are commercially justified and the Swiss acquiring entity is the beneficiary of the underlying services.

Transfer taxes

Where the seller, buyer or intermediary of a share transaction qualifies as a securities dealer (e.g. a bank or Swiss company with more than CHF10 million in shares or securities reported as assets in the statutory balance sheet), a securities transfer tax applies of 0.15 percent on domestic shares and 0.3 percent on foreign shares. Exceptions may apply if the shares are transferred as part of an intercompany restructuring (e.g. merger, spin-off or intercompany transfer of qualifying shares).

Tax clearances

Advanced tax rulings are possible and common in Switzerland. They can usually be obtained within 4 to 6 weeks.

Rulings concerning income and capital taxes must be submitted to the cantonal tax authorities. Rulings concerning VAT, stamp duties, securities transfer taxes and WHT must be submitted to the Swiss tax authorities. Rulings that the buyer wishes to submit pre-closing for the Swiss target company usually require authorization by the target company and seller.

Choice of acquisition vehicle

The acquisition of a Swiss business or Swiss target company should be carefully structured because the choice of acquisition vehicle has a significant impact on the overall tax rate.

Local holding company

Dividend income from ‘qualifying participations’ benefits from a participation deduction scheme. Qualifying participations are participations having a share quota of at least 10 percent or a FMV of at least CHF1 million. This scheme reduces the income tax in the proportion of the net revenue from qualifying participations to the company’s net profit. The ‘net revenue’ from qualifying participations is defined as the gross revenue less proportionate financial expenses and a lump-sum deduction of 5 percent for administration expenses. The participation income is virtually tax-exempt as a result.

Due to the absence of group taxation in Switzerland (except for VAT), a Swiss target company does not necessarily need to be acquired by a Swiss acquisition vehicle. However, a Swiss buyer may benefit from specific tax benefits (e.g. debt pushdown, VAT credit on transaction costs) or enable a tax-neutral merger with the target company (e.g. if required by the financing banks). In addition, the use of a Swiss acquisition vehicle is required to not qualify as a tax avoidance scheme for Swiss WHT purposes.

For corporate shareholders, a depreciation of shares due to a lower FMV is tax-deductible, but the shareholder is required to revalue qualifying participations for tax purposes up to the initial book value if the FMV increases in the future.

Interest expenses borne in connection with the funding of the acquisition can be offset against taxable income. Where taxable income is insufficient, the expenses increase the holding company’s tax losses carried forward. Pushing debt down by merging the acquisition vehicle with the target company is unlikely to be accepted by the Swiss tax authorities for anti-abuse reasons.

According to a current practice, a debt pushdown can usually only be achieved for strategic buyers or by careful structuring.

Foreign parent company

An acquisition by a foreign parent company should take into account existing tax treaties or the application of bilateral agreements in order to benefit from a reduced or zero WHT on dividends.

In 2005, Switzerland introduced the reduction-at-source concept for qualifying dividend payments to treaty-entitled foreign parent companies. The reduction is obtained by filing an advance application with the Swiss tax authorities, which is valid for 3 years. The Swiss tax authorities review the treaty entitlement of the foreign shareholder, focusing on substance and beneficial ownership. An advanced ruling stating the facts for the shareholder’s entitlement is therefore generally recommended.

On approval of the application, only the net applicable treaty tax rate is payable (i.e. the refundable 35 percent WHT does not need to be paid and refunded). In any case, all relevant WHT declaration forms need to be filed to the tax authorities within 30 days after the due date of the dividend distribution. If the forms are filed late, the Swiss tax authorities may still grant a reduction at source, subject to a late filing penalty.

In addition to tax treaties, similar rules to those in the European Union (EU) Parent-Subsidiary and Interest and Royalties Directives became applicable to Swiss companies in 2005 (Swiss-European Taxation of Savings Treaty). With the entry into force of the automatic exchange of information (AEOI) in Switzerland on 1 January 2017, the Swiss-European Taxation for Savings Treaty has been replaced by the agreement on the AEOI on tax matters between Switzerland and the EU. Accordingly, dividend payments to EU-domiciled parent companies on direct shareholdings of at least 25 percent held for at least 2 years still benefit from a full reduction of withholding at source (i.e. WHT rate of 0 percent). The same applies to certain intragroup interest payments and royalties.

Irrespective of any treaty, a foreign shareholder selling its Swiss subsidiary is not subject to Swiss income tax based on domestic law (exceptions for real estate companies may apply).

Non-resident intermediate holding company

The comments earlier in this report on a foreign parent company also apply for non-resident intermediate holding companies. The holding company needs to meet the requirements of the Swiss tax authorities in terms of substance and beneficial ownership in order to benefit from a tax treaty or from the AEOI agreement (see earlier in this report).

Local branch

A foreign corporation acting as the head office of a Swiss branch is subject to Swiss income and capital tax with respect to income and net assets allocated to the branch.

The acquisition of a target company by a Swiss branch should be carefully structured because participations are usually considered to be allocated to the head office for tax purposes.

Swiss branches are taxed in the same way as companies. For dividend distributions from a Swiss target company, the tax treaty between Switzerland and the country of the foreign head office usually applies, but this needs to be reviewed case-by-case.

Joint venture

The taxation of joint ventures depends on their legal form, whether they are corporations (see earlier comments on holding companies) or partnerships, which are usually considered as being transparent for tax purposes. In the latter case, the tax residency and legal form of the partners determine the tax implications. Usually, a joint venture in the form of a separate corporate entity is preferred because the joint venture partners’ liability is limited and the allocation of profits and application of tax treaties are less complex.

Choice of acquisition funding

The funding of the acquisition with debt, equity or hybrid instruments must be considered from a Swiss tax perspective to achieve a tax-efficient funding structure.

Debt

No stamp duty is levied on the issue and transfer of bonds (including cash bonds and money market instruments).

In general, interest on ordinary loans is not subject to WHT. However, WHT of 35 percent is levied on interest due on bonds and other collective fundraising schemes as listed below, whereas a refund applies in accordance with Swiss domestic tax law or tax treaty, if applicable.

- A loan qualifies as a collective fundraising scheme (‘bond’) where the aggregate number of non-bank lenders (including sub-participations) to a Swiss company under a facility agreement exceeds 10 (under equal conditions) or 20 (under variable conditions), and the total amount of such debt exceeds CHF500,000.

- Debt without fixed maturity date (e.g. cash pooling) is usually not relevant for a Swiss company as debtor (i.e. the company does not qualify as a bank for Swiss tax purposes), where the aggregate number of its non-bank lenders does not exceed 100 and the total amount of such debt does not exceed CHF5 million.

In general, third-party funding arrangements of foreign group companies are not subject to Swiss WHT. However, where the tax authorities consider such funding arrangements to be a collective fundraising scheme for Swiss tax purposes, interest charges would be subject to Swiss WHT. Among others, this treatment can apply in certain situations where the foreign company borrows the funds and:

- the foreign company is a subsidiary of a Swiss company

- the Swiss parent company is the guarantor

- the funds are lent onwards to a Swiss company.

The funding arrangement needs to be assessed case-by-case.

As interest on private and intercompany loans is generally not subject to WHT, taxpayers should ensure that they do not exceed the above thresholds and that they comply with Swiss anti-abuse rules.

Deductibility of interest

Arm’s length interest is generally tax-deductible. However, deduction of interest paid to affiliates may be subject to limitations. The Swiss tax authorities publish annual guidelines on the interest rates considered appropriate on CHF and foreign currency borrowings (safe haven minimum and maximum interest rates).

The Swiss tax authorities have also issued thin capitalization guidelines (safe haven rules), which define the level of related-party debt generally accepted from a Swiss tax perspective.

Based on these guidelines, Swiss companies can leverage the acquisition of assets up to the following debt-asset ratios.

For finance companies, the safe haven debt ratio is usually 6/7 of total assets (finance branch: 10/11). As mentioned earlier, these guidelines are only safe haven rules. The company can diverge from them, provided it can prove that the financing structure within its business complies with arm’s length terms.

Non-compliance with the thin capitalization rules that cannot be commercially justified results in a reclassification of part of the related-party debt into equity (subject to capital tax) and of interest being qualified as a non-tax-deductible deemed dividend subject to Swiss WHT. Debt from third parties is outside the scope of the thin capitalization rules, but third-party debt secured by related parties qualifies as related-party debt for thin capitalization purposes.

Withholding tax on debt and methods to reduce or eliminate it

Arm’s length interest on loans is not generally subject to WHT. For funding arrangements qualifying as bonds, for Swiss tax purposes, WHT of 35 percent is levied at source (i.e. Swiss-resident borrower).

In an international context, WHT may be refunded or credited in accordance with any applicable tax treaty or AEOI agreement.

Checklist for debt funding

- Does the debt qualify as third-party debt (no related-party guarantees)?

- Are the safe haven interest rates for intercompany financing met?

- Are the thin capitalization rules complied with, or is a third-party test available?

- Does the debt qualify as a collective fundraising scheme (‘bond’) or the borrower as a bank for Swiss tax purposes?

- Does a Swiss parent company grant a guarantee to a fundraising foreign subsidiary with funds being used in Switzerland?

Equity

Some equity financing may be required to meet debt-to-equity requirements of financing banks or to strengthen the equity position of the acquiring company.

Stamp duty at the rate of 1 percent is payable on the issue of shares, whereas a one-time exemption applies on CHF1 million. Other contributions of direct shareholders as well as a capital surplus are also subject to stamp duty. Exemptions may apply to restructurings.

Dividends are generally subject to a WHT of 35 percent. Refunds or reductions of the applicable WHT rate may be available under a tax treaty or the AEOI agreement. Dividends from a shareholding of at least 20 percent from a Swiss company to a Swiss corporate shareholder can be distributed without WHT by applying the Swiss domestic notification procedure.

Under the capital contribution principle, the repayment of reserves derived from qualifying equity contributions made by direct shareholders (e.g. capital surplus, contributions) can be distributed without being subject to WHT and without being subject to income tax for Swiss individuals holding the shares as private assets. In the case of listed Swiss companies, limitations to the benefits of the capital contribution principle apply.

Reorganizations

Transactions and reorganizations are generally tax-neutral if the net assets remain subject to taxation in Switzerland, the tax book values remain unchanged and the transferred business is a going concern or business unit.

Statutory merger

The Merger Act provides for two kinds of statutory mergers.

- Merger by absorption: Assets and liabilities are transferred to the surviving company in exchange for newly issued shares. The shares in the absorbed company are then cancelled, and the company is dissolved.

- Merger by combination: A third company is formed specifically for the absorption of two or more companies. The shareholders of the combined companies receive shares in the new company in exchange for their shares in the combined companies.

Mergers are generally income tax-neutral (i.e. hidden reserves should be transferable without taxation) where the following conditions are met.

- Assets and liabilities are transferred at tax book value (thus, a step-up in basis without income tax consequences is not possible).

- Net assets remain subject to Swiss income taxation. This requirement is met even if after the merger the net assets are allocated to a PE in Switzerland.

In general, the absorbing company takes over the tax attributes of the absorbed company. Any tax loss carried forward of the absorbed company can be used by the absorbing company, unless the transaction is qualified as a tax avoidance scheme.

The merger should not trigger any WHT consequences where reserves and retained earnings of the merged entity are transferred and remain subject to Swiss WHT in case of a distribution.

A share capital increase in the context of a qualifying reorganization (merger) usually is not subject to stamp duty. In addition, the transfer of securities (e.g. shares) is usually exempt from securities transfer tax, if applicable.

Where the surviving entity of a merger uses treasury shares, which were previously repurchased from shareholders, to compensate the shareholders of the absorbed company, any gain is considered taxable income of the absorbing company. For private Swiss shareholders receiving such shares, the difference between nominal value (and proportionate capital contributions, if available) and FMV is subject to income tax. As a result, a private individual shareholder may suffer tax consequences without being aware of the exposure beforehand and without receiving any additional cash. Foreign corporate and private individual shareholders receiving new shares may be subject to non-refundable Swiss WHT. Contractual hold-harmless clauses are recommended.

Cash considerations to private individual shareholders are subject to WHT and subject to income tax at the shareholders’ level.

Cross-border mergers

The Swiss Code on Private International Law (CPIL) includes provisions governing registered office transfers to and from a foreign country, as well as provisions to cover cross-border mergers, demergers and transfers of assets. In contrast to purely domestic mergers and immigration through cross-border mergers, the requirements for emigration mergers include pre-transaction safeguards to protect creditors (art. 163b par. 3 CPIL). The provisions apply correspondingly to demergers and transfers of assets involving Swiss and foreign companies.

Other provisions relate to the place for debt collection and jurisdiction in connection with cross-border transactions and to the recognition of registered office transfers, mergers, demergers and transfers of assets carried out in foreign jurisdictions.

Immigration merger

Basically, the same tax principles apply as for a domestic merger. However, from a legal perspective, foreign legislation needs to allow an immigration merger.

Emigration merger

Where a Swiss business is transferred outside Switzerland, significant tax consequences may arise. Qualifying for Swiss tax purposes as a deemed liquidation, an emigration merger triggers the same tax consequences as a statutory liquidation (i.e. hidden reserves are subject to income taxes and any deemed liquidation proceeds are subject to WHT). To the extent that net assets are allocated to a Swiss PE of the foreign absorbing company, the emigration merger does not trigger income tax consequences. With regard to the WHT liability, a refund or reduction of the WHT rate may apply, depending on the domicile of the shareholders of the absorbed Swiss company and, in an international context, the applicable tax treaty or AEOI agreement.

Share-for-share transactions involving Swiss target company and/or Swiss investors (quasi-merger)

In exchange for their shares, the shareholders of the contributed company are compensated with shares in the receiving company. The acquired target company continues to exist as a subsidiary of the acquiring company. Share-for-share transactions are in principle tax-neutral if conditions of restructuring relief rules are met and the transaction does not qualify as tax avoidance scheme.

They are often a more flexible alternative than statutory mergers because, for example, risks and liabilities of the target company are kept isolated and the administrative and operational burden may be lower than in the case of a cross-border merger transaction.

Private individual shareholders of target companies may prefer a share-for-share deal anyway. Cash consideration of up to 50 percent of the transaction value is permissible and, in principle, is tax-free for a Swiss private individual shareholder. Cash consideration by merged entities in a statutory merger generally qualifies as taxable income and is subject to WHT.

The less favorable tax consequences of a statutory merger cannot be avoided by structuring the transaction as a share-for-share deal with subsequent absorption of the target company. Based on the substance-over-form rule, such transaction would qualify as a statutory merger if the absorption occurs within a 5-year period. Swiss private individual shareholders who might be facing taxable income on a subsequent merger are likely to insist on hold-harmless clauses in transaction agreements.

Demerger

The Merger Act stipulates that corporations and associations can either split up or spin off parts of their business.

- In a split-up, the transferring entity is dissolved after the transfer and shareholders receive shares of the entities that take over the business.

- In a spin-off, the transferring entity continues operations after the transfer and shareholders receive shares of the entities that take over the business.

Demergers are generally income tax-neutral. Any hidden reserves should transfer tax-free if the following conditions are met.

- Assets and liabilities are transferred at tax book value (thus, a step-up in basis without income tax consequences is not possible).

- Net assets remain subject to Swiss income taxation. This requirement is met even if the net assets are allocated after the demerger to a PE in Switzerland.

Separated entities are to operate their own business after the reorganization.

Neither the assets transferred nor the shares in the transferee entity are subject to a blocking period. Thus, investors can immediately dispose of business units that are not in line with their strategic plans or need to be transferred for anti-trust reasons. Additionally, in principle, the business of a target company can be restructured tax neutrally in order to meet the market’s expectations.

However, the requirement of continuing businesses at the level of the separated entities is generally subject to close scrutiny by the tax authorities. For pure holding companies, the term ‘business’ implies that the participations held are qualifying participations in active companies and that the holding companies perform true group management functions with appropriate personnel. Finance and intellectual property companies qualify as businesses if they conduct transactions with third parties or affiliated entities and have at least one full-time employee engaged in the operations. For non-operating entities, a demerger might prove difficult due to the stringent requirements on the business criteria. Other means of transfer may be preferable, such as the transfer of assets (discussed later). If a group with mixed business entities is to be divided into two or more separate groups, the demerger of the common holding and intellectual property entities requires special attention.

The demerger should not trigger any WHT consequences if reserves and retained earnings of the transferring entity are transferred and remain subject to Swiss WHT in the case of a distribution.

If reserves and retained earnings are converted into share capital or capital contribution reserves, WHT is due and Swiss private individual shareholders realize taxable income. Whether, and to what extent, a refund of the WHT (35 percent) is available must be analyzed case-by-case.

A share capital increase in the context of a qualifying reorganization (demerger) may not be subject to stamp duty. In addition, the transfer of securities (e.g. shares) is usually exempt from securities transfer tax, if applicable.

Intragroup transfer of assets

In principle, the domestic intragroup transfer of qualifying participations (i.e. share quota of at least 20 percent), businesses or parts of businesses, and business assets at tax book value is tax-neutral. The tax-neutrality of the transfer of such assets is subject to a 5-year blocking period applying to the assets transferred and the common control of the Swiss legal entities involved (e.g. if the Swiss transferor and transferee have a common parent company).

In complex group structures, the ownership of the participation needs to be closely monitored to satisfy these requirements. If a blocking period is breached, the Swiss entities under common management at that time are jointly and severally liable for taxes due.

In practice, the blocking period is mainly relevant for transfers of individual assets, such as real estate or intellectual property. The transfer of businesses should qualify under the demerger rules, in which case no blocking period applies.

If the transferee breaches the blocking period, hidden reserves are taxed at the level of the transferor entity and a dividend is deemed to be paid. The deemed dividend is subject to WHT, which is levied at source at the level of the transferring company and may not be fully recoverable by beneficiaries in accordance with tax treaty or AEOI being applicable.

Asset drop-down

The contribution or sale at tax book value of businesses, business units, fixed assets or qualifying participations (i.e. share quota of at least 20 percent) by a company to a subsidiary that is subject to Swiss taxation is tax-neutral. Except for the transfer of qualifying participations, the drop-down of qualifying assets is subject to a 5-year blocking period. The blocking period applies to both the transferred assets and the shares held by the transferring entity in the subsidiary.

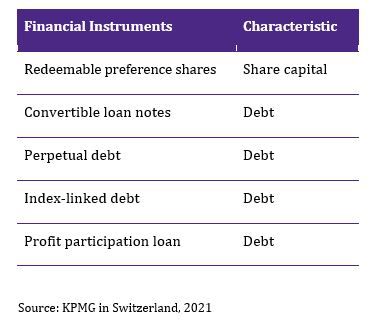

Hybrids

Debt is usually only reclassified as equity if thin capitalization is an issue. In other circumstances, instruments having the form of debt are accepted as such and follow Swiss accounting principles.

As a rule, hybrid financial instruments can be characterized as follows.

Regarding income derived from hybrid instruments, the Swiss participation deduction and privileged taxation of dividend do not apply to (dividend) income treated as tax-deductible by the payer.

Discounted securities

An acquisition of securities at a discount generally results in a taxable gain if the full value of the security is realized. The tax treatment generally follows accounting rules, but this should be reviewed case-by-case.

Deferred settlement

A deferred settlement of interest generally does not affect the deduction of the interest for tax purposes when the interest is booked.

Deferred settlements of the purchase price can be structured through a seller loan or earn-out rules. For seller loans, the comments on debt financing apply. Earn-out elements generally should be treated as part of the capital gain for the seller and subsequent acquisition costs for the buyer. Depending on the circumstances, it may be advisable to gain certainty on the tax treatment with an advance ruling.

Other considerations

Concerns of the seller

As mentioned, a Swiss-resident seller (corporation or individual holding the shares as private assets) usually prefers a share deal to benefit from a privileged taxation of capital gain.

A seller with tax losses close to forfeiture may be willing to agree to an asset deal. However, sellers usually prefer a share deal because the historical tax risks remain with the entity to be sold.

Company law and accounting

The Swiss Code of Obligations (CO) covers a number of business entities in Switzerland. In structuring a transaction, the parties involved must decide which type of entity best suits their needs. Tax issues may play an important part in these decisions.

Corporation — Aktiengesellschaft (AG)

The corporation corresponds to the American corporation and is the most widespread form of association in Switzerland. It is also considered best suited for the requirements of foreign business interests. It is preferred for its ease of incorporation and the limited liability. Its main features are:

- formation according to the CO

- liability limited to share capital

- formed by issue of bearer or registered shares

- minimum share capital of CHF100,000

- restrictions on the acquisition of own shares.

Limited liability company — Gesellschaft mit beschränkter Haftung (GmbH)

The limited liability company (LLC) is a hybrid of a corporation and a partnership that is becoming more widespread in Switzerland. For Swiss tax purposes, the LLC qualifies as a corporation. Its main features are:

- formation procedure similar to a corporation, according to CO

- owners have limited legal liability

- owners may participate in the management of the company

- minimum share capital of CHF20,000.

Other, non-corporate forms of business entities admitted by the CO are as follows:

Partnership — Kollektivgesellschaft

The main features of partnerships are:

- partners must be individuals

- no legal personality

- partners have unlimited liability

- transparent for tax purposes.

Limited partnership — Kommanditgesellschaft

The main features of limited partnerships are:

- partners with unlimited liability must be individuals

- partners with limited liability can be individuals or corporations, among others

- transparent for tax purposes.

Simple association — Einfache Gesellschaft

The main features of simple associations are:

- registration in the commercial register is not possible

- contractual arrangement in the nature of a joint venture

- corporations and individuals can be members

- transparent for tax purposes.

Corporate reorganizations, such as spin-offs, mergers, business transfers, and, in principle, cross-border mergers, are possible under the Merger Act of 2004. Most of these restructurings can be implemented tax neutrally.

Swiss entities must follow the Swiss accounting rules, which are also relevant for tax purposes.

Group relief/consolidation

Apart from VAT, the concept of a consolidated or group tax return is unknown in Swiss tax law. Accordingly, each corporation is treated as a separate taxpayer and files tax returns on its own.

Under Swiss company law, consolidated financial statements are required for companies under common control, by majority vote or by another method.

The company is exempt from the duty to prepare consolidated statements if, together with its subsidiaries, it does not exceed two of the following thresholds in any 2 successive fiscal years:

- a balance sheet total of CHF20 million

- revenues of CHF40 million

- an average annual number of employees of 250.

However, consolidated statements must be prepared for the purpose of assessing as reliably as possible the company’s financial position where:

- the company has outstanding bond issues

- the company’s shares are listed on a stock exchange

- shareholders representing at least 10 percent of the share capital request a consolidated statement.

Consolidated financial statements of non-listed companies are not publicly available.

Transfer pricing

Today, most countries have adopted their own national transfer pricing regulations and documentation rules. Although national transfer pricing regulations can differ in detail, they are usually based on the ‘arm’s length principle’, as defined by the Organisation for Economic Co-operation and Development (OECD) transfer pricing guidelines and in Article 9 of the OECD model tax treaty.

Switzerland is a member of the OECD and has accepted the OECD guidelines without reservation. On 4 March 1997, the Swiss tax authorities issued a circular letter instructing the cantonal tax authorities to adhere to the OECD guidelines when assessing multinational companies.

Swiss tax law does not contain specific documentation requirements. However, the taxpayer is obliged to provide the tax authorities with the necessary information regarding its own tax position as part of its normal obligation to cooperate. In this regard, Swiss tax authorities can request information on transfer pricing. Generally, OECD-compliant transfer pricing documentation is recommended and should be accepted by the Swiss tax authorities.

Although Switzerland does not have specific transfer pricing penalties, general tax penalties can be assessed in severe cases of non-arm’s length arrangements, ultimately assessed as abusive or even fraudulent. In such cases, taxpayers are advised to provide full disclosure of all available information to counter the assessment and avoid penalization.

Dual residency

Companies are subject to Swiss income tax if their statutory seat or actual management is in Switzerland. Thus, companies whose statutory seat is outside of Switzerland but whose day-to-day business is managed in Switzerland qualify as Swiss tax-resident.

Special rules apply to residency for Swiss stamp duty and WHT purposes. Transaction planning needs to reflect these taxes and, in particular, the provisions of an applicable tax treaty.

Foreign investments of a local target company

Switzerland has no formal controlled foreign company (CFC) rules and applies the participation deduction on dividends irrespective of any minimum taxation requirements. The participation deduction regime (see ‘Local holding company’) also applies to capital gains on the sale of qualifying participations held for a minimum of 1 year. Income associated with foreign PEs is tax-exempt under domestic law. Tax losses from foreign PEs are typically allocated to the Swiss headquarters on a provisional basis and recaptured to the extent the PE makes profits within a 7-year period.

Comparison of asset and share purchases

Advantages of asset purchases

- The purchase price (or a proportion) can be depreciated or amortized for tax purposes.

- A step-up in the cost base for capital gains tax purposes is obtained.

- Generally, no inheritance of historical tax liabilities (except for VAT, social security, employee WHT or in the case of reorganizations).

- No deferred tax liabilities on retained earnings.

- Possible to acquire only part of a business.

- Interest expenses for the acquisition generally can be set off against taxable income of the acquired business.

- Profitable operations can be acquired by loss-making companies in the buyer’s group, thereby gaining the ability to use the losses.

Disadvantages of asset purchases

- Possible need to renegotiate supply, employment and technology agreements, and change stationery.

- From a legal point of view, the transaction involves more work and set-up of individual acquisition entities for a cross-border transaction.

- May be unattractive to the seller due to a taxable gain, which may increase the price.

- Higher transfer duties (e.g. on real estate and securities).

- Benefit of any losses incurred by the target company remains with the seller.

Advantages of share purchases

- Likely to be more attractive to the seller, so the price is likely to be lower (if the seller is a private Swiss individual or corporation).

- May benefit from tax losses of the target company (set off against subsequent profits of target for a limited period).

- May benefit from existing supply or technology contracts and tax rulings for the target company.

- No real estate transfer tax (except for acquisitions of real estate companies).

Disadvantages of share purchases

- Deferred tax liability on difference between market and tax book value of assets.

- Risks and previous liabilities remain with the acquired entity.

- No deduction for the purchase price (no tax-effective depreciation of goodwill).

- Potential acquisition of tax liabilities on retained earnings that are ultimately distributed to shareholders.

- Debt for acquisition cannot generally be pushed down to the operating company.

KPMG in Switzerland

Simon Juon

KPMG AG

Badenerstrasse 172 PO Box

CH-8036 Zurich Switzerland

T: +41 58 249 53 66

E: sjuon@kpmg.com

This country document does not include COVID-19 tax measures and government reliefs announced by the Swiss government. Please refer below to the KPMG link for referring jurisdictional tax measures and government reliefs in response to COVID-19.

Click here — COVID-19 tax measures and government reliefs

This country document is updated as of 31 January 2021.