December 2021

On Tuesday 7 December, the European Central Bank (ECB) released their supervisory priorities for 2022 to 2024, which are based on a thorough assessment of the main risks and vulnerabilities faced by the Significant Institutions (SIs) under ECB direct supervision. The ECB acknowledges that banks have remained resilient over the last year and have been able to withstand the impact of the COVID-19 pandemic. Though macroeconomic conditions have improved as compared with the prior year, the uncertainty of the coming years’ economic outlook combined with ongoing concerns over the quality of banks’ assets mean that there is a concern that the full impact of the pandemic may only materialise in the medium term. Furthermore, already-existing structural vulnerabilities of banks’ business models and internal governance have been exacerbated by the pandemic and could also impact the ability for banks to proactively manage emerging risks, especially in the area of climate-related and environmental risks.

With this in mind, the ECB this year for the first time has used its risks and priorities exercise to prioritise and coordinate its activity over a medium-term time horizon – i.e. three years. The ECB states that this approach should make it possible to achieve good progress in addressing relevant vulnerabilities but confirms that it will review the strategic agenda on an annual basis, or even on an ad-hoc basis as required.

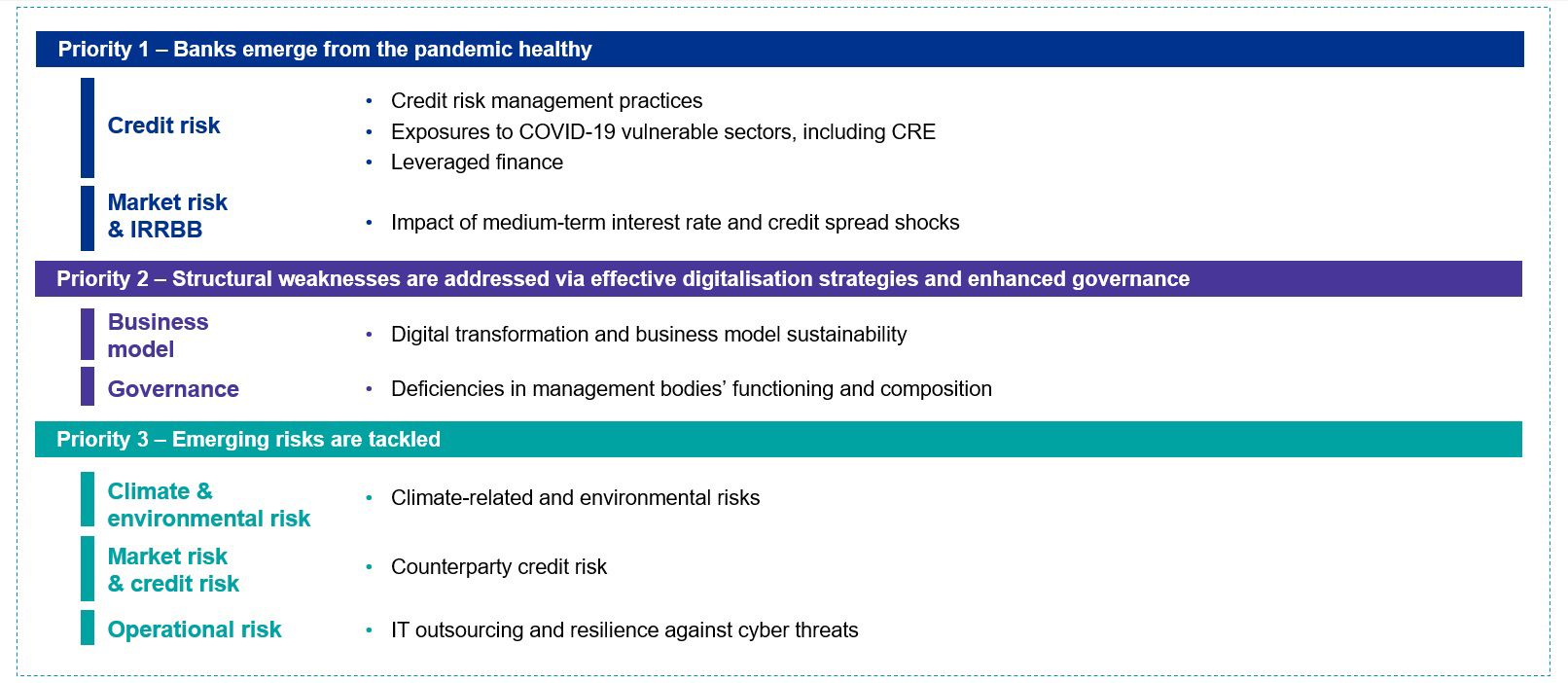

Therefore, the ECB priorities for 2022 to 2024 are threefold; each priority is of equal importance and associated with an underlying high-level work programme to address key vulnerabilities, which are outlined within the priority along with an overview of the ECB’s planned supervisory activities. We have summarised the three priorities below, along with the details for each of the identified vulnerabilities:

Figure 1: SSM priorities 2022-2024

Source: ECB Banking Supervision, 2021

What do the priorities mean for banks and what are KPMG’s key recommendations?

In alignment with the above, the ECB has outlined its key supervisory activity that it intends to undergo for each vulnerability. We have summarised some key recommendations on what banks can start doing now based upon these priorities:

Priority one: Banks emerge from the pandemic healthy and with implications on credit risk management and market risk management

- Credit risk management: re-review identified deficiencies during the “Dear CEO” exercise and be prepared for additional scrutiny on key areas of focus such as the governance of management overlays, the appropriateness of staging transfers and the assessment of significant increases in credit risk (SICR). Next year,

- Monitor exposure towards COVID-19 vulnerable sectors; for banks with exposures to commercial real estate (CRE) expect additional scrutiny including on the revaluation of collateral and challenge on impairment approach.

- Assess ongoing implementation of the ECB’s guidance on leveraged transactions.

- Market risk management: evaluate how interest rate and credit spread assessments in both the trading and banking books are monitored and managed. Identify weaknesses on a timely basis for remediation

Priority two: Structural weaknesses are addressed via effective digitalisation strategies and enhanced governance

- Following the hint that the ECB will run a bank digitalisation strategy survey, begin to prepare relevant documentation, identify weaknesses upfront and understand the ECB’s expectations based upon any relevant guidances or discussions.

- Prepare documentation and review policies around management bodies’ collective suitability and diversity in advance of a planned data collection exercise as well as the publication of additional guidance on this topic.

Priority three: Emerging risks are tackled

- Continue preparation for the upcoming climate risk stress test in 2022. Review identified gaps to the ECB guidance on climate risks and prepare for onsite inspections into this year and the next on this topic.

- Re-review and prepare for targeted onsite inspections on the topic of counterparty credit risks, especially in the case of exposures to non-bank financial institutions.

- Prepare for upcoming data-collection on banks’ outsourcing registers; review compliance with EBA guidelines on this topic.

In short, at a minimum we would advise banks to analyse the priorities, identify the most challenging areas – and the ones most likely to be implemented in their supervisory examination plans – and develop action plans to prepare themselves in advance. We believe the ECB is clearly expecting a more strategic and pre-emptive approach to many topics, including credit risk management.

For further insights, take a look at the SSM beyond COVID-19 series.

Contact us

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia