Resolution and bail-in capital – what banks, creditors and shareholders should know

Resolution and bail-in capital

Over the last months, progress has been made in defining EU resolution and bail-in capital requirements, which banks, creditors and shareholders should have on their radar.

Over the last three months, there have been a number of developments in the second pillar of the European banking union, the Single Resolution Mechanism (SRM). This article provides an overview of these developments, designed to deal with, among others, the too-big-to-fail-dilemma and the EU sovereign-bank nexus.

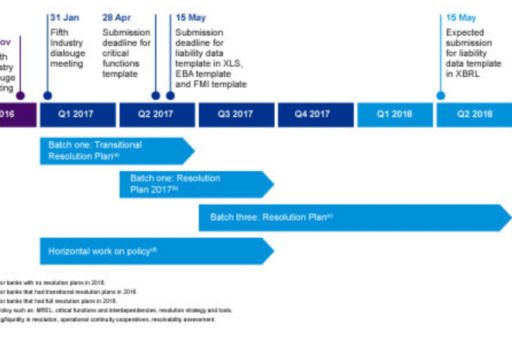

At its fifth industry dialogue on January 30, the SRB provided banks with more detail on liability data reporting. They aim to obtain necessary for bail-in tool execution, (which requires a separation of liabilities related to critical functions) and potential use of other resolution strategies: the sale of the business or a bridge bank. The SRB also announced that the process of collecting Liability Data Templates (LDTs) will continue to evolve in 2017. The scope of the LDT for each bank is now colossal: it comprises 4 million data points, including data requirements on single trade level. Given the scope and frequency of the LDT request, the SRB recommends the industry starts the development of IT solutions for reporting liability information on the basis of the 2017 LDT. The SRB will also aim to develop the infrastructure to accept submissions in a standard system (see timeline in figure 1). In its current format, the LDT takes into account some developments in the legislative proposal by the European Commission for amending the BRRD and implementing TLAC into the EU (“BRRD2”). Of course, further LDT developments may lie ahead for banks due to e.g. the operationalization of resolution tools that require the ad hoc separation of liabilities associated with critical functions or further standardization of MREL eligibility criteria through revisions to CRR.

Bail-in capital

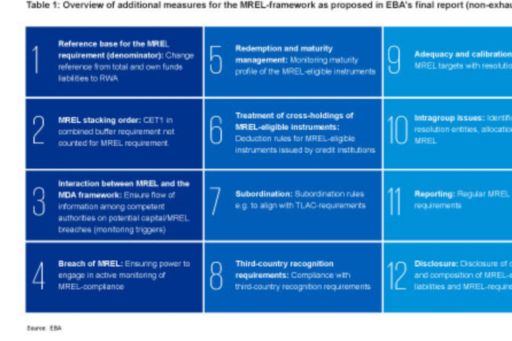

Published in mid-December, the EBA’s final report on the implementation and design of the MREL framework provides additional insights on potential specifications of MREL and its implications for bank funding. While there is continuity with the earlier Regulatory Technical Standard (RTS) on MREL, the EBA’s report identifies a number of potential changes to improve the technical soundness of the MREL framework and to implement the FSB TLAC standard:

From a quantitative perspective, the EBA reports an average MREL ratio of approximately 37% of RWAs as of end December 2015 for 133 EU-banks (32.1% for G-SIBs); furthermore, the estimated aggregate funding need ranges between EUR 66.5 billion and EUR 276.2 billion. The SRB also expects a “significant, though manageable, shortfall” which is assumed to be “a real issue for less than a handful of banks”. For now, it appears unclear whether EBA’s final report and the identified areas will result in BRRD2 changes (the SRB states in its workplan that it will contribute to the BRRD-revision and SRMR as well as to the transposition of total loss-absorbing capacity (TLAC) into EU legislation).

Operational continuity

The SRB has repeatedly emphasized its 2017 focus on operational continuity, i.e. ensuring the functioning of critical services after the resolution (e.g. regarding funding capacity, access to financial market infrastructures, and continuity of critical functions). As a backdrop to this, the FSB published in August 2016 a guidance on arrangements to support operational continuity in resolution. At a European level, the EBA has specified a core list of services and facilities that are necessary to operate a business transferred to [a resolution authority] in accordance with article 65(5) of Directive 2014/59/EU. For banks, creditors and shareholders, the SRB’s focus on operational continuity should be observed closely as this might have an impact on the resolution strategies (e.g. on single/multiple point of entry strategies) and the question on structural separation (also relevant e.g. for the application of article 42 (2) CRR).

Last but not least: Precautionary recapitalization

As 2016 closed, the precautionary recapitalization measure attracted great attention. As an exceptional measure included in the BRRD (Article 32), it allows the injection of capital into a solvent bank by the state to preserve financial stability. However, the requirements for applying this measure are tightly defined and follow a two step-approach: first, the ECB has to confirm the solvency of the bank, i.e. that capital injection is needed to sufficiently address a shortfall under the adverse scenario of a stress test. Second, the capital injection is subject to final approval under the European Union State aid framework. If both tests are ‘passed’, and burden sharing can be achieved in parallel (through bail-in of junior bond-holders, liability management exercises and private capital investments) then such recapitalization does not trigger the resolution of the bank. For now, it appears to be an open question whether precautionary recapitalization applies only in exceptional cases, or whether the SRB and EU COM will allow it to become a ‘new normal’ for recapitalization, an outcome which would clearly be in tension with the wider BRRD bail-in framework.

Conclusion

To conclude with a metaphor, consider the abovementioned developments within the ‘SRM’ to be the construction of a bridge. This bridge is meant to cross the rivers of the too-big-to-fail dilemma and the sovereign-bank-nexus. Following years of intense construction work, the fine-tuning and load proof testing stages have been completed. Recently, however, a major convoy took a slip road marked ‘precautionary recapitalization’ to avoid using the untested bridge. It remains to be seen whether this slip road becomes the highway or the byway.

Footnotes

1In 2016, the SRB collected about 1,500 Excel files manually from 143 banking groups.

2An explanatory YouTube video from the SRB on the LDT can be found here.

3Elke König at the Belgian Financial Forum (27 January 2017).

4Guidelines EBA/GL/2015/06 (non-exhaustive list of relevant requirements).