Options and national discretions: For the rule books

Options and national discretions: For the rule books

The ECB has sorted 122 of 150 options and discretions into official regulations and guidelines. The SSM’s commitment brought about two major milestones in the project.

The long-debated issue of options and national discretions was finally settled in December 2015. After a full year in review and development, 122 of 150 options and national discretions have been sorted into regulations and guidelines under the ECB’s mandate.

The Public consultation on Draft ECB Regulation on the exercise of options and discretions and draft ECB Guide on options and national discretions available in Union law was closed on 16 December 2015.

The Single Supervisory Mechanism (SSM) began identifying those options and national discretions under SSM mandate that were included in the CRD IV/CRR package at the beginning of 2015. IT was considered by many to be a long and arduous process, but without the ECB’s commitment to harmonization the process could have taken much longer.

The major milestones in the project have been: 1) on 11 November 2015 the publication of draft ECB Regulation on the exercise of options and discretions available and the draft ECB Guide on options and discretions available in Union law; and 2) the public hearing that was held in Frankfurt 11 December 2015.

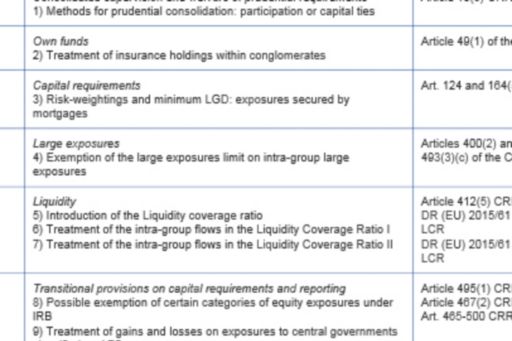

Of the 150 options and discretions that the ECB identified in CRR/CRD IV, 122 are under its mandate as supervisor. One quarter of these (related to general prudential decisions applying to all the SSM institutions) are covered in the regulation – a binding legal instrument of the Union law. The remaining three-quarters are covered in the guidelines, which is not legally binding. The guidelines cover those options and national discretions where a "case-by-case" decision would be required.

Both, Regulation and Guidelines, have in common that they only apply to the significant credit institutions. Bank concerns may vary depending on the different national laws or even different business models, but some of the most relevant/prominent issues that banks mentioned during the hearing fall into these categories:

- The principle of protection of legitimate expectation should be fully applied. This would mean that the transitional arrangements should not be shortened or revoked.

- The proposal made with respect of some waivers are too stringent and could create a distinction between groups merely on the basis of their location.

- Permanent waivers already authorized should be maintained unless a new SSM decision related to that specific waiver is taken.

To avoid any risk of regulatory fragmentation within the SSM zone, we consider that the non-significant institutions should be under the scope of these proposals.

Some options and national discretions will impact banks heavily. An analysis covering the impact of the execution of options to the capital and business planning may prove to be worthwhile. The Regulation will enter into force on the twentieth day after of its publication in the Official Journal of the European Union which it is expected by March 2016.