COVID-19 has dramatically changed the state of play and the conditions in which banks operate. Governments, the ECB and other major monetary authorities have initiated a wide range of measures in an attempt to tackle the immediate impacts of a global economic break, still unpredictable, and to ensure that banks continue funding the real economy. This unexpected turn of events is also leading the SSM to significantly change supervisory priorities planned for the year, focusing all efforts on enabling the ECB and other monetary policymakers to avoid a deep recession.

Domino effect for the economy has been stopped, additional challenges for banks

The public measures taken, including quarantining millions of people to reduce the spread of COVID-19, have resulted in an unprecedented stop of economic activities across the globe. As a response, firms are drawing their credit facilities. The macroeconomic environment will most likely impact banks capital due to significant increases in exposures to corporates and households in (temporary) financial distress. More specifically, banks are expected to be faced with significantly higher capital demand due to above average number of rating migrations across their corporate portfolios (particularly SMEs), potentially increasing IFRS 9 stage transfers. Heightened market volatility, increased credit spreads and higher bid-ask-spreads are likely to materialize in higher Value-at-Risk (VaR) numbers and an increase in Prudent Value Adjustments (PVA).

To prevent a domino effect for banks and the economy from quarantining people and a global economy that is grinding to a halt, the ECB as well as EBA, ESMA, National Competent Authorities (NCAs) in the Euro-area and others have signaled large degrees of flexibility with regards to capital requirements for banks and other supervisory requirements. Regarding the former, the ECB will namely allow banks to:

(As of 27 March 2020)

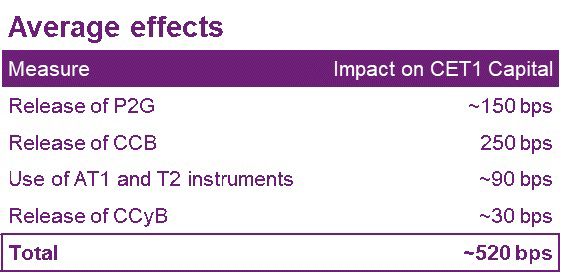

- Operate temporarily below the level of capital defined by P2G,1 the capital conservation buffer (CCB) and the liquidity coverage ratio. (Most NCAs have cut the countercyclical capital buffer (CCyB)); and

- Use AT1 and Tier 2 capital instruments to meet P2R.2 This brings forward a measure that was initially scheduled to come into effect in January 2021, as part of the latest revision of CRD V.

Source:

Measures taken from: ECB Banking Supervision provides temporary capital and operational relief in reaction to coronavirus

P2G, CCB, CCyB figures: ECB publication: Supervisory Review (SREP) – Aggregate SREP outcome for 2019.

AT1 and T2 instruments figures taken from: ECB SREP methodology 2019 and the Introductory statement by Andrea Enria, Chair of the Supervisory Board of the ECB, at the press conference on the results of the 2019 SREP cycle.

The ECB expect these measures to relieve banks of up to EUR 120 billion of capital that could be used to absorb potential losses resulted from an increase of NPLs or provide households, SMEs and Corporates with up to an additional EUR 1.8 trillion of lending facilities. These measures not only have a direct impact on banks’ capital planning (which will need to align with ECB’s expectations on capital usage); but also bring additional challenges for banks: to balance risk-taking and funding the real economy in a stress scenario; to ensure a high-level of risk culture in decision-making processes that include government support measures; to service clients struggling due to COVID-19 without losing focus on financing innovation and growth of other clients, just to name a few.

Are banks prepared to cope with COVID-19?

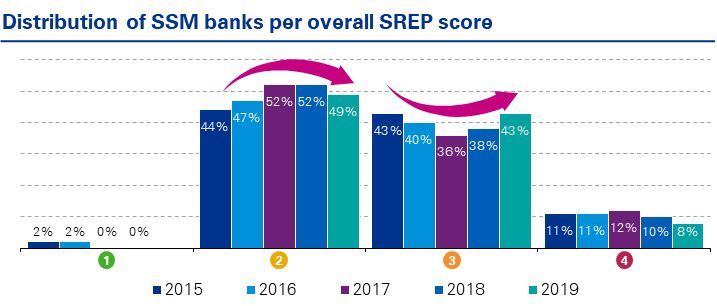

In this crisis, particularly wholesale banking departments need to act fast. Portfolios and risk concentrations are being analysed daily. At the same time, business continuity measures have to be implemented. Large banks with off shore or near shore operations need to be aware of local COVID-19 government measures. For example, India has been locked down, too. This requires excellent risk management governance, culture and spirit. Let us assume that the SREP score on internal governance and risk management (IG&RM) would provide us with insights on the level of preparedness of the banking industry. KPMG analysed SREP results showed a deterioration of SREP scores in the area of IG&RM. However, before drawing conclusions this might reflect either a genuine deterioration in the quality of banks’ IG & RM, or the effect of greater supervisory scrutiny. More specifically, the SSM identified banks’ most common IG&RM deficiencies to include: poor risk data aggregation and data quality, the complexity of the organisational structure, the effectiveness of the Management’s oversight, the Compliance and Internal Audit functions; and the effectiveness of the control frameworks (including areas relating to AML/CFT). Some banks therefore are likely to be placed under greater pressure as internal procedures and risk management processes are brought to their limits in this crisis. It will be interesting to see once the crisis has ended whether individual SREP scores and the successes in managing the COVID-19 crisis are correlated.

Operational and funding resilience

Looking ahead, an adequate quantification and identification of risks will be crucial to face the new reality of reduced capital expectations whilst ensuring resilience in the long term. The ICAAP could therefore be a strategic ally that banks can rely on to meet these purposes, provided that proper improvements are implemented, such as enhancements on data quality, risk identification and inventory, and stress testing methodologies. It is also important to take into consideration the lessons learnt from the 2019 data collection exercise (“Risk-by-Risk”) that could enrich the identification, quantification and management of the main risk drivers. These enhancements will not only close the gap with the ECB’s expectations on banks’ ICAAPs but will also redound in a more robust and reliable tool for managing their capital post COVID-19.

In addition to the impacts that COVID-19 could have on banks’ capital levels in the short and medium term, there are also a number of regulatory and supervisory initiatives in the pipeline that are likely to have a greater impact on capital planning than many banks expected:

- CRD V, which allows banks to cover P2Rs with Additional Tier 1 and Tier 2 capital instruments, could lead to an average decline of CET1 requirements by up to 90 bps from 2021. Although this effect was frontloaded by the measures announced on 12 March 2020, we expect many banks will see this ‘gain’ offset by other factors, and that average MDA levels are unlikely to fall in the long run.

- The upcoming ‘Basel IV’ changes may push up many banks’ Pillar 1 and CET1 levels, which could create more upward pressure on CET1 than some banks anticipate.

- Under the mandate of CRD V, the EBA is reviewing its SREP guidelines and is likely to consult on these during 2020. Possible additions could include further proportionality measures, assessments of ESG risks, greater focus on AML controls and methodological changes to the IRRBB and CSRBB.

- The ECB’s ‘Risk-by-Risk’ (RbR) 2019 exercise, which scrutinised banks’ individual risk drivers, is expected to make Pillar 2 determinations more consistent. If the RbR were to be integrated into the ICAAP, average P2Rs could increase - especially for those banks with weaker ICAAP processes- creating additional pressure on CET1 requirements.

Banks will once again need to pay close attention to capital levels, since quantitative requirements seem to have returned, at least temporarily, to the top of regulators and supervisors’ agendas. Nonetheless, banks will need to remain vigilant to their IG&RM since we do not expect that the ECB will relax its scrutiny during these turbulent times. Therefore, a strong governance framework and an adequate risk management will be even more fundamental to ensure that banks are sufficiently resilient to successfully come through this difficult period. One way or another, it’s clear that banks need to redouble their focus on resilience perspective.

Footnotes

1corresponds to about €90 billion of CET1 capital release for significant institutions.

2corresponds to €30 bln in CET1 capital release.

Get in touch

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia