IFRS 17 – Proposed amendment to insurance standard

IFRS 17 – Proposed amendment to insurance standard

Proposal to amend presentation requirements to ease implementation challenges

The proposal gives practical relief to insurers by offsetting groups of insurance contracts in the same portfolio

An amendment to the new insurance contracts standard, IFRS 17, has been proposed by the IASB1 at its December 2018 meeting.

The proposal aims to provide practical relief to insurers by requiring them to present insurance contracts on the balance sheet at the portfolio level – a higher level of aggregation than currently required by IFRS 17.

The Board also discussed 12 other topics at the meeting, but did not propose any amendments in these areas.

“Many insurers are likely to welcome the IASB’s proposal to require that insurance contracts are presented on the balance sheet at the portfolio level. It remains to be seen where else the Board will seek to ease the challenges insurers have identified.”

Joachim Kölschbach,

KPMG’s global IFRS insurance leader

Proposed change to presentation requirements

IFRS 17 currently requires insurers to present separately on the balance sheet the carrying amounts of groups of insurance contracts that are assets, and groups that are liabilities – i.e. groups cannot be offset.

The Board has tentatively decided to propose a change, so that this requirement applies to portfolios of insurance contracts, rather than groups. This means that offsetting, for presentation purposes only, would be applied between groups in the same portfolio.

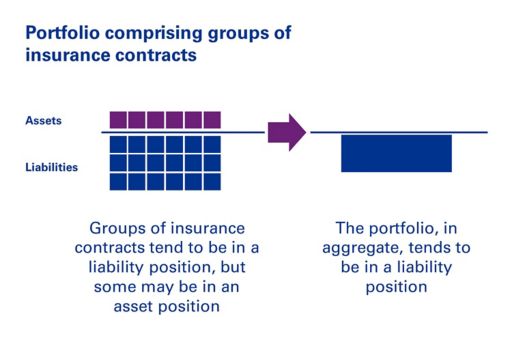

When aggregating insurance contracts under IFRS 17, a group of contracts is a smaller unit of account than a portfolio (see diagram below). These groups generally comprise similar contracts issued within a single annual, or shorter, period.

While groups of contracts may switch between asset and liability positions over time depending on the timing of cash flows, portfolios of insurance contracts are expected to be in a liability position most of the time.

Click to enlarge graphic (JPG, 171 KB)

The tentative decision responds to insurers’ concerns about the difficulty of allocating premium cash flows and the liability for incurred claims to the carrying amounts of individual groups of insurance contracts, due to system limitations.

The Board noted that:

- the loss of information caused by offsetting groups on the balance sheet could be seen as acceptable when balanced against the significant practical relief for preparers of financial statements; and

- the amendment would not unduly disrupt on-going implementation processes, and may even reduce implementation costs and simplify the process for insurers.

While the proposed amendment is likely to provide practical relief for insurers, some may still encounter challenges when it comes to data. For example – as reinsurance deposits are often held by cedants – some reinsurers' portfolios may be in an asset position, with others in a liability position. An allocation of cash flows between these portfolios would be required.

Other challenges that remain include allocating cash flows which are settled on a net basis to the liability for remaining coverage and the liability for incurred claims. This is particularly common with reinsurance agreements and transactions with brokers.

The Board noted that preparers could disaggregate required line items to show additional information if such presentation is relevant to an understanding of an insurer’s financial position. In addition, the disclosure requirements of IFRS 17 would provide users with useful information about the risks related to insurance contracts.

Other topics discussed

The Board discussed 12 other topics, out of a total of 25 identified at the October meeting. They decided not to propose any amendments to IFRS 17 on 11 of these topics because any amendments would not meet the criteria set out by the Board at its October meeting. One topic, applicability of the risk mitigation option on transition to IFRS 17, will be discussed at a future meeting with other topics related to transition requirements.

The process that the Board is taking, together with the outcome of its first in-depth discussion about concerns and implementation challenges related to IFRS 17, emphasise how important it is for insurers to continue to assess the impact of IFRS 17’s requirements and identify practical solutions that address the complexities of implementation.

Next steps

The Board’s decision follows on from its tentative decision in November to propose that IFRS 17’s effective date be deferred to 2022. Any further actions will be subject to the Board’s normal due process, which requires that an exposure draft be published followed by a public comment period.

The timing of an exposure draft is uncertain – this will be subject to the timing and nature of the discussions on the remaining topics, which will be covered at a future meeting.

Stay tuned for our next web article, which will keep you up to date on the outcome of these important discussions.

Visit IFRS – Insurance to read all of our insights on the new insurance contracts standard. Also, our insights on insurers’ IFRS 17 and IFRS 9 implementation can be found on our In it to win it web page.

You can also visit Insurance – Transition to IFRS 17 to find out more about the implementation challenges discussed by the IASB’s Transition Resource Group for Insurance Contracts.

1. The International Accounting Standards Board ('the Board').

© 2024 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.