Japan - Extended Filing and Payment Deadlines for 2020 Individual Taxes

JP - Extended Tax Filing and Payment Deadlines

The Japanese government has announced that filing and payment due dates for individual income tax, individual consumption tax, and gift tax for 2020 will be extended by one month to April 15, 2021.

Japan’s National Tax Agency announced on 2 February 2021, that the filing and payment due dates for individual income tax for 2020 will be extended by one month to 15 April 2021, due to the spread of COVID-19.1

WHY THIS MATTERS

The extension of the filing deadline for 2020 individual income tax returns to 15 April 2021, is one of the measures that has been undertaken to allow taxpayers additional time to organise their tax affairs and to avoid large crowds at the tax office with taxpayers submitting tax returns.

For prior coverage of last year’s extension, see GMS Flash Alert 2020-042 (2 March 2020).

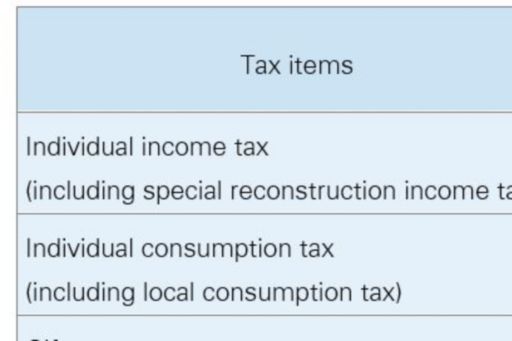

Extended Due Dates

The extended filing and payment deadlines for various individual taxes are as follows:

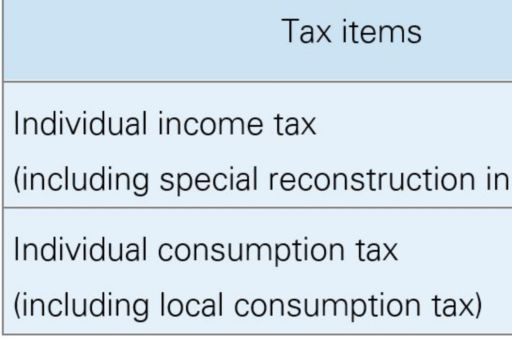

Payment dates for individual income tax and individual consumption tax by using automatic bank transfer will also be extended as follows:

FOOTNOTE

1 ・申告所得税、贈与税及び個人事業主の消費税の申告・納付期限を令和3年4月15日(木)まで延長します(令和3年2月2日)(in Japanese) on the website of the National Tax Agency.

VIEW ALL

The information contained in this newsletter was submitted by the KPMG International member firm in Japan.

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 KPMG Tax Corporation, a tax corporation incorporated under the Japanese CPTA Law and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.