Go back to the Euro Tax Flash homepage.

European Commission publishes BEFIT and Transfer Pricing proposal

European Commission – Fair taxation – Business in Europe – Framework for Income Taxation – BEFIT Common corporate tax base – Profit allocation – Transfer Pricing - CCCTB

On September 12, 2023, the European Commission (EC) issued a proposal for a Council Directive on Business in Europe: Framework for Income Taxation (BEFIT draft Directive or BEFIT proposal) and a proposal (PDF 617 KB) for a Council Directive on transfer pricing (TP draft Directive or TP proposal).

The BEFIT proposal provides common rules for determining the corporate tax base for EU-based entities that are part of a group with global consolidated revenues above a certain threshold. BEFIT would also include provisions for the allocation of profits to relevant Member States. Once allocated, profits would be subject to the corporate income tax rate of the respective Member State. The TP proposal meanwhile relates to the implementation of common rules for determining the transfer pricing approach for EU-based entities, based on OECD principles.

Background

The EC has been actively promoting the idea of a common consolidated corporate tax base (CCCTB) since 2011 when the first Directive proposal for a single set of corporate tax rules in the EU was published. Following a deadlock on the initial proposal, the CCCTB was re-launched in October 2016 in the form of a two-step approach: (i) the determination of a common corporate tax base (“CCTB Directive”) and (ii) additional rules on the formation of a consolidated tax group and a formulary apportionment of the consolidated tax base to the respective Member States (“CCCTB Directive”).

In 2021, the EC announced an intention to withdraw the pending CCTB and CCCTB proposals in light of a new initiative that was presented as part of its Communication on Business Taxation for the 21st Century to promote a robust, efficient and fair business tax system in the EU. In this context, the EC published a call for evidence for an impact assessment and asked for public feedback on proposed policy options for a new corporate tax system referred to as “BEFIT” on October 13, 2022.

According to the consultation documents, BEFIT would aim to provide common rules for the determination of the corporate tax base of EU-based entities that are part of a group with global consolidated revenues above a certain threshold. In addition, the 2022 consultation documents included provisions for the allocation of profits to Member States based on a pre-defined formula (formulary apportionment).

As part of the consultation, the EC also asked for views on how the administration of transfer pricing rules and the application of the arm’s length principle could be simplified and whether to incorporate the OECD arm’s length principle and Transfer Pricing Guidelines in EU law.

The EC also proposed simplified filing requirements (e.g., a single EU corporate tax return combined with a one-stop-shop for submitting the group’s tax returns), simplified interactions with tax authorities (e.g., a coordination of local audits), and alternative dispute prevention and resolution methods.

For more information on the initiative, please refer to Euro Tax Flash Issue 489 and Issue 504.

BEFIT proposal by the European Commission

The proposed Directive is structured into six Chapters that set out the rules, starting with general provisions on scope and definitions, moving to the detailed provisions relating to the calculation of the BEFIT tax base, the allocation of the BEFIT tax base to members of the BEFIT group, a simplified approach to transfer pricing compliance, administrative provisions and then finishing with provisions dealing with the transposition of the proposed Directive into the local legislation of EU Member States.

Scope

The proposed Directive would apply to companies that are resident for tax purposes in a Member State, including their permanent establishments located in other Member States. It would also apply to permanent establishments located in Member States of entities resident for tax purposes in a third country (i.e., a non-EU company with an EU permanent establishment).

The proposed Directive includes certain mandatory and optional scoping provisions which are dependent on the size of the relevant MNE Group and its activities within the EU:

- Mandatory scoping provisions: The proposed Directive applies the same scoping thresholds as the OECD Pillar Two GloBE rules. As such, groups operating in the EU (whether headquartered in the EU or in a third country) with annual combined revenues of at least EUR 750 million will be within the scope of BEFIT. However, the scope of the proposed Directive will not apply to a non-EU headquartered group if, in two of the last four years, the combined revenues of the group’s EU subsidiaries and permanent establishments does not exceed (i) five percent of the total group revenues or (ii) EUR 50 million.

- Voluntary scoping provisions: Where the scoping thresholds above are not met, a group may still opt to apply BEFIT provided the group prepares consolidated financial statements. Where a group opts to apply BEFIT, the framework will apply to the whole BEFIT group.

A BEFIT group would be formed where two or more companies or permanent establishments which fall within the scope of the Directive meet a 75 percent ownership threshold test (direct or indirect holding).

While the proposal does not exclude any sectors from the scope of BEFIT, sector-specific characteristics are reflected in relevant parts of the proposal. The Explanatory Memorandum accompanying the Directive highlights adjustments that are proposed for international transport and extractive industries.

Calculation of the preliminary tax result of each BEFIT group member

The starting point for the calculation of the preliminary tax result is the financial accounts of the BEFIT group entities. These financial accounts must follow the accounting standard of the ultimate parent entity or the filing entity in the case of a non-EU headquartered group. In addition, the accounting standard must be accepted under EU law (e.g., the generally accepted accounting principles of an EU Member State or IFRS).

While the Explanatory Memorandum notes that BEFIT includes fewer tax adjustments than the Pillar Two GloBE rules, the financial accounting net income or loss would still be subject to a number of adjustments, including:

- Taxable income: certain types of income would need to be included in the preliminary tax results where they have not already been recorded in the financial accounting statements (e.g., financial assets held for trading, and capital gains received by life insurance undertakings in the context of unit-linked/index-linked contracts).

- Excluded income: certain items would need to be excluded from the calculation of preliminary tax results (e.g., certain qualifying dividends and capital gains or losses on shares or ownership interests, income or losses attributable to permanent establishments, shipping income subject to a national tonnage tax regime approved by the EC).

- Non-deductible expenses: certain expenses would not be allowed to reduce the preliminary tax results, i.e., they need to be added-back to the financial accounting net income or loss (e.g. borrowing costs that are paid to parties outside the BEFIT group in excess of the ATAD interest limitation rule, fines, penalties and illegal payments such as bribes, corporate taxes that were already paid or top-up taxes in relation to Pillar Two).

- Depreciation rules: the proposed Directive also introduces a common set of tax depreciation rules. Fixed tangible assets valued below EUR 5,000 would be expensed immediately, while other assets would be depreciated on a straight-line basis across the duration of the useful life of the asset. The proposal would also allow to depreciate goodwill if it is acquired and is present in the financial accounts.

- Further specific adjustments: the proposal also addresses certain timing and quantification issues with the intention to prevent potentially abusive situations (e.g., differences between the cost of stocks and work-in progress, revenues and costs from long-term contracts, the treatment of hedging instruments) and provides rules for entities entering or leaving the BEFIT group as well as other business reorganizations.

Aggregation and allocation of the tax results

Aggregation of the preliminary tax results into a single BEFIT tax base

Once the preliminary tax results for each member of the BEFIT group have been calculated (following the approach outlined above), these results would then be aggregated into a single pool, which would be considered to represent the BEFIT tax base. This does not apply to income or losses from (i) extractive industries and (ii) international transport activities (not covered by an approved tonnage tax regime), which would not be aggregated.

In the context of aggregating the preliminary tax results into a single tax base, the proposed Directive would allow for members of the BEFIT group to set-off losses throughout the BEFIT group (i.e., losses could be utilized cross-border). In addition, no withholding taxes would need to be applied on interest and royalty payments within the BEFIT group, provided that the beneficial owner of the payment is a BEFIT group member. A definition of the term beneficial owner is not provided in the proposed Directive.

Allocation to eligible BEFIT group members

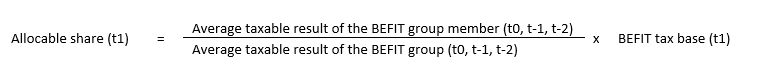

In the first seven fiscal years post-implementation (transition phase), the BEFIT tax base would be allocated to the members of the BEFIT group using a baseline allocation percentage (calculated using their percentage of the average taxable results in the prior three fiscal years).

In the first fiscal year in which a BEFIT group is subject to the BEFIT framework (t1), the prior year taxable results (t0) would need to be determined in accordance with the national corporate tax rules of the Member State in which the BEFIT group member is resident or situated for tax purposes. In subsequent fiscal years (e.g. t2), the calculation of the prior year taxable result (e.g. t1) would generally need to be based on the BEFIT provisions for calculating the preliminary tax result of the BEFIT group member.

The proposal clarifies that where a BEFIT group member has negative taxable results, the baseline allocation percentage for the respective BEFIT group member would be deemed to be zero. In addition, the proposal provides that adjustments to the allocation percentage would be required for intra-BEFIT group transactions that are not priced at arm’s length. Other adjustments that need to be made to the baseline allocation percentage of a BEFIT group member include deduction limitations for exceeding borrowing costs, which arise from a transaction between BEFIT group members and re-calculation requirements in case of BEFIT group members joining or leaving the group.

The Explanatory Memorandum notes that this allocation approach may pave the way for a permanent allocation method that could be based on a formulary apportionment.

Local adjustments to allocated tax results

Once allocated, each BEFIT group member would be required to make additional local adjustments to its part of the taxable base (e.g., for pre-BEFIT losses, pension provisions, etc.). In particular, the proposal provides for local adjustments in respect of distribution-based tax systems (i.e. taxation of corporate income is not on a yearly basis, but upon distribution of the profits), whereby the allocated part of the aggregated tax base would be carried forward each year in proportion to the non-distributed income.

In addition, Member States would be allowed to apply any further deductions, tax incentives or base increases to their allocated part of the BEFIT taxable base provided that such local adjustments are compliant with the Pillar Two GloBE rules. As such, the tax rate and enforcement policies would fully remain with Member States according to the Explanatory Memorandum.

The proposal further requires Member States to grant foreign tax credits (i.e. taxes on a BEFIT group member’s income that is imposed in another Member State or in a third country) in line with the applicable double taxation convention or national law and subject to certain conditions. The tax credit would then need to be shared amongst the BEFIT group members based on the respective baseline allocation percentage of each BEFIT group member.

Transfer pricing considerations

TP simplifications in the transition period

As a simplification in the first seven fiscal years post-implementation (transition phase), the proposal requires Member States to deem intra-BEFIT group transactions to be priced at arm’s length where they fall within a low-risk zone. The low-risk zone would cover expense incurred / income earned by a BEFIT group member from an intra-BEFIT group transaction that increases by less than 10 percent compared to the average amount of the income or expense in the previous three fiscal years. Where the income or expense increases by more than 10 percent, the pricing would not be considered to be priced at arm’s length, with any increase beyond 10 percent to be removed from the baseline allocation percentage of the group member. An exception applies where the BEFIT group member provides evidence that the relevant intra-BEFIT group transaction was priced in accordance with the arm’s length principle.

Traffic light system for low-risk activities

With regard to transactions with associated enterprises outside the BEFIT group,the BEFIT proposal aims to facilitate compliance by providing a risk assessment tool. In this context, the proposal provides for a simplified approach to transfer pricing compliance. This approach would be based on commonly accepted public benchmarks that would be available for low-risk activities performed by certain eligible distributors and contract manufacturers.

The benchmarks would be representative of the profit performance of independent entities operating in the EU that predominantly perform distribution or manufacturing activities. The results of the benchmarks would need to be published on the EC website and updated every three years. According to the Explanatory Memorandum, an expert group would be commissioned to perform the benchmarking analyses.

Member States would be required to assess in-scope transactions as being low, medium or high risk, depending on how they compare to profit markers that are derived from the benchmarks. Depending on this risk assessment, Member States would proceed with the following actions:

- Low-risk zone: while the competent authorities of Member States would retain the right to perform transfer pricing adjustments of profit margins, the competent authorities of the Member States may not dedicate additional compliance resources to further review the transfer pricing results of a taxpayer that falls within the low-risk zone.

- Medium-risk zone: the competent authorities of the Member States may monitor the results, using available data, and contact the taxpayer to seek a better understanding of its circumstances before deciding whether to allocate compliance resources to carrying out risk assessments and audits.

- High-risk zone: the competent authorities of the Member States may recommend that the taxpayer reviews its transfer pricing policies and may decide to initiate a review or audit.

For BEFIT groups, the benchmarks would be available to be used as a self-assessment risk tool and may provide taxpayers with increased levels of advance certainty regarding the arm’s length returns that they are expected to achieve in transactions with associated enterprises outside the BEFIT group.

According to the Explanatory Memorandum, the system is intended to allow Member States to use their resources more efficiently, while at the same time affording businesses a higher level of predictability and tax certainty. In addition, the EC proposed in parallel a Directive on transfer pricing without limitation to low-risk activities to incorporate the OECD transfer pricing guidelines into EU law (please see below for further information).

Administration

Filing requirements

The proposed BEFIT Directive would provide for a one-stop-shop to allow businesses to deal with one single authority in the EU for filing obligations. The filing obligation would generally sit with the ultimate parent entity (filing entity) which would then file a single information return for the whole BEFIT group (BEFIT Information Return) directly with its own tax administration (the ‘filing authority’).

The BEFIT Information Return would need to be filed no later than four months after the end of the fiscal year and would require information on the group and ownership structure as well as information on the individual BEFIT group members. In addition, the filing entity would need to submit information on the calculation of the preliminary tax result of each BEFIT group member, the BEFIT tax base, the allocated part of each BEFIT group member and the baseline allocation percentage as part of the BEFIT Information Return. The local tax authority would then share the information with the tax administrations of the other Member States in which the group operates.

In addition, each individual BEFIT group member would also be required to file an individual tax return to their local tax administration, in order to ensure that any additional local adjustments to their allocated part of the BEFIT tax base are captured correctly.

Tax assessment and audits

The proposal would introduce the concept of a ‘BEFIT Team’ that would be composed of representatives of each relevant tax administration from the Member States where the BEFIT group operates the members. The BEFIT team would examine and reach consensus on the completeness and accuracy of the BEFIT Information Return, except for the outcome of the computation of the preliminary tax result of each BEFIT group member. According to the Explanatory Memorandum, this concept is targeted at facilitating information exchange and coordination between the local tax administration, as well as providing early certainty and resolving disputes on specific topics.

The Member State in which a BEFIT group member filed its individual tax return would be required to issue an individual tax assessment and enforce the relevant tax liability in accordance with its domestic legislative provisions. The proposal further clarifies that national tax administrations may initiate and coordinate audits of local BEFIT group members in accordance with their national provisions. In addition, local tax administrations would be entitled to request joint audits. Following the outcome of an audit, the BEFIT team would facilitate corrections and adjustments.

Sanctions

To ensure that the rules of the common framework are implemented and enforced correctly, the proposal would require Member States to lay down rules on penalties applicable to infringements of national BEFIT provisions in an effective, proportionate and dissuasive manner.

Transfer Pricing proposal by the European Commission

Policy considerations

The EC notes that, although almost all Member States are committed to following the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD Guidelines), the status and role of the OECD Guidelines currently differs from Member State to Member State. As such, the EC is of the view that there is a lack of harmonization at the level of the EU regarding TP rules which has (i) led to the cultivation of a complex and uneven playing field for taxpayers and, (ii) has had adverse effects for the EU Single Market. According to the EC, some of the specific issues arising from this disparity include profits shifting and tax avoidance, litigation, double taxation, and high compliance costs. On this basis, the EC has proposed a Directive to address these issues by the inclusion of the OECD arm’s length principle and OECD Guidelines in EU law, alongside the gradual development of common approaches to the practice of applying TP.

Incorporation of the arm’s length principle

The TP draft Directive is structured into three parts that set out the rules, starting with the arm’s length principle and the potential consequences of its application, moving to the core elements to be considered for the application of the arm’s length principle and then finishing with the inclusion of a mechanism for establishing further common rules covering a limited set of subjects.

The Directive would apply to transactions between two associated enterprises, a term which has been defined in Article five of the Directive as “a person who is related to another person in any of the following ways:

- a person participates in the management of another person by being in a position to exercise a significant influence over the other;

- a person participates in the control of another person through a holding that exceeds 25 percent of the voting rights;

- a person participates in the capital of another person through a right of ownership that, directly or indirectly, exceeds 25 percent of the capital;

- a person is entitled to 25 percent or more of the profits of another person”.

The arm’s length principle provides that if transactions between associated enterprises are not at arm’s length, they must be adjusted to reflect the terms and conditions that would have been agreed if the transaction had been between independent parties. The Directive also specifies rules regarding the application of primary and corresponding adjustments. Specifically, Member States would be required to introduce adequate mechanisms to enable them to make a corresponding adjustment when a primary adjustment is made in another jurisdiction.

Reference to OECD Transfer Pricing Guidelines

In addition, the Directive provides Member States with common rules regarding certain core elements such as, the accurate delineation of the commercial and financial relations, TP methods1, selection of the most appropriate method, comparability analysis and establishing an arm’s length range, and documentation. Furthermore, it should be noted that the latest version of the OECD Guidelines would be binding for Member States regarding the application of the arm’s length principle. The Explanatory Memorandum acknowledges that, in the interest of ensuring consistency with the OECD Guidelines, as they are amended from time to time, these new guidelines should be the new binding reference framework. The Directive defines the OECD Guidelines by reference to the 2022 version and any further amendments to these OECD Guidelines that the EU approved in the context of the OECD Committee on Fiscal Affairs via the adoption of a Union position (under Article 218(9) of the Treaty on the Functioning of the EU – TFEU). The EC may also propose future amendments to the Directive.

Implementing acts

With a view to maximizing tax certainty, the Directive also proposes that additional binding rules will be established by means of implementing acts. Such acts would provide for (i) additional visibility for taxpayers regarding what Member States consider acceptable for specified transactions, and (ii) safe harbors that would mitigate the administrative burden.

Next steps

It is expected that the EC will launch a public consultation seeking feedback from interested stakeholders on both of the proposed Directives. Based on the general process, the public consultation would run for an eight-week feedback period starting from September 12, 2023, but extended every day until the proposal is available in all EU languages. For more information, please refer to the public consultation webpage.

Considering that the legal basis for the EC’s proposal is Article 115 of the Treaty on the Functioning of the EU (TFEU), the Directive requires unanimous approval in the Council. In addition, the Council would only be allowed to adopt the text once the Parliament and any relevant Committees have given their (non-binding) opinions.

Where the Directive is approved in the Council, it would enter into force on the twentieth day following that of its publication in the Official Journal of the EU. The EC proposes that Member States should transpose the BEFIT proposal into domestic law by January 1, 2028, and that the provisions of the Directive should apply as of July 1, 2028. The TP proposal should be transposed by December 31, 2025 at the latest and the rules should be applied from January 1, 2026.

ETC Comment

As noted above, the BEFIT Directive would require unanimous approval in the Council. Experience with discussions on the C(C)CTB proposals shows that it may prove challenging for all Member States to reach agreement on a common corporate tax base framework.

One key issue in the discussions between Member States appears to relate to the allocation of the aggregated taxable profits. It is noteworthy that the EC decided against the allocation of profits to Member States based on a pre-defined formula (formulary apportionment) as was proposed in 2022 consultation documents. The latter had explored options for an allocation based on allocation factors such as tangible assets (excluding financial assets), labor (possibly, a combination of staff numbers and payroll) and sales by destination, as well as intangible assets. Instead, the EC is now proposing to allocate the BEFIT tax base to the members of the BEFIT group using a baseline allocation percentage in the first seven fiscal years post-implementation. According to the Explanatory Memorandum, a permanent allocation method may be introduced following this initial phase and could be based on formulary apportionment by taking into account more recent County-by-Country Reporting (CbCR) data and the information gathered from the first years of the application of BEFIT.

Another open issue relates to the EC’s proposal for a Directive on a debt-equity balance reduction allowance (DEBRA), the examination of which has been suspended until other proposals in the area of corporate income taxation announced by the EC have been put forward. It had been understood that these other proposals related to the BEFIT initiative. While the Explanatory Memorandum notes that the BEFIT proposal is in line and complements a number of previous EC proposals, DEBRA appears to have not found its way into the BEFIT proposal. As such, stakeholders need to monitor whether discussions at Council level will now resume with a view to adopt the DEBRA and BEFIT proposals as separate files.

The TP proposal is also designed to be in line with existing EU policies to create a robust, efficient and fair tax framework. In particular, the explanatory memorandum explains that DAC3 and DAC6 are of particular relevance to the proposal given that they relate to TP. In addition, it should be noted that the TP proposal differs in scope to the BEFIT proposal such that it would apply to all MNE groups operating in the EU. In this regard, Member States would be required to apply the TP proposal to a broader scope of entities than that defined in the BEFIT proposal.

Alongside the BEFIT and TP proposal, the EC also issued a related proposal for a Directive for a Head Office Tax System for SMEs. Based on that proposal, certain standalone SME entities with permanent establishments abroad would be able to calculate their tax liability based only on the tax rules of the Member State of their Head Office. In addition, qualifying SMEs would need to file only one single tax return with the tax administration of their Head Office. The Member State of the Head Office would be required to share this information with other Member States where the SME is operating and to transfer any resulting tax revenues to the countries where the permanent establishments are located. For more information, please refer to the EC’s press release. A separate Euro Tax Flash will be released shortly to cover this initiative.

Should you have any queries, please do not hesitate to contact KPMG’s EU Tax Centre, or, as appropriate, your local KPMG tax advisor.

Jack Cannon

Manager

KPMG’s EU Tax Centre

1In line with Chapter three of the OECD Guidelines, article nine of the Directive refers specifically to (i) the comparable uncontrolled price method, (ii) the resale price method, (iii) the cost-plus method, (iv) the transactional net margin method, and (v) the profit split method (together, the listed methods). In addition, Member States shall allow for application of other methods only if it can be demonstrated that (i) none of the listed methods are appropriate, or (ii) the selected valuation method is consistent with the arm’s length principle and provides a more reliable estimate than the listed methods.