Go back to the Euro Tax Flash homepage.

European Commission issues call for evidence and public consultation on a new common corporate tax system in the EU (BEFIT)

European Commission – Fair taxation – Business in Europe – Framework for Income Taxation – BEFIT – Common tax base – Formulary apportionment

On October 13, 2022, the European Commission published a call for evidence for an impact assessment and asked for public feedback on proposed policy options for a new corporate tax system referred to as “Business in Europe: Framework for Income Taxation (BEFIT)”.

This initiative would provide common rules for determining the corporate tax base for EU-based entities that are part of a group with global consolidated revenues above a certain threshold. BEFIT would also include provisions for the allocation of profits to Member States based on a pre-defined formula (formulary apportionment). Once allocated, profits would be subject to the corporate income tax rate of the respective Member State.

Interested parties are asked to provide feedback and comments by January 5, 2023. The planned adoption by the Commission of a legislative proposal is expected for the third quarter of 2023.

Background

The European Commission (EC) noted on several occasions concerns regarding the lack of a common corporate tax system in the EU, which is considered to create a competitive disadvantage compared to third country markets. According to the EC, such a disadvantage results from distortions in investment and financing decisions driven by tax optimisation strategies and higher compliance costs for businesses due to different tax systems in the EU.

The EC has therefore been actively promoting the idea of a common consolidated corporate tax base (CCCTB) since 2011 when the first Directive proposal for a single set of corporate tax rules in the EU was published. Following a deadlock on the initial proposal, the CCCTB was re-launched in October 2016 in the form of a two-step approach: (i) the determination of a common corporate tax base (“CCTB Directive”) and (ii) subsequent additional rules on the formation of a consolidated tax group and a formulary apportionment of the consolidated tax base to the respective Member States (“CCCTB Directive”). Both the CCTB and CCCTB were designed to apply to corporate groups with consolidated revenue exceeding EUR 750 million, with an opt-in option for smaller groups.

In 2021, the EC announced intentions to withdraw the pending CCTB and CCCTB proposals in light of the new BEFIT initiative that was presented as part of its Communication on Business Taxation for the 21st Century to promote a robust, efficient and fair business tax system in the EU. According to the Communication, BEFIT is aimed to provide for common rules for determining the corporate tax base and for the allocation of profits between Member States, based on a pre-defined formula (formulary apportionment) under consideration of the previous CCTB proposal as well as principles agreed upon under the OECD Pillar One and Pillar Two (for more details, please refer to Euro Tax Flash issues 448 and 449).

BEFIT objectives and policy options

According to the call for evidence document, the initiative aims to reduce complexity and compliance costs resulting from having to deal with 27 different corporate tax systems in the EU. The EC aims to boost the competitiveness of the single market, support investment in the EU and provide sustainable tax revenue in light of the current economic challenges.

To achieve those objectives, the EC recommends EU action in the form of a directive, which would be composed of the following five key building blocks:

Scope

In the call for evidence, the EC sets forth two options in terms of scope:

- Option 1: Groups with consolidated global revenues above a threshold of EUR 750 million in correspondence to the scope of the proposed EU Minimum Tax Directive (Pillar Two), or

- Option 2: Lowering the revenue threshold below EUR 750 million in order to make the framework more inclusive and to reduce disparities. According to the call for evidence, this may also include an opt-in option for SMEs with cross-border activities to enable them to benefit from common EU rules on tax base and the allocation of profits.

The public consultation questionnaire asks stakeholders for views on a number of options in terms of scope, including thresholds over EUR 250 million, EUR 50 million and all groups or standalone companies, regardless of their revenues (including SMEs).

In addition, the call for evidence notes that the EC aims to limit sectoral carveouts. Where there is a need for sectoral exclusions, the questionnaire explores ways to deal with groups that operate in a mix of sectors and proposes to exclude the company’s full income from the BEFIT tax base for a certain tax year where revenues arising from excluded activities exceed a certain revenue threshold (e.g. 50 percent of a company’s total revenue).

Tax base

For purposes of determining the tax base, the EC is considering drawing inspiration from Pillar Two and preparing a list of tax adjustments that would need to be applied to the consolidated financial account net income or loss of a group entity.

According to the questionnaire, the financial accounting net income or loss would be determined based on a single EU acceptable accounting standard for the whole group, to ensure that all group members use the same accounting standard as a basis for computing their tax base under BEFIT. The financial accounting net income or loss would then need to be adjusted to account for categories of income and expenses that EU Member States commonly treat differently for tax purposes and which are responsible for a significant part of the corporate tax base (around 90 percent). In the questionnaire the EC is asking stakeholders for feedback on the following tax adjustments:

- depreciation of fixed assets;

- exemption of received profit distributions (non-deductibility of linked expenses);

- exemption of the income and non-deductibility of the losses of a permanent establishment;

- non-deductibility of corporate taxes and similar profit-based taxes;

- rules on addressing the debt bias;

- tax credit on income already taxed outside the EU (other than exempt income) such as interest, royalties and other income paid to a company within the scope of BEFIT;

- anti-abuse rules on common issues such as a general anti-abuse rule (GAAR), controlled foreign company (CFC) rules, interest deduction limitation and hybrid mismatches;

- rules on entering and leaving BEFIT (corporate restructuring and transition phase).

Following the tax adjustments, the individual tax bases of all EU group members would need to be consolidated. The questionnaire notes that the need for transfer pricing adjustments for intra-group transactions in the EU would be abolished and the option to offset cross-border losses would be introduced as a result.

Alternatively, the EC proposes to establish a framework that would provide for detailed rules for the determination of the tax base. In this context, the call for evidence already indicates that Member States would have to run two comprehensive sets of corporate tax rules in parallel under this option.

Allocation of taxable profits

In order to effectively allocate the tax base to Member States, the EC proposes to apply formulary apportionment under consideration of the OECD’s Pillar One solution. The allocation of taxable profits under BEFIT would be based on three factors commonly used for formulary apportionment of profits between tax jurisdictions, namely:

- tangible assets (excluding financial assets);

- labor (possibly, a combination of staff numbers and payroll); and

- sales by destination.

While noting that these factors should reflect the income generation most accurately and should be the most resistant to abusive practices, the EC is also considering taking into account intangible assets as a fourth factor in the formula to better reflect economic reality. According to the call for evidence, a proxy value would be added to the formula. The questionnaire notes that such proxy value could be determined based on research and development expenses as well as marketing and advertising costs that meet certain nexus requirements.

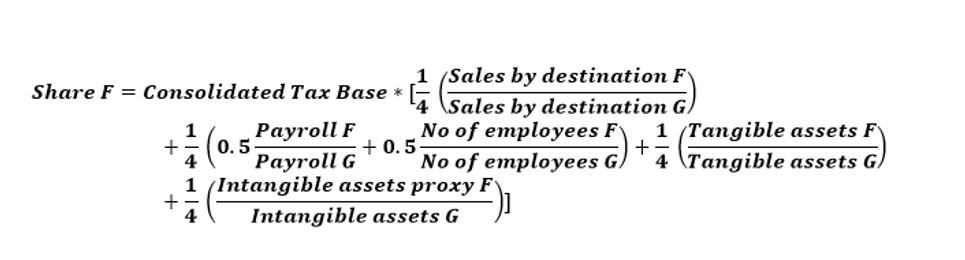

In addition, the questionnaire explores several options to weight the apportionment factors and considers the need for sector-specific variations of the formula. The following formula is provided as a sample1:

Stakeholders are asked whether sales by destination should be given a higher weighting in the formula so as to increase the profit allocated to the EU country of destination (market jurisdiction).

Allocation of profits to related entities outside the BEFIT group

The EC is also exploring efficient ways to allocate profits to related entities outside the EU, which would not be subject to the BEFIT provisions, i.e. outside the BEFIT group. In this regard, the EC is considering issuing guidance on how tax authorities assess the risk of certain transactions in accordance with the OECD’s arm’s length principle. The guidance would provide clarifications on whether a related-party transaction is at low, medium or high risk of not complying with the arm’s length principle based on how it compares to a series of benchmarks for each category of macro-industry (e.g. automotive) and type of activity (e.g. distribution).

The guidance would not replace the arm’s length principle, and companies would still need to carry out the necessary transfer pricing analysis. However, the EC aims to provide a simplified approach to the administration of transfer pricing rules that would provide an increased level of tax certainty for businesses when carrying out the necessary transfer pricing analysis.

Alternatively, the call for evidence proposes to keep the current approach to the application of the transfer pricing rules.

Administration

According to the call for evidence, the administration aspect of BEFIT is considered to be an integral part of the system in order to achieve the objective of reducing compliance and administrative costs for taxpayers and Member States. In this context, the questionnaire explores ways to provide:

- filing simplifications relating to tax returns (e.g. a single EU corporate tax return combined with a one-stop-shop for submitting the group’s tax return and possibly settling annual tax liability);

- simplifications relating to interactions with tax authorities (e.g. coordination of audits, including joint audits, by the tax authorities of EU countries in which the group has a taxable presence), and

- alternative dispute prevention and resolution methods in addition to the existing national judiciary system.

Next steps

Interested parties are asked to provide feedback and comments by January 5, 2023, in particular, on the following aspects of the proposed BEFIT framework:

- the problem and the need to act;

- the scope of the new system;

- how to calculate the common tax base;

- how to consolidate the tax bases of group members and allocate the consolidated tax base to the eligible Member States;

- how to allocate profit in the context of transactions between members of the group and entities outside the group (in the EU and in non-EU countries); and

- how to simplify the administration of the system.

The input received will be published on the EC’ website and will be taken into account in fine tuning the initiative. The planned adoption by the EC of a legislative proposal is expected for the third quarter of 2023.

EU Tax Centre comment

The call for evidence notes that the proposal will build on the principles agreed upon under the OECD BEPS 2.0 framework and further adapt these to ensure suitability for an extended use within the EU. It will therefore be interesting to see how BEFIT will interact with the OECD’s Multilateral Convention implementing Amount A or an alternative legislative EU proposal to address digital economy taxation in the absence of the implementation of the Pillar One (for more details, please refer to KPMG’s Tax News Flash).

Based on statements previously made by the President of the EC (Ursula von der Leyen) and the Commissioner for Economy (Paolo Gentiloni), the BEFIT initiative has been framed as a measure to particularly benefit start-ups and SMEs by ensuring a level playing field for smaller-sized businesses, as compared to larger ones. The public consultation questionnaire also notes that the formula to allocate the tax base to Member States should deviate from the one proposed under the OECD’s Pillar One solution. While the Pillar One revenue sourcing rules use one factor (i.e. place where a good, service, or intangible is used or consumed), which is subject to marketing and distribution safe harbor adjustments (based on the return on depreciation and payroll in a jurisdiction), the “more complex” allocation under BEFIT should use at least three factors (i.e. tangible assets, labor and sales by destination).

It is also noteworthy that according to the call for evidence document, the EC considers that the legal basis for the scheduled legislative proposal is Article 115 of the Treaty on the Functioning of the EU (TFEU). A BEFIT Directive would require unanimous approval in the Council as a result. Given the experience with the C(C)CTB proposals, it may be challenging for all Member States to reach agreement on a common corporate tax base framework in the EU.

Should you have any queries, please do not hesitate to contact KPMG’s EU Tax Centre (mailto:kpmgeutaxcentre@kpmg.com), or, as appropriate, your local KPMG tax advisor.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia