The EBA’s final Guidelines on Loan Origination and Monitoring address some of banks’ concerns – but include some additional requirements. Overall, this remains a very demanding set of regulations with huge implications for data management, lending strategies and client relationships. Banks should respond quickly.

The EBA’s Guidelines on Loan Origination and Monitoring, a key response to the European Council’s Action Plan on non-performing loans, represent the new standard for loans and advances in Europe. The Guidelines aim to improve lending processes and practices, limit NPL inflows and ensure fair consumer treatment. Their ultimate goal is to enhance the stability and resilience of European banks.

The five chapters of the Guidelines are:

- Internal governance for credit granting and monitoring: which includes the fundamental framework for credit activities and defines the content of credit risk policies and procedures.

- Loan origination procedures: the core chapter of the Guidelines, which focuses on key aspects of assessing different types of borrowers.

- Pricing: which details the need to set up a comprehensive pricing framework.

- Valuation of immovable and movable property: which focuses on the handling of collateral valuation.

- Monitoring framework: which specifies key requirements for credit monitoring measures and procedures.

The requirements and expectations contained in the Guidelines call for banks to re-engineer their lending processes, building strong capabilities from the point of origination to monitoring throughout the loan life cycle.

It is also important to note that the Guidelines are addressed to European competent authorities and financial institutions, and are applicable on individual, sub-consolidated and consolidated bases. This means that subsidiaries of European banks located outside the EU may also need to meet some of the requirements included in the new standards.

The final Guidelines were published on 29 May 2020. This was several months later than planned, but that does not denote a lack of concern. If anything, the economic downturn caused by COVID-19 makes asset quality of the credit portfolios a greater priority than ever. Instead, the delay reflects the variety of requirements and the volume of consultation comments received from the industry.

The EBA has revised the Guidelines by introducing new application deadlines and transitional arrangements over a three-year period, starting from 30 June 2021 (see figure 1).

Figure 1 – Effective application dates for the final Guidelines

| Date | Application |

|---|---|

| 30 June 2021 | Application date for newly origination loans and advances; |

| 30 June 2022 | Application date for existing loans and advances (granted before 30 June 2021) and advances that require renegotiation or contractual changes; and |

| 30 June 2024 | For loans issued before 30 June 2021, missing data and information can be gathered until 30 June 2024. The requirements for the monitoring of the stock of existing loans should be fully applicable by this date also. |

The final Guidelines also contain clarifications in a number of areas that generated a strong response during the consultation period, including:

- On proportionality: Dividing ‘professional’ borrowers into ‘micro and small enterprises’ and ‘medium-sized and large enterprises’, with specific requirements for loan origination procedures in each category; and increasing flexibility around the sophistication of valuation and monitoring requirements.

- On prescriptiveness: Reducing the use of the wording ‘at least’ and making it clearer that the Guidelines’ annexes represent best practices, not minimum expectations.

- On terminology: Aligning several definitions with those in other European and national regulations.

Set against that, the EBA has made some changes that will require some additional effort from banks. Even lenders which have already adjusted their loan procedures in recent years should note that the final Guidelines:

- Add several requirements to incorporate ESG factors and associated risks - into credit risk policies and procedures, valuations and creditworthiness assessments.

- Require institutions to implement differentiated pricing frameworks for different types of loans and borrowers.

- Include additional monitoring requirements: a) for institutions engaged in syndicating leveraged transactions; and b) for considering qualitative factors – as well as financial and credit metrics - when gauging loan repayment prospects.

In short, the changes announced in May 2020 do not alter the fact that this detailed new set of regulations will have far-reaching implications for lenders (see Figure 2). The Guidelines’ forward looking, pro-active approach and emphasis on monitoring credit quality throughout the lifecycle of a loan will have a major impact on how banks’ data, technology, methodology, people, governance and processes are organised. In time, they will also have a tangible effect on client relationships and commercial lending practices.

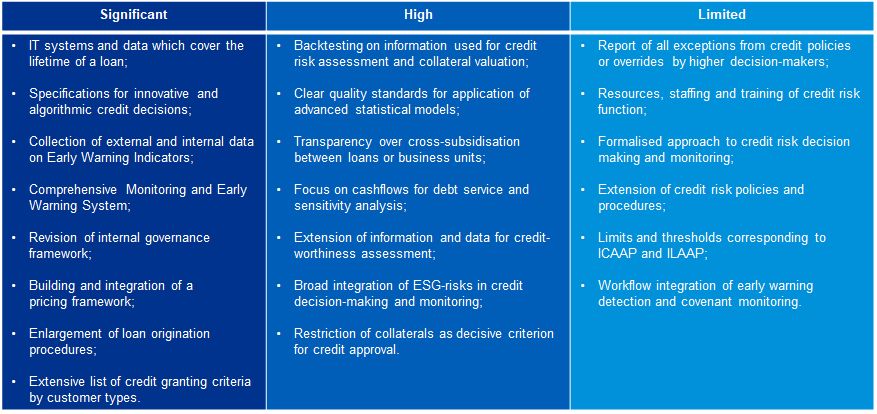

Figure 2 – Expected areas of impact at European level

Source: KPMG assessment

The practical challenges for banks will arguably be greatest in relation to change management, understanding the methodologies to be applied, the aggregation and reconciliation of credit data, and metrics calculation.

For example, the Guidelines require lenders to:

- Establish a data infrastructure that allows for continuous capturing and monitoring of data currently stored on a variety of databases, in contracts and on paper.

- Maintain a robust, transparent credit decision-making process with full data sharing between front line decision makers, second line functions such as risk and finance, and management bodies.

- Develop a good understanding of which businesses will be most affected, as a basis for prioritising change programmes.

- Set up comprehensive project plans to share with different entities, departments and business lines.

- Develop a data-driven pricing framework with portfolio-based approaches for consumers, micro and small enterprises, and medium or large enterprises.

- Incorporate the requirements of the Guidelines into policies, risk management practices, training and incentives, and to regularly assess how they are being applied by staff.

Taking this into account, we believe that credit departments should consider focusing on the key areas below, if they have not done so already.

- Addressing shortcomings and findings from the past (for example, via a gap-remedy programme to address OSI findings on credit underwriting).

- Levelling-up efficiency by:

- Streamlining loan origination procedures;

- Reducing manual workload by producing regular monitoring (automated reports);

- Reconsidering which property collateral will mitigate credit risk in the timeliest and most cost-efficient way; and

- Setting up an integrated workflow in technology systems over the credit life cycle.

- Securing budget for technology projects; and

- Addressing any resource shortages within credit departments and risk functions.

Furthermore, it’s not only the EBA that is strengthening its approach. Last year, the ECB identified the quality of credit underwriting as a supervisory priority for another year running. Also, in the ECB’s latest report on 10 June 2020, they detail the findings from the credit underwriting exercise in 2019 which reinforces the increasingly forward-looking approach to credit supervision. The ECB further plan to conduct a more detailed analysis of potential pockets of risk, with a particular focus on the quality of assets in areas such as commercial real estate, residential real estate and leveraged finance. This will be examined through on-site inspections and follow-up actions in the future.

In conclusion, the scope of the final Guidelines mean that banks need to move quickly to design change programmes, build teams, engage with supervisors and begin implementation. They should also identify any overlaps with the ECB’s agenda or related projects such as Definition of Default, IRB repair programme and NPE regulation.

This calls for a robust, coordinated project plan, beginning with a comprehensive gap and impact assessment. KPMG member firms have extensive experience of supporting banks through this process, drawing on the insights and resources of the ECB Office and expertise from KPMG’s international network.

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia