When deal making resumes, private equity players have an opportunity to earn outsized returns—as the top private equity players did after the 2008-09 recession. But finding value will require differentiated diligence. As in the last recession, there will be many smaller, messier deals—distressed assets and carve-out. Finding “diamonds in the rough” will be even harder this time because the economic disruption caused by the COVID-19 lockdown, which makes it exceedingly difficult to find true value in a sea of noisy data.

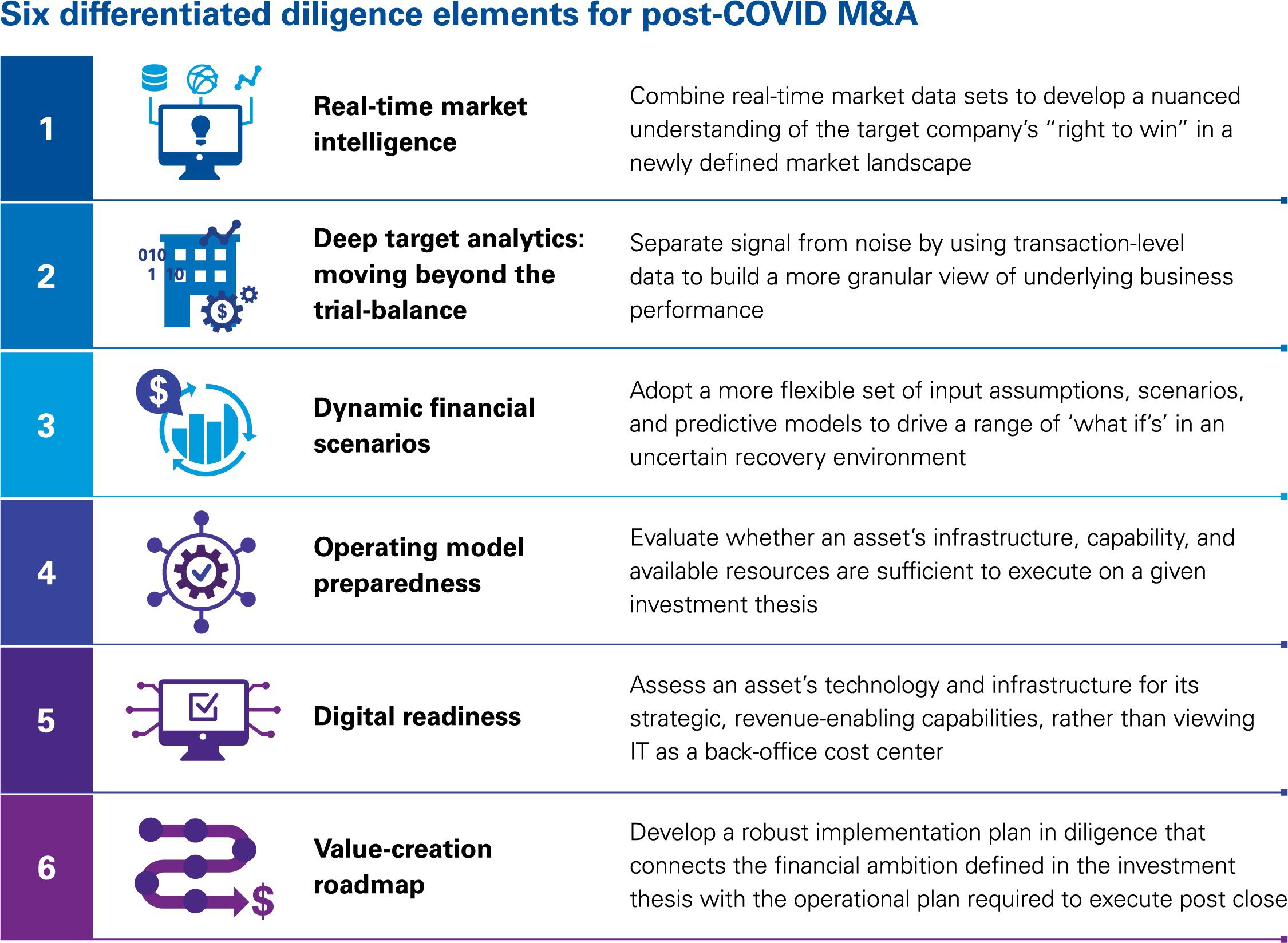

This makes the use of advanced diligence techniques essential. In this paper we share six techniques that we have used over the past several years with the most successful PE investors. These techniques help deal makers gather intelligence that routine diligence can’t provide by seeing beyond reported numbers and expert insights to discover true sources of value (and barriers to value capture). Players that use differentiated diligence after COVID-19 can hope to match or exceed the returns that top players achieved after the last recession.

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia