The current humanitarian crisis in Ukraine is changing by the hour. Potential implications on credit risks for European banks and businesses are huge. The vulnerabilities identified in 2021 resulting from the pandemic, together with the additional risks from the current crisis, point to a packed agenda for supervisors and banks over the medium term. The first quarter of the year is already seeing intense supervisory activity across a range of credit risk topics.

Credit risk management is a key supervisory priority for 2022-2024

Despite further reductions in overall NPL ratios and stage 2 loans across the banking sector (see the latest EBA Risk Dashboard), European supervisors continue to take a prudent approach to asset quality. The ECB’s Supervisory priorities for 2022-2024 once again put credit risk front and centre.

This approach reflects the ECB’s view that it may still be too soon to assess the final impact of the pandemic on asset quality, given the fast-changing macro-economic environment. The ECB also believes that exceptional public sector support for the real economy may have inadvertently made it harder for banks to assess borrowers’ creditworthiness. The Ukraine crisis and the sanctions imposed on Russia are also expected to have series of direct and indirect impacts on credit risks in the short to medium term. Banks’ exposure to these inherent risks could also be accentuated by persistent deficiencies in credit risk management — something identified as a key vulnerability in the Single Supervisory Mechanism’s (SSM) risk assessment of 2021.

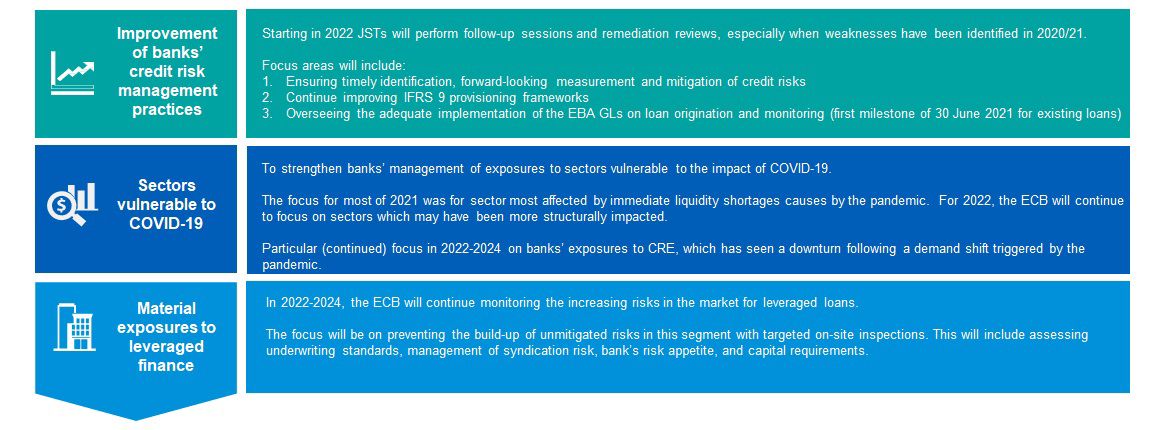

Figure 1: 2022-2024 key strategic objectives of the ECB for credit risk

Source: ECB Banking Supervision, 2022

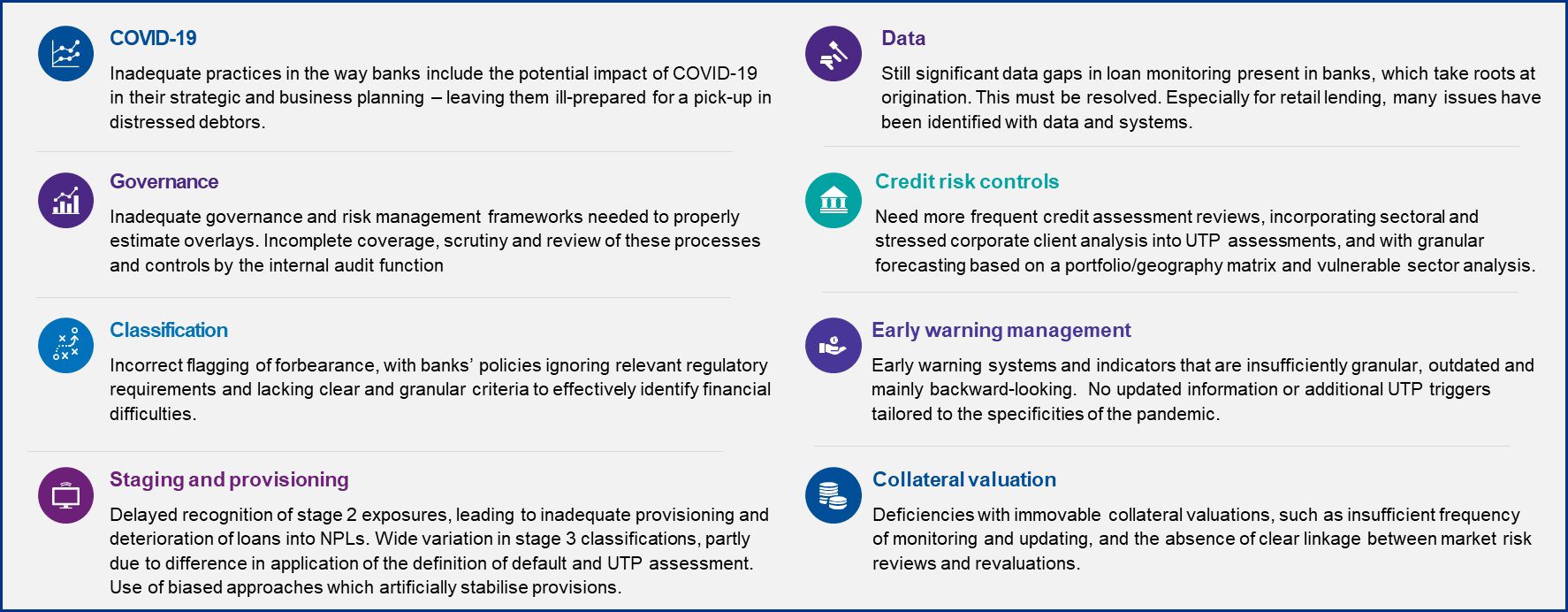

As discussed in our previous article, 2021 saw the ECB conduct an in-depth review of banks’ alignment with its credit risk management expectations during the pandemic. A broad range of recuring weaknesses were identified. The affected areas included timely identification of credit deterioration, forward-looking measurement, mitigation of credit risks, collateral valuation, and adequacy of provisioning practices. The ECB informed banks of its findings and recommendations in the second half of 2021, with many banks required to provide a clear mitigation plan for 2021-2022.

This year, banks will be expected to resolve these issues and implement sound mechanisms to robustly manage credit risks. Joint Supervisory Teams (JSTs) will continue monitoring banks that have reported material deficiencies. The first quarter of 2022 is already seeing intense supervisory activity. Continuing the pattern of 2021, this includes a broad range of targeted reviews, on-site inspections, and internal model investigations.

Figure 2: Deep dive into some of the credit risk management deficiencies identified in 2021

Source: ECB Banking Supervision, 2021

The current focus is on compliance with the EBA Guidelines on loan origination and monitoring

The EBA Guidelines on loan origination and monitoring1 (the Guidelines) are at the core of supervisory expectations for credit risk management. The ECB’s focus for 2022 will be to review and challenge banks’ compliance with the Guidelines, in line with the relevant milestones. The ECB’s priorities also state that real estate portfolios will be a particular area of focus.2

This activity is already well underway. In late January/early February the ECB sent many banks a self-assessment questionnaire covering the implementation status of chapters 4-8 of the Guidelines. The deadline for responses was very short. Most banks had to reply in February, and some have been told that JSTs will discuss their answers with them as soon as March.

Questionnaires vary between banks but are typically made up of around 120 questions in line with the chapters of the Guidelines. Each question requires banks to state whether they comply with the Guidelines fully, partially, or not at all. Where the response is “partially”, banks must then list the specific items that are yet to be implemented, whether implementation is in progress, and when completion is expected. Banks must also indicate exactly where the Guidelines’ requirements are represented in their internal policies, guidelines or action plans. Supporting documents need to be shared with JSTs too. Additional bank-specific questions are sometimes added, focusing on specific areas where deficiencies have been identified by JSTs.

We expect the ECB to use the questionnaire as the basis for standardised benchmarking of all banks’ implementation progress, and as a blueprint for individual banks’ compliance assessments. It is clearly essential that banks provide accurate, comprehensive responses.

Looking ahead: Extensive supervisory activities for credit risk in 2022

In addition to assessing banks’ compliance with the Guidelines, we expect 2022 to see the ECB continuing last year’s focus on key areas of risk. These could include IFRS9 and sectors considered especially vulnerable to the pandemic, such as commercial real estate. These activities will also be accompanied by a thematic review of leveraged finance, together with growing pressure on banks to implement regulatory measures relating to climate risk and the wider ESG agenda. For banks, 2022 promises to be an exceptional year for credit risk scrutiny.

Related content

Contact us

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

1 EBA/GL/2020/06 (PDF 780 KB)

2 See also our previous article detailing the on-going ECB programme for Commercial Real Estate (CRE) off-site inspections.