China - Taxation of cross-border mergers and acquisitions

Taxation of cross-border mergers and acquisitions for China.

Taxation of cross-border mergers and acquisitions for China.

Introduction

Over the past few years, new People’s Republic of China[1] tax rules affecting merger and acquisition (M&A) activities were issued by the State Taxation Administration (STA) and other government departments. While these new tax rules mostly enhance and update existing rules, they have brought significant changes for investors undertaking M&A activities in China. Specifically, tax rules released in 2020 are mainly measures aimed at facilitating China cross-border trade and investment. The government also introduced regional preferential policies in certain areas such as Hainan Free Trade Port.

This report highlights recent M&A-related tax developments in China and then addresses the three fundamental decisions that a prospective buyer typically faces when undertaking M&A transactions:

- What should be acquired, the target’s shares or its assets?

- What will be the acquisition vehicle?

- How should the acquisition vehicle be financed?

For the purposes of this report, the terms ‘China’ and the ‘People’s Republic of China’ are used interchangeably and do not include the Hong Kong and Macau Special Administrative Zones nor Taiwan, which have their own taxation systems.

Recent developments

Incentives in Hainan Free Trade Port

Innovative Income Tax Policies

Following the 1 June 2020 issuance of the Overall Plan for the Construction of Hainan Free Trade Port (Hainan FTP Plan), the Chinese Ministry of Finance (MOF) and STA on 30 June 2020 set out detailed Corporate Income Tax (CIT) and Individual Income Tax (IIT) preferential policies for Hainan FTP. Businesses may find these tax rate reductions and administrative simplifications very attractive in deciding whether to establish operations in Hainan.

The Hainan FTP Plan outlined a range of innovative tax policies, many going well beyond those on offer in China’s existing pilot free trade zones. MOF and STA Circular CaiShui [2020] No. 31 and CaiShui [2020] No. 32 have now given concrete detail on these measures, including the following:

- Reduced CIT rate: A reduced 15 percent CIT rate (China standard rate is 25 percent) applies to enterprises (i) registered in Hainan FTP, (ii) engaged in substantive business activities, and (iii) in encouraged industries. Please note that Circular 31 requires establishment of the enterprise’s management body in Hainan FTP, which requires substantive local management and control over business operations, staff, accounting, assets, etc. Moreover, enterprise revenue from ‘encouraged industry’ business must be at least 60 percent of the total amount.

- Exemption for ‘new’ foreign-sourced income: Provided that the statutory CIT rate of the investee jurisdiction is not lower than 5 percent, qualified ‘new’ foreign-sourced income received by Hainan FTP enterprises in the tourism, modern services and high-tech industries is CIT exempted until end of 2024. New foreign-sourced income refers to (i) operating profits earned by newly established overseas branches of the Hainan company, or (ii) dividends repatriated from an overseas subsidiary in which the Hainan company has a shareholding of at least 20 percent. The dividends must arise from new direct investment made in the overseas subsidiary.

- 100 percent expensing and accelerated depreciation regimes: Eligible capital expenditures (i.e. newly purchased fixed assets (except for immovables) and intangible assets with a unit value less than RMB5 million) could qualify for the 100 percent expensing and accelerated depreciation regimes. There is no limitation on industry or usage of assets. However, note that buildings are excluded from the above scope and intangible assets are yet to be defined for the purpose of the relief.

- IIT incentive: Pursuant to Caishui [2020] No.32, IIT exemption has been designed to provide a maximum 15 percent IIT rate for income of personnel with high-end and urgently needed skills, working in Hainan FTP. As for the qualified income scope, comprehensive income, operating income and Hainan government subsidies are covered, while investment or asset transfer income is excluded. It is considered that exemption should cover income of partners in a fund, as operating income, though more clarity is needed. Detailed eligibility criteria and implementation measures on non-resident individuals are yet to be provided.

Many businesses are actively looking at establishing operations in Hainan FTP. The following should be considered:

- Strategy and planning: Some enterprises may look to leverage Hainan FTP’s innovative new policies for a thorough restructuring or adjustment of their existing investment holding structure and operating model, including redeployment of human resources to Hainan and optimized financing arrangements. While yet to be clarified, it is anticipated that the ‘substantive management’ requirement may be fairly robust, which might require the enterprise to have functions, including decision-making capacity commensurate with profitability. It could also require organizational resources, premises and personnel commensurate with enterprise functions.

- Tax optimization: The tax cost savings from establishing operations in Hainan should be carefully evaluated against the tax position under China’s standard tax rules, taking into account the costs of managing economic substance requirements and revised TP arrangements.

- Implementation: Enterprises will need to assess any potential challenges arising from redeploying human and material resources, and set and oversee a step plan for any move to Hainan.

‘Zero-tariff’ Incentive Policies

According to the Hainan FTP Plan, ultimately a zero-tariff rate will apply to a wide range of imports into Hainan island, which will be treated as a special customs bonded area. A simplified tax system (e.g. consolidation of various turnover taxes into a single ‘sales tax’) will also apply. Prior to this whole island regime coming into effect, certain categories of imports are entitled to import duty, import VAT and consumption tax exemptions. On 11 November 2020, the MOF, the General Administration of Customs (GAC), and the STA jointly released a Notice, in effect from 1 December 2020, to implement these exemptions.

To some degree, the Notice breaks with the traditional customs supervision model using special customs supervision zones and bonded importation for the processing trade. The Notice clarifies that the zero-tariff treatment for raw and auxiliary materials will be subject to a catalogue system and sets out a list of 169 items with their 8-digit HS Codes. This covers agricultural products (e.g. coconuts, barley, etc.), industrial raw materials (e.g. ores, coal, petroleum oil, liquified natural gas, wood, etc.), chemical raw materials (e.g. xylene, methanol, etc.), preformed bars for drawing optical fiber, base metal mountings, parts and components used for repair of aircraft and vessels (including repairs of relevant parts and components).

This Notice benefits agricultural processing, industrial manufacturing and energy enterprises by reducing their operational and capital costs. The ‘zero tariff’ policy for parts and components used for repairing aircraft and vessels will also benefit the development of the aviation industry, aircraft repair industry, vessel repair industry, and the relevant processing and assembly industries.

The Notice provides substantial benefit for enterprises in Hainan FTP. Enterprises inside/outside Hainan FTP should pay attention to the following issues:

- Enterprises outside Hainan FTP should evaluate the feasibility of establishing a platform company/regional headquarters with functions such as import and export trading, investment and financing, logistics/supply chain management, so as to improve overall operations including investment, taxation, customs and trade.

- Enterprises inside Hainan FTP should assess the relevant preferential tax policies and regulatory requirements of the Hainan FTP, and take full advantage of the preferential policies for the imported goods on the basis of compliance.

- It should be noted that imported equipment and transportation means for own use are not included in the current ‘zero-tariff’ product list. Separate lists to regulate imported production equipment for own use, imported transportation means for operation as well as imported goods for consumption within the Hainan island are expected; businesses should pay close attention to these.

- The Notice indicates that the MOF and the relevant government bodies will adopt dynamic adjustments to the ‘zero-tariff’ product list, and therefore, businesses may voice concerns and make suggestions on the list.

Foreign invested enterprise (FIE) investment in domestic equity

Huifa [2019] No. 28 (Circular 28), issued and effective on 25 October 2019, introduces 12 new measures to facilitate China cross-border trade and investment. This includes the removal of restrictions on FIEs from using their registered capital for domestic equity investments. Restrictions previously applied where these were not ‘FIE investment enterprises’ (i.e. FIEs with equity investment as a listed activity in their registered scope of business).

In view of this, FIE non-investment enterprises could become an alternative structure for making domestic equity investments, alongside QFLP, FIVCIEs, and other variants of FIE investment enterprises. Indeed, the tax rules are clearer for FIEs than for other investment platforms such as QFLP. FIEs can also benefit from the incentive in Circular 102 (2018) which defers the application of withholding tax (WHT) on dividends where profits are reinvested in China.

Moreover, red chip structures (i.e. Chinese companies with a Hong Kong or Cayman top company as listing entity) can also benefit. These companies can inject the foreign capital raised overseas into their onshore controlled entities, which can then make onward domestic equity investments.

The change, which builds on earlier pilot schemes, should facilitate the expansion of foreign business and investment in China. While some uncertainties remain to be further clarified, such as to what extent should registered capital in domestic investments be qualified as ‘genuine’ and reasonable, etc., it is observed that different local authorities might have different practical standards.

Offshore indirect disposals

China’s existing offshore indirect disposal reporting and taxation rules were completely revamped with Announcement 7 (which replaced Circular 698, which was abolished by Announcement 37).

The offshore indirect disposal rules seek to ensure that Chinese tax cannot be avoided through the interposition of an offshore intermediary holding entity that holds the Chinese assets. Under these rules, if an offshore indirect disposal of Chinese taxable property (discussed further below) by a non-Chinese TRE is regarded as being undertaken without reasonable business purposes with the aim of avoiding Chinese WHT, the transaction would be re-characterized as a direct transfer of Chinese taxable property and subject to Chinese WHT at the rate of 10 percent under the Chinese General Anti-Avoidance Rules (GAAR).

However, the tax basis for calculating taxable gains for indirect transfers has been unclear, and the practice varies between different locations and tax authorities.

Compared with Circular 698, Announcement 7 expands the scope of the transactions covered, enhances the enforcement mechanism and sets out a more specific framework for dealing with so-called ‘tax arrangements’ with the introduction of a safe harbor and a blacklist. The major aspects of the rules under Announcement 7 are as follows:

- Announcement 7 not only captures transfers of offshore holding companies that ultimately own equity interests of the Chinese resident companies, but also covers foreign companies holding Chinese immovable properties and assets belonging to Chinese PE of foreign companies. The types of offshore transactions that can trigger the rules span from simple offshore equity transfers to transfers of partnership interests/convertible bonds, as well as restructurings and potentially share redemptions.

- While the seller or the buyer are not required to report the offshore transactions to the tax authorities, Announcement 7 requires the buyer to act as the withholding agent and apply 10 percent WHT to the purported transfer gain. The withholding agent faces stringent penalties for failure to pay tax within the required timeframe if the seller also fails to pay its taxes to the Chinese tax authorities. However, the buyer can mitigate potential penalties by making a timely reporting of the transaction. Note that the seller, as the taxpayer, is still on the hook for tax not withheld by the buyer.

- Extensive new guidance was introduced on whether a transaction lacks ‘reasonable business purposes’ and thus should be subject to tax under the Chinese GAAR. This includes a ‘7 factors test’, which considers:

- whether the offshore company’s principal value or source of income is derived from China,

- the functionality and duration of existence of the offshore holding company and ‘substitutability’ of the offshore transaction with an onshore direct disposal of the Chinese taxable assets,

- the overseas taxation position of the offshore transfer, including the application of a tax treaty.

A parallel ‘automatic deeming’ test was introduced, which treats an indirect transfer transaction as lacking reasonable business purpose if, among other black-list factors, more than 75 percent of the value and more than 90 percent of the income or assets of the offshore holding company are derived from or attributable to China. New safe harbor rules to deem a transaction as having ‘reasonable business purposes’ or otherwise not taxable cover the following situations:

- foreign enterprises buying and selling securities on the public market,

- cases where a tax treaty would apply to cover a transaction re-characterized as a direct disposal,

- intragroup reorganizations within a corporate group that meet certain conditions.

In practice, Announcement 7 creates many challenges in its application to indirect transfer transactions due to the difficulties of aligning buyer and seller positions on the reporting and taxability of an indirect transfer M&A transaction. The seller and buyer sometimes find it difficult to agree on whether the Chinese tax authorities would consider an indirect transfer transaction as lacking reasonable business purposes, particularly where there is certain substance offshore. Given the potential stiff penalties that could apply, particularly for buyers as the withholding agents, and given the potential mitigation of penalties through timely voluntary reporting of the indirect transfer cases to the Chinese tax authorities, disputes can arise between transacting parties over whether transactions should be reported at all and whether, and how much, tax needs to be paid or withheld.

Historically, escrow and indemnity arrangements have been used in practice. Now, buyers increasingly tend to require sellers to timely report the transaction to the Chinese tax authorities as a condition for closing the deal.

Announcement 7 was supplemented by Shuizonghan [2015] No. 68 (Circular 68), which provides further implementation guidance and an improved reporting mechanism. The circular clarifies Announcement 7’s measures regarding formal receipts for taxpayer reporting (giving assurance in relation to the penalty mitigation measures), single reporting for transferred Chinese taxable assets in multiple locations in China, and GAAR procedures (including SAT review and appeal procedures). However, there is still a need for a clarified refund process, confirmation on the applicability of safe harbors and timeframes for the conclusion of the GAAR investigations.

Also, there have been cases in the past where the gains on the sale of offshore companies were regarded as Chinese- sourced on the basis that the offshore company’s tax residency is deemed to be in the Chinese under Chinese domestic tax laws (broadly based on the place of effective management). The approach was first applied in a Circular 698 reporting case in the Heilongjiang province of China in 2012 that was made public. Hence, the tax-resident status of foreign incorporated enterprises (particularly those controlled by Chinese residents) should be considered when assessing whether gains from the disposal of Chinese equities offshore by foreign investors in the M&A space could be taxable in the Chinese resident company simply under Chinese domestic tax laws.

This additional exposure needs to be monitored and factored into M&A transactions where foreign investors make offshore indirect acquisitions and disposals of Chinese investments.

Negotiations may be further complicated where investors seek to obtain warranties and indemnities that the deal target is not effectively managed from the offshore incorporation location.

Value Added Tax and land appreciation tax on onshore indirect disposals of properties situated in China

Under Chinese land appreciation tax (LAT) regulations, a transfer of an equity interest in Chinese TRE technically should not give rise to LAT as any underlying properties are not directly transferred. However, the tax authorities may seek to impose LAT on the transfer of an equity interest in a Chinese company that directly holds real estate if the transfer consideration is equivalent to the value of the real estate and/or the primary purpose of the equity transfer is to transfer the land use right and property (rather than the company). There have been some enforcement cases where transfers of equity interests in Chinese property holding companies were re-characterized as direct transfers of Chinese properties for LAT purposes and thus LAT was imposed on the sale of equity interests in the Chinese holding company as if the underlying property had been disposed of.

Further, a local tax circular issued by the Hunan tax authority (i.e. Xiang Di Shui Cai Xing Bian Han [2015] No. 3) clarifies that the ‘transfer of properties in the name of transfer of equity’ should be subject to LAT, because the transfer of Chinese company shares, which in substance represents a transfer of the underlying Chinese properties, should be subject to LAT.

Currently, only transactions that are deemed as ‘disguised’ property transfers would be subject to LAT, which would be assessed case-by-case. In making the assessments, the Chinese tax authorities would look at certain criteria to decide whether the nature of the transaction is, in substance, a property transfer transaction. These criteria include:

- whether the share transfer consideration was equal to or close to the valuation of the Chinese properties,

- the duration of the holding period,

- the transaction agreements.

The look-through of an equity transfer to impose LAT is not explicitly supported by existing LAT law (which, unlike the CIT law, does not have an anti-avoidance provision). Hence, these look-through cases are still rare in practice, but investors should closely monitor future developments as this approach could significantly affect investment returns.

The position under China’s new Value Added Tax (VAT) rules, in effect since 1 May 2016, is similar. That is, the transfer of unlisted equity interests is not subject to VAT. However, the transfer of real estate assets is generally subject to 9 percent[1] VAT (or a reduced rate of 5 percent, where certain grandfathering arrangements apply). The new VAT rules contain an anti- avoidance provision and the tax authorities could take a look-through approach similar to the above on LAT and impose VAT on disguised transfers of properties via equity transfers.

Treaty relief claims

In 2009, the Chinese tax authorities adopted measures to monitor and resist granting tax treaty relief in cases of perceived treaty shopping through the use of tax treaties to gain tax advantages. Guoshuifa [2009] No. 124 (Circular 124, issued in 2009, which is superseded by another tax circular; see below) introduced procedural requirements under which tax authority pre-approval may be required before treaty relief can be applied. This has made it easier for the tax authorities to identify cases where the taxpayer is relying on treaty protection.

Circular 601 and Announcement 30 (both of which will be superseded by Announcement 9 from 1 April 2018) and Shuizonghan [2013] No. 165 (Circular 165, issued in April 2013) set out the factors that the Chinese tax authorities should take into account in deciding whether a treaty’s BO requirements are satisfied. These circulars also provide guidance on the interpretation of the negative factors.

In 2015, the SAT issued SAT Announcement [2015] No. 60 (Announcement 60), which replaced Circular 124 and revamped the tax treaty relief system. The new system, which took effect as of 1 November 2015, abolishes the tax treaty relief pre-approval system under Circular 124. Instead, the taxpayer self-determines whether tax treaty relief applies and informs the withholding agent (or the tax authority directly where no withholding agent is involved) that it will be claiming the treaty relief.

To encourage the withholding agent to process the relief without taking on excessive risk and uncertainty, the detailed tax treaty relief forms, completed by the taxpayer, include a section requiring information that the withholding agent will check before applying the treaty rate and a separate, more detailed section that the tax authorities may refer to during their follow-up procedures. The withholding agent’s section includes, along with basic details on how the taxpayer satisfies the terms of the treaty, a BO test defined under Circular 601 (to be replaced by Announcement 9 from 1 April 2018), which is a control test along the lines of that applied in other countries.

Following the release of Announcement 60, on 29 October 2015, the SAT further issued Shuizongfa [2015] No. 128 (Circular 128) to clarify the follow-up procedures as emphasized in Announcement 60. Circular 128 stipulates that Chinese tax authorities would audit at least 30 percent of the tax treaty relief claim cases on dividends, interest, royalties and capital gain within 3 months after the end of each quarter and perform special audits to assess the risks of treaty abuse in various aspects. If the tax authorities discover on examination that treaty relief should not have applied and tax was underpaid, the tax authorities would instruct the taxpayer to pay the underpaid tax within a set time period.

If the payment is not made on time, then the tax authorities can pursue other Chinese-sourced income of the non-resident or take stronger enforcement action under the Chinese Tax Collection and Administration Law. The tax authorities may also launch anti-avoidance proceedings, either under the relevant anti-abuse articles of tax treaties or the domestic GAAR.

In view of Circular 128, there have been cases where Chinese tax authorities have sought to recover underpaid taxes from treaty relief claimants due to their improper treaty claims. In a recent case in Quanzhou City, Fujian Province, published in 2017, a Hong Kong company was regarded by the Chinese tax authorities as a conduit company that was established predominantly for the purpose of attaining the reduced WHT rate of 5 percent instead of 10 percent under the Hong Kong–China tax treaty. Consequently, the Chinese tax authorities have recovered the underpaid dividend WHT of RMB10.46 million and imposed a late payment surcharge of RMB423,600.

On 22 October 2019 the SAT released new tax treaty relief administrative guidance in SAT Announcement [2019] No. 35 (Announcement 35). This will take effect from January 2020 and replaces the existing guidance in Announcement 60.

Announcement 35 now simply requires that supporting documents are kept by the taxpayers on their files for review. Solely a short notification form is sent to the authorities, either directly from the taxpayer or via the WHT agent. Announcement 35 also makes clear that the WHT agent’s responsibility is just to check that the taxpayer has fully filled out the form, and submit the form to the tax authorities.

Most other provisions are unchanged from Announcement 60, such as those concerning the use of contracts, board resolutions and tax residence certificates as supporting documents, requirements on the taxpayer and WHT agent to assist the authorities with follow-up review, refund procedures, etc. This being said, the multiple complex relief forms, which were different for companies and individuals, and for different income types, are now replaced with a single simple form.

On 6 February 2018, the SAT issued Announcement 9, which replaced Circular 601 and Announcement 30 as of 1 April 2018 (see ‘Recent developments’ section).

In summary, the treaty relief system under Announcement 35 remains as an open and efficient channel to access treaty relief and aid the conduct of M&A and restructuring transactions. However, taxpayers have a greater burden to ensure that self-assessment is grounded in prudence and satisfies the relevant conditions, including those under Circular 601 and Announcement 30 (before 1 April 2018) and Announcement 9 (on and after 1 April 2018).

While Announcement 9 has set out the relevant rules and addressed certain issues pertaining to treaty benefit claims for foreign investors, there are still uncertainties regarding how the assessment of BO of dividends distributed from Chinese resident enterprises to their foreign shareholders would align with international practice and norms. For example, it is uncertain whether unincorporated entities such as partnerships and trusts that are paying foreign CIT in their own capacities would be eligible to apply for treaty benefits in their own right, rather than being treated by the Chinese tax authorities as a pass-through.

Reorganization relief

In 2014 and 2015, a number of key improvements to the Chinese tax restructuring reliefs were made to the STT that result in tax deferral treatment for corporate restructurings. The changes lowered the eligibility threshold and introduced new ways to access STT.

Circular 59, the principal tax regulation on restructuring relief issued in 2009, sets out the circumstances in which companies undergoing restructuring can elect for STT. Absent the application of STT, the general tax treatment (GTT) requires recognition of gains/losses arising from the restructuring. The STT conditions include two tests:

- a ‘purpose test’ akin to the Chinese GAAR (i.e. the transaction must be conducted for reasonable commercial purposes and not for tax purposes),

- a ‘continuing business test’ (i.e. there is no change to the original operating activities within a prescribed period after the restructuring).

The conditions also set out two threshold tests that aim to ensure the continuity of ownership and the continued integrity of the business following the restructuring. Under these tests:

- consideration must comprise 85 percent of equity,

- 75 percent of the equity or assets of the target must be acquired by the transferee.

Although Circular 59 was intended to provide favorable tax treatment to restructuring transactions, STT had not been widely used due to the high thresholds. Caishui [2014] No. 109 (Circular 109) was subsequently issued to lower the 75 percent asset/equity acquisition threshold to 50 percent. This facilitates the conduct of many more takeovers/restructurings in a tax-neutral manner. Circular 109 also introduces a new condition for STT that removes the 75 percent ownership test. The new condition permits elective non-recognition of income on transfer of assets/equity between two Chinese TREs that are in a ‘100 percent holding relationship’, provided no accounting gains/losses are recognized. Both the purpose test and the continuing business test from Circular 59 hold, and the tax basis of transferred assets for future disposal is their original tax basis. The supplementary SAT Announcement [2015] No. 40 (Announcement 40) clarifies certain terms used in Circular 109 and spells out in detail the situations to which the relief applies.

Given that China does not, unlike many other countries, have comprehensive group relief or tax consolidation rules, the introduction of this intragroup transfer relief is a real breakthrough in Chinese tax law. However, the relief does not cover transfers of Chinese assets by non-TREs (whether between two non-TREs or between a non-TRE and a TRE). Taxpayers also need to be aware of the emphasis being placed by tax authorities on the purpose test, particularly as the intragroup transfer relief opens the door to tax loss planning strategies that previously were not possible under Chinese tax law.

SAT Announcement [2015] No. 48 (Announcement 48) also abolishes the tax authority pre-approvals previously needed for STT to be applied, moving instead to more detailed STT filing at the time of the annual CIT filing. The transition from tax authority pre-approval to taxpayer self-determination on the applicability of STT (and on tax treaty relief claims as discussed earlier) is in line with the broader shift in Chinese tax administration away from pre-approvals. However, while the abolition of pre-approvals potentially expedites transactions, it also places a greater burden on taxpayer risk management procedures and systems to ensure that treatments adopted are justified and adequately supported with documentation.

VAT reform

China’s transition from business tax (BT) to VAT has been a major tax reform initiative, which was designed to facilitate the growth and development of the services sector and to relieve the indirect tax impact in many business-to-business transactions. Since 2012, the VAT reforms have been gradually expanded to sectors which were historically under the BT regime.

As of 1 May 2016, all transactions involving goods and/or services fall within the scope of VAT, and BT is no longer in operation. The following sectors are among the last major batch that transitioned from BT to VAT from 1 May 2016: real estate and construction, financial services, and lifestyle services (which is a general category capturing all other services).

In the context of M&A transactions, the VAT reform rules significantly affect how transactions are undertaken, whether by way of asset or business transfer or equity. Given the significant changes in VAT rates for some industries (compared with the previous BT rates), the ability to recover VAT under contracts that may be acquired or assumed as part of any M&A transactions is a significant area of focus. The funding of transactions also needs to take into account the VAT implications, given that China’s VAT system applies 6 percent VAT to financial services, including interest income.

The Chinese government issued a number of circulars during 2017 to clarify certain VAT-related uncertainties and adjust certain existing VAT rates. Therefore, it is expected that the Chinese VAT system will continue to evolve in the future, to further update and clarify various practical aspects of the Chinese VAT reform that remain uncertain.

More recently, as of 1 January 2018, new VAT rules were introduced to reduce the applicable VAT rate for the operation of asset management products, such as trusts and funds, to 3 percent (from 6 percent) for Chinese asset managers but without the ability to claim input VAT credits. This change affects interest income derived from such asset management products, as well as gains on trading of financial products (among other things). However, whether the new VAT rate would also apply to foreign investors that qualify as a ‘qualified foreign institutional investor’ or ‘Renminbi qualified foreign institutional investor’ is currently unclear, given that such an investor cannot register itself as a VAT taxpayer for Chinese VAT purposes.

Asset purchase or share purchase

In addition to tax considerations, the execution of an acquisition in the form of either an asset purchase or a share purchase in the PRC is subject to regulatory requirements and other commercial considerations.

Some of the tax considerations relevant to asset and share purchases are discussed below.

Purchase of assets

A purchase of assets usually results in an increase in the cost base of those assets for capital gains tax purposes, although this increase is likely to be taxable to the seller. Similarly, where depreciable assets are purchased at a value greater than their tax-depreciated value, the value of these assets is refreshed for the purposes of the buyer’s tax depreciation claim but may lead to a clawback of tax depreciation for the seller.

Where assets are purchased, it may also be possible to recognize intangible assets for tax amortization purposes. Asset purchases are likely to give rise to relatively higher transaction tax costs than share purchases, which are generally taxable to the seller company (except for stamp duty, which is borne by both the buyer and seller, and deed tax, which is borne by the buyer of land and real property). Further, for asset purchases, historical tax and other liabilities generally remain with the seller company and are not transferred with the assets. As clarified in ‘Choice of acquisition funding’, it may be more straightforward, from a regulatory perspective, for a foreign invested enterprise to obtain bank financing for an asset acquisition than for a share acquisition.

The seller may have a different base cost for their shares in the company as compared to the base cost of the company’s assets and undertaking. This, as well as a potential second charge to tax where the assets are sold and the company is liquidated or distributes the sales proceeds, may determine whether the seller prefers a share or asset sale.

Caishui [2014] No. 116 (Circular 116) allows for deferral of tax on gains deemed to arise on a contribution of assets by a TRE into another TRE in return for equity in the latter. The taxable gain can be recognized over a period of up to 5 years, allowing for the payment of tax in instalments. This relief, potentially also extending to the contribution of assets by minority investors into a TRE, complements the intra-100 percent group transfer relief under Circulars 59 and 109 (see ‘Recent developments’ section).

According to SAT Announcement [2015] No. 33 (Announcement 33), where applicable, taxpayers can elect to apply either the relief under Circular 116 or the intra-100 percent group transfer relief under Circulars 59 and 109.

Further, SAT Announcement [2011] No. 13 (Announcement 13), issued in February 2011, provided a VAT exclusion for the transfer of all or part of a business pursuant to a restructuring.

However, certain limitations in the practical applicability of the relief still exist.

Purchase price

For tax purposes, it is necessary to apportion the total consideration among the assets acquired. It is generally advisable for the purchase agreement to specify the allocation, which is normally acceptable for tax purposes provided it is commercially justifiable. It is generally preferable to allocate the consideration, to the extent it can be commercially justified, against tax-depreciable assets (including intangibles) and minimize the amount attributed to non-depreciable goodwill. This may also be advisable given that, at least under old Chinese generally accepted accounting principles (GAAP), goodwill must be amortized for accounting purposes, limiting the profits available for distribution.

Goodwill

Under CIT law, expenditure incurred in acquiring goodwill cannot be deducted until the complete disposal or liquidation of the enterprise.

Amortization is allowed under the CIT law for other intangible assets held by the taxpayer for the production of goods, provision of services, leasing, or operations and management, including patents, trademarks, copyrights, land-use rights, and proprietary technologies, etc. Intangible assets can be amortized over no less than 10 years using the straight-line method.

Depreciation

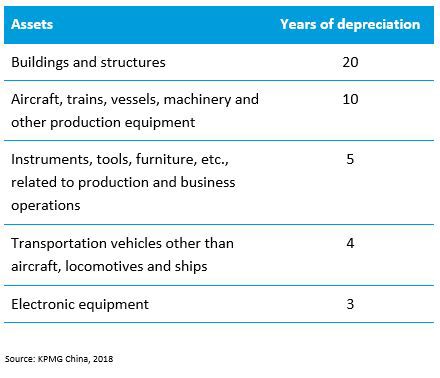

Depreciation on fixed assets is generally computed on a straight-line basis. Fixed assets refer to non-monetary assets held for more than 12 months for the production of goods, provision of services, leasing, or operations and management, including buildings, structures, machinery, mechanical apparatus, means of transportation and other equipment, appliances and tools related to production and business operations.

The residual value of certain fixed assets (i.e. the part of the asset value that is not tax-depreciable) is to be reasonably determined based on the nature and use of the assets.

Once determined, the residual value cannot be changed. The minimum depreciation periods for relevant asset types are as follows:

Any excessive accounting depreciation over the tax depreciation calculated based on the above minimum depreciation period should be added back to taxable income for CIT purposes.

In addition, Caishui [2018] No. 54 (Circular 54) issued on 7 May 2018, clarified that, from 1 January 2018 to 31 December 2020, depreciation of newly purchased equipment or machinery is subject to the following CIT treatment:

- A 100 percent immediate tax deduction for CIT purposes is allowed on the condition that the unit price of each item of equipment or machinery is individually less than RMB5 million. Depreciation for tax purposes is not required.

- Where the unit price of an item exceeds RMB5 million, the accelerated depreciation rules set out in SAT Announcement [2019] No. 66 and Cai Shui [2015] No. 106 shall be applied.

Certain fixed assets are not tax-depreciable, including:

- fixed assets, other than buildings and structures, that are not in use,

- fixed assets leased from other parties under operating or finance leases,

- fixed assets that are fully depreciated but still in use,

- fixed assets that are not related to business operations,

- separately appraised pieces of land that are booked as fixed assets,

- other non-depreciable fixed assets.

Tax attributes

Generally, tax attributes (including tax losses and tax holidays) are not transferred on an asset acquisition. They generally remain with the enterprise until extinguished.

Value Added Tax

As of 1 May 2016, VAT has fully replaced BT, such that any transactions involving the sale of goods or provision of services is potentially within the scope of VAT. VAT was levied at the rates of 3 percent, 6 percent, 11 percent and 17 percent, depending on the good or service after the VAT reform. The Chinese government issued a number of announcements since 2017 to reduce the VAT rates. VAT is levied at the rates of 3 percent, 6 percent, 9 percent (reduced from 11 percent to 10 percent and further reduced to 9 percent from 1 April 2019) and 13 percent (reduced from 17 percent to 16 percent, and further reduced to 13 percent from 1 April 2019), depending on the good or service. Generally, the sale or importation of goods, or the lease of goods, is subject to 13 percent VAT.

Transportation, certain telecommunication services, as well as sales and lease of real estate are subject to 9 percent VAT. Most other services are subject to 6 percent VAT.

Certain business reorganizations, including certain transfers of a business where all assets are disposed of, employees transferred and liabilities assumed, are currently outside the scope of VAT, provided certain conditions are met.

However, the scope of the concession is more limited in China compared with equivalent concessions for the sale of a going concern in other countries. A sale of assets, in itself, may not be regarded as a transfer of a business and should not benefit from the concession. Announcement 13, issued in February 2011, clarified that a VAT exclusion may be available for the transfer of part of a business, though in practice it can be difficult to access. Given that in China there is generally no ability for a buyer to obtain a refund of excess VAT credits (instead, excess credits may be carried forward, potentially for an indefinite period), the cash flow implications can be significant and long-lasting.

Transfer taxes

Stamp duty is levied on instruments transferring ownership of assets in China. Depending on the type of assets, the transferor and the transferee are each responsible for paying stamp duty of 0.03 to 0.05 percent of the transfer consideration for the assets in relation to their own copies of the transfer agreement (i.e. a total of 0.06 percent to 0.10 percent stamp duty payable). Where the assets transferred include immovable property, deed tax, land appreciation tax and VAT and local surcharges may also need to be considered.

Purchase of shares

The purchase of a target company’s shares does not result in an increase in the base cost of that company’s underlying assets; there is no deduction for the difference between underlying net asset values and consideration. There is no capital gains participation exemption under Chinese tax law; therefore, a Chinese seller is subject to CIT or WHT on the sale of shares. However, tax deferral relief may be available if the consideration consists of shares in the buyer and the various conditions for attaining the reorganization relief (discussed earlier) can be satisfied.

Tax indemnities and warranties

In a share acquisition, the buyer assumes ownership of the target company together with all of its related liabilities, including contingent liabilities. Therefore, the buyer normally needs more extensive indemnities and warranties than in the case of an asset acquisition. An alternative approach is for the seller’s business to be moved into a newly formed subsidiary so the buyer can acquire a clean company. However, for tax purposes, unless tax relief applies, this may crystallize any gains inherent in the underlying assets and may also crystallize a tax charge in the subsidiary to which the assets were transferred when acquired by the buyer.

As noted earlier (see ‘Recent developments’ section), a pressing new issue that must be dealt with through warranties and indemnities concerns the impact on buyers of shares in offshore holding companies where the seller has not complied with Announcement 7 (previously Circular 698) reporting and filing requirements. Purchasers are subject to WHT obligations in the case of an Announcement 7 enforcement and could be subject to potential penalty where the seller fails to report the transaction and pay the taxes. The buyer may ask the seller to warrant and provide evidence that they have made the reporting or indemnify them for tax and/or penalty ultimately arising.

To identify such tax issues, it is customary for the buyer to initiate a due diligence exercise, which normally incorporates a review of the target’s tax affairs.

Tax losses

Under the CIT law, generally a share transfer resulting in a change of the legal ownership of a Chinese target company does not affect the Chinese tax status of the Chinese target company, including tax losses. However, in light of the introduction of the GAAR, the buyer and seller should ensure that there is a reasonable commercial rationale for the underlying transaction and that the use of the tax losses of the target is not considered to be the primary purpose of the transaction, thus triggering the GAAR’s application.

Provided that the GAAR does not apply, any tax losses of a Chinese target company can continue to be carried forward to be offset against its future profits for up to five years from the year in which the loss was incurred after the transaction. China currently has no group consolidation regulations for grouping of tax losses.

There is a limitation on the use of tax losses through mergers.

Crystallization of tax charges

China has not yet imposed tax rules to deem a disposal of the underlying assets under a normal share transfer, but the buyer should pay attention to the inherent tax liabilities of the target company on acquisition and the potential application of GAAR. As Chinese tax law does not provide for loss or VAT-grouping, there is no ‘degrouping’ charge to tax (although care must be taken on changes of ownership where assets/shareholdings have recently been transferred within the group and reorganization relief has been claimed).

The tax authorities may seek to impose VAT/LAT on a ‘disguised’ property transfer under the cover of an equity transfer. As discussed, however, the imposition of LAT and VAT based on the look-through of the equity transfer is not explicitly supported by existing LAT or VAT laws.

Pre-sale dividend

In certain circumstances, the seller may prefer to realize part of the value of the target company as income by means of a pre-sale dividend. The rationale is that the dividend may be subject to a lower effective rate of dividend WHT than capital gains, where treaty relief is available. Hence, any dividends paid out of retained earnings prior to a share sale would reduce the proceeds of sale and the corresponding gain arising on the sale, leading to an overall lower WHT leakage. The position is not straightforward, however, and each case must be examined based on its facts.

Transfer taxes

The transferor and transferee are each responsible for the payment of stamp duty of 0.05 percent of the transfer consideration for the shares in a Chinese company in relation to their own copies of the transfer agreement (i.e. a total of 0.10 percent stamp duty payable).

Tax filing requirements for STT on special corporate reorganizations

The STT on special corporate reorganizations is elective. To enjoy the tax deferral under a corporate reorganization, applicants must submit, along with their annual CIT filings, relevant documentation to substantiate their reorganizations’ qualifications for the STT. Failure to do so results in the denial of the tax-deferred treatment.

Tax clearance

Currently, Chinese tax authorities do not have any system in place for providing sellers of shares in an offshore holding company, where the sellers have made their Announcement 7 (previously Circular 698) reporting, with a written clearance to the effect that the arrangement will not be attacked under the GAAR. Consequently, as noted above, buyers should seek to protect themselves through appropriate warranties and indemnities in the SPA.

Choice of acquisition vehicle

The main forms of business enterprise available to foreign investors in China are discussed below.

Foreign parent company

The foreign buyer may choose to make the acquisition itself, perhaps to shelter its own taxable profits with the financing costs. However, China charges WHT at 10 percent on dividends, interest, royalties and capital gains arising to non-resident enterprises. So, if relevant, the buyer may prefer an intermediate company resident in a more favorable treaty territory (WHT can be reduced under a treaty to as low as 5 percent on dividends, 7 percent on interest, 6 percent on royalties and 0 percent on capital gains). Alternatively, other structures or loan instruments that reduce or eliminate WHT may be considered.

Non-resident intermediate holding company

If the foreign country taxes capital gains and dividends received from overseas, an intermediate holding company resident in another territory could be used to defer this tax and perhaps take advantage of a more favorable tax treaty with China.

As outlined in the ‘Recent developments’ section, the buyer should be aware of the rigorous enforcement of the anti-treaty-shopping provisions by the Chinese tax authorities — especially against the backdrop of the Organisation for Economic Co-operation and Development’s (OECD) BEPS Action Plan, which may restrict the buyer’s ability to structure a deal in a way designed solely to obtain such tax benefits.

Further, in setting out the Chinese interpretation of BO for tax treaty relief, Circular 601 (which is replaced by Announcement 9 as of 1 April 2018) effectively combines a BO test (which in most countries is a test of ‘control’ over income and the assets from which it derives) with an economic substance-focused treaty-shopping test. Application of the treaty- shopping test as an element of the BO test, rather than as an application of the Chinese GAAR, prevented taxpayers from arguing their ‘reasonable business purposes’ in using an overseas holding, financing or intangible property leasing company, as the GAAR procedures would allow them to do so. The public discussion draft on ‘special tax adjustments’ (not yet finalized at the time of writing) reiterates that the Chinese tax authorities are empowered to initiate general anti-avoidance investigations and apply the GAAR on treaty shopping. Hence, the development of the BEPS implementation in China and the potential issuance of the draft ‘special tax adjustments’ rules should continue to be observed under the new tax treaty relief system.

Announcement 7 should also be kept in mind where an offshore indirect disposal is contemplated. However, even in the absence of treaty relief, the 10 percent WHT compares favorably with the 25 percent tax that would be imposed if the acquisition were held through a locally incorporated vehicle.

Further, as explained in the ‘Debt’ section later in this report, debt pushdown at the Chinese level may be difficult and the Chinese corporate law requirement to build up a capital reserve that may not be distributed until liquidation might also favor the use of a foreign acquisition vehicle (however, see ‘Chinese partnership’ section below). Where the group acquired has underlying foreign subsidiaries, the complexities and vagaries of the (little-used) Chinese foreign tax crediting provisions must also be taken into account.

Wholly foreign-owned enterprise

- A wholly foreign-owned enterprise may be set up as a limited liability company by one or more foreign enterprises or individuals.

- Profits and losses must be distributed according to the ratio of each shareholder’s capital contribution. Earnings are taxed at the enterprise level at the standard 25 percent rate and WHT applies at standard rate of 10 percent on dividends (unless eligible for treaty relief).

- Asset acquisitions may be relatively easier to fund than share acquisitions from a regulatory viewpoint (see the section on choice of acquisition funding later in this report).

- Must reserve profits in a non-distributable capital reserve of up to 50 percent of amount of registered capital.

- May be converted to a joint stock company (company limited by shares) for the purposes of listing on the stock market.

Joint venture

- Joint ventures can be formed by one or more Chinese enterprises together with one or more foreign enterprises or individuals either as an equity joint venture or cooperative joint venture.

- An equity joint venture may be established as a limited liability company. The foreign partners must own at least 25 percent of the equity interest.

- Profits and losses of the equity joint venture must be distributed according to the ratio of each partner’s capital contribution, and the tax and corporate law treatment is the same as for wholly foreign-owned enterprises, as described earlier.

- A cooperative joint venture may be established as either a separate legal person with limited liability or as a non-legal person.

- Profits and losses of the cooperative joint venture may be distributed according to the ratio agreed by the joint venture agreement and can be varied over the contract term.

- Where the cooperative joint venture is a separate legal person, the earnings are taxed at the enterprise level at the standard 25 percent rate; otherwise, the earnings are taxed at the investor level.

- WHT applies at a standard rate of 10 percent on dividends (unless eligible for treaty relief) paid by the legal person cooperative joint venture.

- Distributions by the non-legal person variant may not bear WHT, but the joint venture partner of the cooperative joint venture may be exposed to Chinese PE risk. The structure bears similarities to the partnership form (which is increasingly preferred).

Chinese holding company

- A Chinese holding company (CHC) can finance the purchase of a Chinese subsidiary from another group company through a mixture of equity and shareholder debt, in line with the ‘debt quota.’

- Permitted to obtain registered capital/loans from abroad to finance equity acquisitions (but cannot borrow domestically to finance equity acquisitions).

- Same tax treatment as wholly foreign-owned enterprises (10 percent WHT unless eligible for treaty relief, 25 percent CIT on profits and gains) and same corporate law restrictions.

- Dividends paid to a CHC from its Chinese subsidiaries are not subject to CIT or WHT.

- A CHC can reinvest the dividends it receives directly without being deemed to pay a dividend.

- Historically, a CHC is required to have a minimum registered capital of USD30 million. While this requirement has now been officially abolished, it may still apply in practice.

Chinese partnership

- Foreign partners are allowed to invest in Chinese limited partnerships as of March 2010.

- Profits and losses are distributed in accordance with partnership agreement.

- Unlike a corporate entity, there is no capital reserve requirement.

- Taxed on a look-through basis, although there is some uncertainty regarding the taxation of foreign partners.

- For an active business, the foreign partner should be taxed at 25 percent as having a PE in the PRC, which in effect potentially eliminates the double taxation that arises with regard to dividend WHT in a corporate context.

- Where a partnership receives passive income, it is unclear whether a foreign partner is treated as receiving that income (with potential treaty relief) or as having a PE in the PRC.

- Uncertainty regarding treatment of tax losses and stamp duty.

Choice of acquisition funding

Generally, an acquiring company may fund an acquisition with equity or a combination of debt and equity. Interest paid or accrued on debt used to acquire business assets may be allowed as a deduction to the payer. Historically, under the State Administration of Foreign Exchange (SAFE) Circular 142, if a Chinese-established entity is used as the acquisition vehicle, the entity may not be allowed to borrow money or obtain registered capital from abroad to fund an equity acquisition in China. This prohibition has been removed by SAFE Circular 19, which was issued in 2015, although it may still need to be observed in practice. Borrowing locally for acquisition is normally not possible because the People’s Bank of China (PBOC) generally prohibits lending to fund equity acquisitions (and local banks have limited interest in using the legal exceptions that do exist to lend to foreign invested enterprises). However, a CHC may be in a position to borrow or obtain registered capital from abroad to fund an equity acquisition.

Debt

The amount of foreign debt that Chinese companies can hold is now subject to a number of new rules issued by the PBOC in the past few years.

PBOC issued Yinfa [2016] No.18 (Circular 18) (effective from January 2016) and Yinfa [2016] No.132 (Circular 132, effective from May 2016) to set out the relevant rules (including new foreign debt limits) for Chinese companies borrowing foreign debts with the aim of easing their foreign exchange settlement restrictions. These circulars were superseded by Yinfa [2017] No. 9 (Circular 9, effective as of January 2017), which revised the foreign debt limits that were prescribed under Circular 18 and Circular 132.

Under Circular 9, the revised foreign debt limit for various types of Chinese entity are as follows:

- A Chinese company that is neither real estate-related nor a financial institution is limited to two times its net asset value.

- A Chinese non-banking financial institution is limited to its capital amount (i.e. the amount of paid-in capital or capital stock plus the amount of capital reserve).

- A Chinese banking financial institution is limited to 80 percent of its tier-one capital amount.

Circular 9 provides for a 1-year transitional period from the date it was issued (i.e. it expired on 12 January 2018), during which a foreign invested enterprise (FIE) financial institution and a FIE non-financial institution can opt for the above revised foreign debt limit or remain under the previous foreign debt limit prescribed under the foreign debt management guideline jointly issued by the National Development and Reform Commission (NDRC), MOF and SAFE.

After the end of the 1-year transitional period, FIE financial institutions are mandated to adopt the foreign debt limit prescribed under Circular 9. However, FIE non-financial institutions will have to wait for further clarification from PBOC and SAFE on whether they will follow suit.

Foreign debt limits for CHCs, which are set out in MOC Order [2004] No. 22 (Order 22), are normally higher than those for FIEs. Specifically, for a CHC with registered capital of not less than US$ 30 million, its foreign debt quota is limited to four times its paid-up capital. For a CHC with registered capital of not less than US$ 100 million, its foreign debt quota is limited to six times its paid-up capital.

Further, according to Guofa [2017] No. 5 (Notice 5), the minimum registered capital requirement for FIEs has been abolished. However, the relevant government authorities (e.g. NDRC, MOFCOM and the State Administration for Industry and Commerce) have not yet updated their implementation guidance on the requirements for setting up FIE. In practice, the below ratios of registered capital to total investment are still valid:

The foreign debts should be registered with the local SAFE in order for the Chinese companies to remit foreign currency overseas to pay interest or settle the loan principal to the foreign lender(s).

Any related-party loans also need to comply with the arm’s length principle under the Chinese transfer pricing rules.

Deductibility of interest

Under the CIT law, non-capitalized interest expenses incurred by an enterprise in the course of its business operations are generally deductible for CIT purposes, provided the applicable interest rate does not exceed applicable commercial lending rates.

The CIT law also contains thin capitalization rules that are generally triggered, for non-financial institutions, when a resident enterprise borrows money from a related party that results in a debt-to-equity ratio exceeding the 2:1 ratio stipulated by the CIT law. Interest incurred on the excess portion is not deductible for CIT purposes. The arm’s length principle must be observed in all circumstances.

Where a CHC has been used as the acquisition vehicle, it should have sufficient taxable income (from an active business or from capital gains; dividends from subsidiaries are exempt) against which to apply the interest deduction, as tax losses (created through interest deductions or otherwise) expire after 5 years. Alternative approaches to utilizing the losses are not available as loss grouping is not provided for under the Chinese law. Thus, CHCs generally are not able to merge with their subsidiaries (precluding debt pushdown), and problems may arise for a non-CHC in obtaining a tax-free vertical merger.

Withholding tax on debt and ways to reduce or eliminate it

Payments of interest by a Chinese company to a non-resident without an establishment or place of business in the PRC are generally subject to WHT at 10 percent. The rate may be reduced under a treaty. Under the VAT reforms implemented for the financial services industry as of 1 May 2016, VAT at 6 percent is levied on interest income earned by non-residents from a Chinese company and the VAT charged is not creditable to the Chinese company.

Under Announcement 60, a taxpayer or its withholding agent is required to submit the relevant documents to the Chinese tax authorities when making the tax filing for accessing treaty benefits (e.g. reduced interest WHT rate). As discussed above, while no pre-approval is required for enjoying the treaty benefits, the tax authorities may conduct post-filing examinations. Where it is discovered that treaty relief should not have applied and tax has been underpaid, the tax authorities will seek to recover the taxes underpaid and may launch anti-avoidance proceedings.

Checklist for debt funding

- Consider whether the application of SAFE and PBOC rules precludes debt financing for foreign investment in the circumstances and in the industry.

- The use of third-party bank debt may mitigate thin capitalization and transfer pricing issues.

- Consider what level of funding would enable tax relief for interest payments to be effective.

- It is possible that a tax deduction may be available at higher rate than the applicable tax on interest income in the recipient’s jurisdiction.

- WHT of 10 percent applies to interest payments to non-Chinese entities unless a lower rate applies under the relevant treaty.

Equity

A buyer may use equity to fund its acquisition, possibly by issuing shares to the seller, and may wish to capitalize the target post-acquisition. However, reduction of share capital/share buy-back in a Chinese company may be difficult in certain locations where pre-approval from the relevant Chinese authorities is still required, and the capital reserve rules may cause some of the profits of the enterprise to become trapped. The use of equity may be more appropriate than debt in certain circumstances, in light of the foreign debt restrictions highlighted above and the fact that, where a company is already thinly capitalized, it may be disadvantageous to increase borrowings further.

Provided that the necessary criteria are satisfied, Circular 59 provides a tax-neutral framework for structuring acquisitions under which the transacting parties may elect temporarily to defer recognizing the taxable gain or loss arising on the transactions (a qualifying special corporate reorganization).

One of the major criteria for qualifying as a special corporate reorganization is that at least 85 percent of the transaction consideration should be equity consideration (i.e. stock-for-stock or stock-for-assets). Other relevant criteria include:

- The transaction is motivated by reasonable commercial needs, and its major purpose is not achieving tax avoidance, reduction, exemption or deferral.

- The assets/equity that are transferred are equal to at least 50 percent of the respective total asset of the transferor/total equity of the transferred enterprise.

- The operation of the reorganized assets will not change materially within a consecutive 12-month period after the reorganization.

- Original shareholders receiving consideration in the form of shares should not transfer such shareholding within a 12-month period after the reorganization.

For qualifying special corporate reorganizations, the tax deferral is achieved through the carryover to the transferee of tax bases in the acquired shares or assets but only to the extent of that part of the purchase consideration comprising shares. Gains or losses attributable to non-share consideration, such as cash, deposits and inventories, are recognized at the time of the transaction.

In addition to the relief under Circular 59, Circular 109 introduced a new condition for STT that permits elective non-recognition of income on transfer of assets/equity between two Chinese TREs that are in a ‘100 percent holding relationship’, provided no accounting gains/losses are recognized. Both the purpose test and the continuing business test in Circular 59 hold, and the tax basis of transferred assets for future disposal is their original tax basis.

Certain cross-border reorganizations need to meet conditions in addition to those described earlier to qualify for the special corporate reorganization, including a 100 percent shareholding relationship between the transferor and transferee when inserting an offshore intermediate holding company.

SAT Announcement [2013] No. 72 (Announcement 72) addresses situations where a cross-border reorganization involves the transfer of the Chinese enterprise from an offshore transferor that does not have a favorable dividend WHT rate to an offshore transferee that has a favorable dividend WHT rate with China. Announcement 72 clarifies that the retained earnings of the Chinese enterprise accumulated before the transfer are not entitled to any reduction in the dividend WHT rate even if the dividend is distributed after the equity transfer reorganization. This measure is designed to prevent any dividend WHT advantages for profits derived before a qualifying reorganization.

Share capital reductions are possible but difficult in certain locations where the pre-approval from the relevant Chinese authorities is still required. As Chinese corporate law only provides for one type of share capital, it is not possible to use instruments such as redeemable preference shares. Where a capital reduction was to be achieved and was to be financed with debt, in principle, it is possible to obtain a tax deduction for the interest.

Hybrids

Consideration may be given to hybrid financing, that is, using instruments treated as equity for accounts purposes by one party and as debt (giving rise to tax-deductible interest) by the other. In light of the OECD’s anti-BEPS recommendations on hybrid mismatch arrangements, this may become more difficult in the future. There are currently no specific rules or regulations that distinguish between complex equity and debt interest for tax purposes under Chinese tax regulations.

Generally, the definitions of share capital and dividends for tax purposes follow their corporate law definitions, although re-characterization using the GAAR in avoidance cases is conceivable. In practice, hybrids are difficult to implement in China, particularly in a cross-border context. China’s restrictive legal framework currently does not provide for the creation of innovative financial instruments that straddle the line between debt and equity.

Other considerations

Company law

Chinese company law prescribes how Chinese companies may be formed, operated, reorganized and dissolved.

One important feature of the law concerns the ability to pay dividends. A Chinese company is only allowed to distribute dividends to its shareholders after it has satisfied the following requirements:

- The registered capital has been fully paid-up in accordance with the articles of association.

- The company has made profits under Chinese GAAP (i.e. after utilizing the accumulated tax losses from prior years, if any).

- CIT has been paid by the company, or the company is in losses or in a tax-exemption period.

- The statutory after-tax reserve funds (e.g. general reserve fund, enterprise development fund, and staff benefit and welfare fund) have been provided.

For corporate groups, this means the reserves retained by each company, rather than group reserves at the consolidated level. Regardless of whether acquisition or merger accounting is adopted in the group accounts, the ability to distribute the pre-acquisition profits of the acquired company may be restricted, depending on the profit position of each company.

Where M&A transactions are undertaken, the MOC rules in Provisions on the Acquisition of Domestic Enterprises by Foreign Investors (revised), issued in 2009, should be considered. Also bear in mind the national security review regulations issued by MOC in March 2011, which affect foreign investment in sectors deemed important to national security. The consent of other authorities, such as the State Administrations of Industry and Commerce, and specific sector regulators, such as the China Securities Regulatory Commission, may also be needed.

Group relief/consolidation

There are currently no group relief or tax-consolidation regulations in the PRC.

Transfer pricing

Where an intercompany transaction occurs between the buyer and the target following an acquisition, any failure to conform with the arm’s length principle might give rise to transfer pricing issues in China. Under the Chinese transfer pricing rules, the tax authorities are empowered to make tax adjustments within 10 years of the year during which the transactions took place and recover any underpaid Chinese taxes. These regulations are increasingly rigorously enforced.

Dual residency

There are currently no dual residency regulations in the PRC.

Foreign investments of a local target company

China’s Controlled Foreign Company (CFC) legislation is designed to prevent Chinese companies from accumulating offshore profits in low-tax countries. Under the CFC rules, where a Chinese resident enterprise by itself, or together with individual Chinese residents, controls an enterprise that is established in a foreign country or region where the effective tax burden is lower than 50 percent of the standard CIT rate of 25 percent (i.e. 12.5 percent) and the foreign enterprise does not distribute its profits or reduces the distribution of its profits for reasons other than reasonable operational needs, the portion of the profits attributable to the Chinese resident enterprise is included in its taxable income for the current period. Where exemption conditions under the rules are met, the CFC rules would not apply.

Comparison of asset and share purchases

Advantages of asset purchases

- Purchase price may be depreciated or amortized for tax purposes and the buyer gains a step-up in the tax basis of assets.

- Buyer usually does not inherit previous liabilities of the company.

- No acquisition of a historical tax liability on retained earnings.

- Possible for the buyer to acquire part of a business only.

- Deduction for trading acquired stock.

- Profitable operations can be absorbed by a loss-making company if the loss-making company is used as the buyer.

- May be easier to obtain financing from a regulatory perspective.

Disadvantages of asset purchases

- Buyer needs to renegotiate the supply, employment and technology agreements.

- Government licenses pertaining to the seller are not transferable.

- May be unattractive to the seller (high transfer tax costs to the seller if the value of the assets has appreciated substantially, particularly if the assets include immovable properties), thus increasing the purchase price.

- It may be time-consuming and costly to transfer assets.

- Accounting profits and thus the ability to distribute profits of the acquired business may be affected by the creation of acquisition goodwill.

- Benefit of any tax losses incurred or tax attributes/incentives obtained by the target company remains with the seller.

Advantages of share purchases

- Purchaser may benefit from existing government licenses, supply contracts and technology contracts held by the target company.

- The transaction may be easier and take less time to complete.

- Less transactional tax usually arises.

- Lower outlays (purchase of net assets only).

Disadvantages of share purchases

- Purchaser is liable for any claims or previous liabilities of the target company.

- More difficult regulatory environment for financing equity acquisitions.

- No deduction for purchase price and no step-up in cost base of underlying assets of the company.

- Latent tax exposures for buyer (unrealized gains on assets), which could be significant if the underlying assets include immovable properties.

KPMG China

John Gu

KPMG

8th Floor, Tower E2, Oriental Plaza

1 East Chang An Avenue

Beijing 100738

T: + 8610 8508 7095

E: john.gu@kpmg.com

Michael Wong

KPMG

8th Floor, Tower E2, Oriental Plaza

1 East Chang An Avenue

Beijing 100738

T: + 8610 8508 7085

E: michael.wong@kpmg.com

Christopher Mak

KPMG

25th Floor, Tower II, Plaza 66,

1266 West Nanjing Road

Shanghai 200020

T: +8620 2212 3409

E: christopher.mak@kpmg.com

Milano Fang

KPMG

8th Floor, Tower E2, Oriental Plaza

1 East Chang An Avenue

Beijing 100738

T: + 8610 8508 7761

E: milano.fang@kpmg.com

This country document does not include COVID-19 tax developments. To stay up-to-date on COVID-19-related tax legislation, refer to the below KPMG link:

Click here — COVID-19 tax measures and government reliefs

This country document is updated as on

1 January 2021.