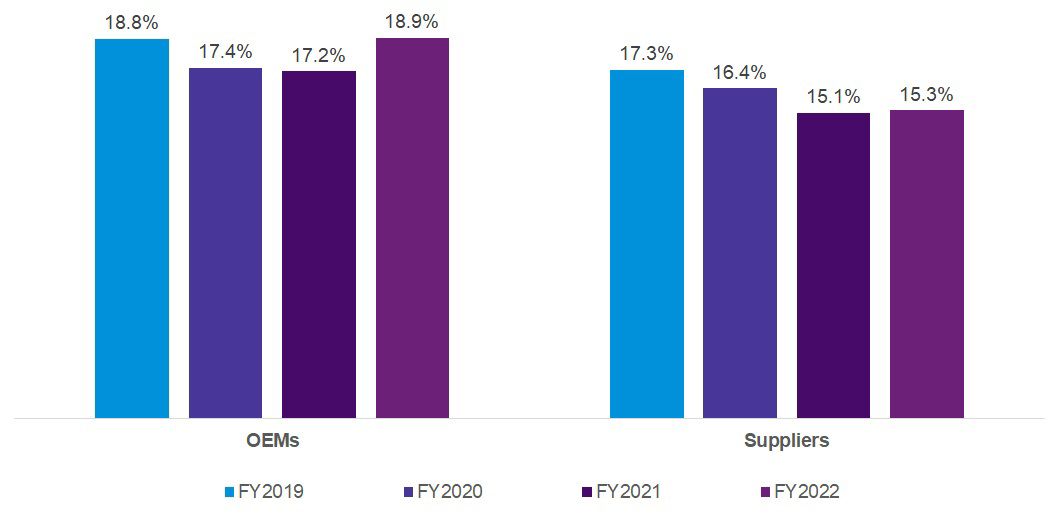

The automotive industry is undergoing a massive change given the key trends like vehicle electrification, autonomous driving, shared mobility, software-as-a-service (SaaS), sustainability and the circular economy. There are certain demand-side and supply-side challenges that have led to dwindling or stagnant profits (see Figure 1) and forced automakers to reevaluate and revamp their present business models. No wonder, automakers want to enable higher transparency of their revenue streams, adopt better prediction and simulation models, and integrate ESG analytics, to boost their corporate performance.

Figure 1: Profitability of top automotive companies

Demand-side upheavals: Still catching up?

Even before the onset of COVID-19 pandemic, a few visible trends were existing that forced automakers to rethink their traditional business models and launch new business models. One such trend was the decreasing share of vehicle ownership among millennials, especially in the developed nations. Another was the accelerated trend of using car-sharing or ride-hailing services. In recent times, purchasing power of potential new consumers have dwindled, aided by higher inflation, higher fuel prices and rising unemployment.

From the sales and distribution perspective, online sales of vehicles have picked up pace. Pure-play online car retailers like Carvana and Vroom have experienced unprecedented sales boom in 2020. It is no surprise then that automotive executives are overwhelmingly predicting majority of vehicle purchases will be completed online by 2030, according to KPMG’s recently concluded Global Automotive Executive Survey.

Concern about purchasing power of new potential consumers (primarily Millennials) have also popularized the demand for vehicle subscription models. And given that Millennials will represent the largest cohort of potential new car-buying population by 2025, automotive executives believe that vehicle subscriptions will be a competitive offering to traditional purchases and leases by 2030.

In addition, ESG mandates pose a challenge to current operating and business models in the automotive industry. Automakers face the humongous task of reporting non-financial ESG KPIs given the new Corporate Sustainability Reporting Directive (CSRD). The trend of “Circular Economy” is another challenge to be dealt with as the used EV batteries will likely prove to be a cost burden and appear as liabilities on the carmakers’ balance sheets.

Hence, popularity of online sales, vehicle subscription models, vehicle-as-a-software, and ESG mandates indicate that the automakers can’t continue to rely on product-centric business models and traditional profitability metrics.

Supply-side disruptions: Too late to act?

From the supply angle, car production has taken a hit due to lack of availability of components (including semiconductors) which is forcing them to reduce features on the new models. Supply chain risks were perennially present in the automotive industry, however, the COVID-19 pandemic and recently the Russia-Ukraine war have exacerbated the issue. Many automakers are now contemplating to implement a dual-sourcing strategy and not just depend on a single country or region (e.g., Russia, Ukraine, China, etc.) for supply of key components and raw materials. Localization or regionalization of the supply chain (where demand is present) is also high on the automotive executive’s agenda.

The disruptions on the supply side and the unpredictability of evolving macroeconomic situations are making the future of the industry more uncertain, not only in the long run but also in the short-term. Thus, automakers can’t continue to rely on simplistic simulation models and scenario management tools with non-relevant parameters, anymore.

What’s the solution?

Automakers need to make “digital”, “customer” and “ESG” as the centerpieces of their new business model strategy to own end-to-end relationship with their customers and successfully compete with new tech entrants and digital start-ups. Unfortunately, as of today, reporting and management accounting still rely mostly on product-oriented profitability analysis. In addition, the legacy systems - that automakers still rely and operate - are complex, not integrated, costly and struggle to reflect the requirements for governing new business models. In addition, rising uncertainties between upside opportunities (e.g., higher profits from gas-guzzling SUVs) and downside risks (e.g., carbon-emission fines and taxes), and geopolitical disruptions creating havoc on the supply chain make it difficult for automakers to model appropriate scenarios and predict profitability.

To overcome these challenges and leverage the data deluge, OEMs need visibility and transparency over their new business and sales models and transform or modernize their legacy data systems. They can do so by measuring the new business on key metrics like customer profitability and lifetime value. In addition, they need to develop agile performance management tools and processes, and invest in master data management and governance. A focus on growing data analytics capabilities and skills by acquiring or collaborating with digital start-ups can also be helpful. These solutions will likely help the automotive OEMs in not only lowering the risk from declining profitability in traditional ICE vehicle sales, but also providing the requisite visibility and transparency over revenue streams based on new business models.

For more information on how automakers can effectively manage corporate performance, please visit: Corporate Performance Management