The banking board of the future

The banking board of the future

Banks' are broadening their view of the expertise that management boards will need in future.

Supervisors increasingly view the composition of banks' managing bodies as a key driver of future stability. This is part of the reason why some banks are reviewing the skills and expertise of board members as well as board compositions. But others seem content to take a `wait and see' approach. This carries risks, with supervisors ready to address any weaknesses head-on. We believe banks should take an active, self-critical approach to

The composition of European banks' managing bodies is changing fast. We see three overlapping forces encouraging institutions to broaden their view of the expertise that management boards will need in future.

The first driver is that banks are changing their operating and business models in response to their economic, social and technological environment. New executive level roles are being created to respond to these macroeconomic changes. With the increasing importance of technology and use of data in the industry, banks are faced with the challenges that come with FinTechs, new cyber risks and increased reliance on outsourced services but also changes in customer demand. Banks are turning to machine learning and data analytics to pre-empt customer behavior, helping build new products and processes.

In particular, outsourcing and digital innovations such as data analytics, cloud computing, artificial intelligence and distributed ledger technologies are playing a growing role. This was seen in the recent addition to BBVA's executive board, who have added a Head of Data at the highest level of their

The second factor is the growing number of supervisory requirements around the skills of board members and the split of their roles and responsibilities. These include:

- The SSM supervisory statement on governance and risk appetite (PDF 458 KB) issued by the ECB in June 2016, which sets out a number of specific requirements about the skills of managing board members.

- The ECB's increasing tendency to demand a clear separation between

first and second line ofdefence - The ECB has reviewed its approach to `fit and proper' (PDF 517 KB)

assessments, and has created a separate DirectorateGenerale focused, among others, onauthorisations . Other divisions include Enforcement & Sanctions, Supervisory Policiesand Supervisory Quality Assurance. Furthermore, the ECB plans tosetup a new platform forauthorisation to ease theauthorisation process.

The third factor is the evolution of corporate governance codes, including a push for companies in all sectors to improve the diversity of their leaders. Corporate governance culture varies between

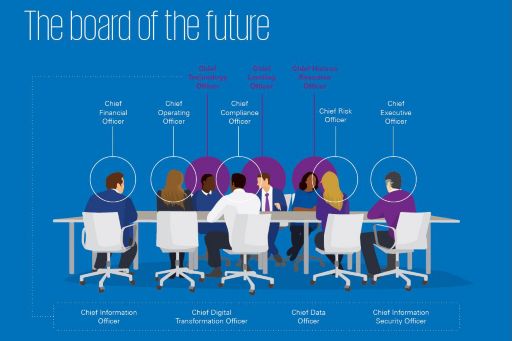

The combined effects of these drivers are pushing banks to review the composition of their management boards. In some cases, boards are getting larger as new capabilities emerge and technical functions become more refined. Apart from Chief Information Officers or Chief Data Officers, we are seeing a small number of banks in Europe that have implemented a Chief Lending Officer or Chief Credit Officer role in addition to a Chief Risk Officer.

Even so, other banks appear to be opting for a passive approach to their board composition. This may reflect a lack of

>>view full illustration (PDF 1.72 MB)

In our view, such a passive approach is a mistake. We see compelling reasons for banks to take a proactive attitude to board composition. To begin with, banks should be aware that the business and changing industry environment requires a re-assessment of board compositions. In addition, JSTs will consider the EBA guidelines as part of the SREP in 2018 and will ensure that SSM priority topics for 2018 are covered adequately by banks' management boards. It also seems likely that the ECB will conduct some form of benchmarking to compare the skills of banks' boards with those of their peers. Ultimately, boards judged to be falling short of supervisory requirements could face compulsory changes to their composition. We have already seen examples of this in Spain, Germany, Italy and Finland.

We therefore believe that banks should take a number of key steps to ensure their management boards are `fit for purpose'.

- First of all, some banks are taking actions to better adapt to the digital age.

- At a minimum, banks must ensure they are familiar with the growing number of ECB and EBA requirements relating to board-level expertise, as well as the priorities of other bodies including the EC and SRB. In our experience, few banks have studied these requirements in detail and some are barely aware of them.

- Ideally, banks should also conduct a critical self-examination of the skills and expertise of their managing body, and how this may be perceived by internal and external stakeholders.

- Lastly - if required - banks should give serious consideration to proactively addressing any shortcomings, instead of waiting to be forced into action by supervisors.

Of course there is no such thing as a `perfect' board. But business is changing fast and the growing supervisory focus on managing bodies means it is increasingly vital for banks to do all they can to build a board that will deliver future success.