A&D industry enters an era of innovation

Investing in R&D in era of innovation

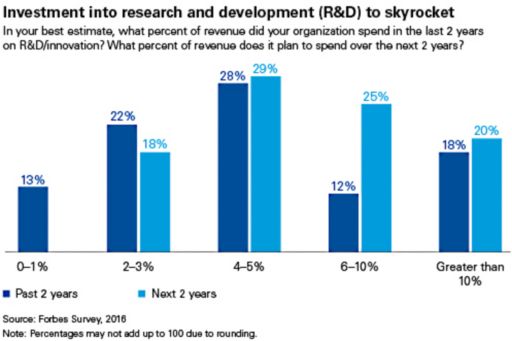

An era of intense competition, fueled by innovation, is driving aerospace and defense manufacturers to increase their R&D investments in their product and service portfolios.

Highlights

While the vast majority of aerospace and defense manufacturers say they will make changes to their existing product and service portfolio, our survey suggests that significant investment will be channeled towards developing entirely new products and services to respond to new and emerging growth areas.

For example, of those respondents that say they are planning to make changes to their product portfolio, almost half – 47 percent – say they will make significant investments to launch one or more new products.

Investing in R&D for growth

What is clear is that A&D organizations expect to ramp up investment into R&D significantly. Indeed, 45 percent say they will spend at least that amount over the next 2 years. More impressive still is the fact that one-in-five respondents say they will spend more than 10 percent of revenues on R&D over the next 2 years.

“This data clearly underscores the fact that A&D organizations are gearing up for massive changes in their product portfolio, their markets and their business models,” says Doug Gates, KPMG’s Global Head of Aerospace and Defense. “Whether developing new products and services to meet emerging demand or tailoring existing products to meet the specifications of customers in new markets, A&D organizations will need to push aside the status quo to grab new opportunities and drive exceptional execution.”

For example, Jose Antonio Filippo, Embraer’s Executive Vice-President, CFO & Investor Relations, notes that, “The Americas have always been a key driver of growth in the regional jet market and we are very focused on delivering the right products to the market through excellent customer service and delivery, and a more effective cost per seat. We are currently developing a new generation of the regional jet that will respond directly to the needs of this market.”

Our data also indicates that OEMs and Defense majors are investing aggressively to carve out competitive advantages and new niche markets. Larger organizations responding to our survey were 2.5 times more likely to say they would invest more than 10 percent of revenues into R&D over the next 2 years.

What’s the point?

Investment into R&D will be massive as A&D manufacturers start to compete on innovation and new products/ services. Leading A&D manufacturers are responding by:

- taking a more strategic view of their innovation ecosystem to identify partners that can help reduce the cost, improve the pace and unlock commercialization of their innovation investments

- exploring opportunities to adapt and leverage commercial capabilities – including infrastructure – to dramatically transform the development process

- prioritizing initiatives that can be leveraged across the enterprise or in multiple markets and lines of business.

- KPMG's 2016 Global Aerospace and Defense Outlook

- Executives optimistic about growth, but focused on efficiency due to uncertain conditions

- A&D leaders are shaping their portfolios of products, services and markets for long-term growth

- The risks of delivering new products and services is driving the need for supply chain visibility

- Global A&D Outlook infographic

- Key takeaways